FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

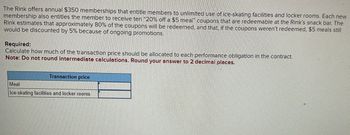

Transcribed Image Text:The Rink offers annual $350 memberships that entitle members to unlimited use of ice-skating facilities and locker rooms. Each new

membership also entitles the member to receive ten "20% off a $5 meal" coupons that are redeemable at the Rink's snack bar. The

Rink estimates that approximately 80% of the coupons will be redeemed, and that, if the coupons weren't redeemed, $5 meals still

would be discounted by 5% because of ongoing promotions.

Required:

Calculate how much of the transaction price should be allocated to each performance obligation in the contract.

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Meal

Transaction price

Ice-skating facilities and locker rooms

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On October 1, 2023, Blossom sold one of its super deluxe combination gas/charcoal barbecues to a local builder. The builder plans to install it in one of its "Parade of Homes" houses. Blossom accepted a three-year, zero-interest-bearing note with a face amount of $3,940. The barbecue has an inventory cost of $1,998. An interest rate of 10% is an appropriate market rate of interest for this customer. Prepare the journal entries on October 1, 2023, and December 31, 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to O decimal places, e.g. 5,275.) te 2023 2023 31, 2023 Account Titles and Explanation Notes Receivable…arrow_forwardWaterway Company offers a set of building blocks to customers who send in 3 UPC codes from Waterway cereal, along with 50¢. The block sets cost Waterway $1.00 each to purchase and 60¢ each to mail to customers. During 2025, Waterway sold 960,000 boxes of cereal. The company expects 30% of the UPC codes to be sent in. During 2025, 96,000 UPC codes were redeemed. Prepare Waterway's December 31, 2025, adjusting entry. (If no entry is required, select "No Entry for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) Credit Account Titles and Explanation Premium Expense Premium Liability Debit 105600 105600arrow_forwardOn January 2, 20X1, Criswell Acres purchased from Mifflinburg Farm Supply a new tractor that had a cash selling price of $109,837. As payment, Criswell gave Mifflinburg Farm Supply $25,000 in cash and a $100,000, five-year note that provided for annual interest payments at 6%. At the time of the sale, the interest rate normally charged to farms with Criswell's credit rating is 10%. Use the following links to the present value tables to calculate answers. (PV of 1, PVAD of 1, and PVOA of 1) (Use the appropriate factor(s) from the tables provided.) Required: 1. Prepare Mifflinburg Farm Supply's journal entry to record the sale. 2. Prepare the journal entry to record the first interest payment Mifflinburg Farm Supply received on December 31, 20X1. 3. Determine the note receivable balance that Mifflinburg Farm Supply will report on December 31, 20X2. 4. Determine Mifflinburg Farm Supply's note receivable balance on December 31, 2OX2, assuming that the company reports notes receivable at…arrow_forward

- Mammoth Publishing, Inc. owns a weekly magazine called “Nova Health,” and sells annual subscriptions for $96. Customers prepay their subscription fee and receive 52 issues starting in the following month. The company also offers new subscribers a 25% discount coupon on its other weekly magazine called “Fishing & Camping,” which has a list price of $84 for an annual subscription. Mammoth estimates that approximately 10% of the discount coupons will be redeemed.Required:(a) How many performance obligations are in a single subscription contract?(b) Prepare the journal entry to account for one new subscription of “Nova Health,” clearly identifying the revenue or deferred revenue associated with each performance obligation. of performance obligations: 2 Journal entry worksheet Note: Enter debits before credits. Transaction General Journal Debit Credit 1arrow_forwardchoose the correct answer (make sure the answer is correct 100%) Fancy Fish Company offers a cash rebate of $0.25 on each $12 package of fish food sold during 2022. Historically, 10% of customers mail in the rebate form. During 2022, 5,000,000 packages are sold, and 150,000 $0.25 rebates are mailed to customers. What is the rebate expense and liability, respectively, reported in the company's 2022 financial statements? a. $37,500; $87,500 b. $125,000; $87,500 c. $125,000; $37,500 d. $125,000; $125,000arrow_forwardA restaurant granted a 25% discount to senior citizens in excess of the 20% mandatory requirement. During the year, the restaurant reported receipts of P108,000 from senior citizen customers.Compute the deduction for senior citizens’ discountarrow_forward

- Service Industry AccountingThe Spectrum Fitness Club charges a nonrefundable annual membership fee of $1,200 for its services. For this fee, each member received a fitness evaluation (value $200), a monthly magazine (annual value $25), and two hours’ use of the equipment each week (annual value $1,100). Each of the three elements of the annual membership can be purchased separately. The initial direct costs to obtain the membership are $180. The direct cost of the fitness evaluation is $100, and the monthly direct costs to provide the other services are estimated to be $25 per person. Give the journal entries to record the transactions in 2019 relative to a membership sold on May 1, 2019.arrow_forwardRevenue Recognition Policy Decisions. For each of these situations, describe the revenue recognition policy that you believe that the company should follow. An international health club sells lifetime memberships costing $1,500 which allow the purchaser unlim-ited use of any of the club’s 300 facilities around the world. The initiation fee may be paid in 36 monthly installments, with a two percent interest charge on any unpaid balance. Franklin Motors, Inc., has always offered a limited, 36-month warranty on its cars and trucks, but to counter the significant competition in the industry, the company has come to the conclusion that it must do something more. With that in mind, the company developed a new warranty program: For a $1,500 payment at the time of purchase, a customer can buy a seven-year warranty that will cover replacement of almost all parts and labor. The purchased warranty expires at the end of seven years or when the customer sells the vehicle, whichever occurs first.…arrow_forwardThe Rink offers annual $150 memberships that entitle members to unlimited use of ice-skating facilities and locker rooms. Each new membership also entitles the member to receive ten "30% off a $5 meal" coupons that are redeemable at the Rink's snack bar. The Rink estimates that approximately 75% of the coupons will be redeemed, and that, if the coupons weren't redeemed, $5 meals still would be discounted by 6% because of ongoing promotions. Required: Calculate how much of the transaction price should be allocated to each performance obligation in the contract. (Round your answer to 2 decimal places.) Transaction price Meal Ice-skating facilities and locker roomsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education