FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

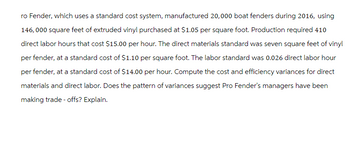

Transcribed Image Text:ro Fender, which uses a standard cost system, manufactured 20,000 boat fenders during 2016, using

146,000 square feet of extruded vinyl purchased at $1.05 per square foot. Production required 410

direct labor hours that cost $15.00 per hour. The direct materials standard was seven square feet of vinyl

per fender, at a standard cost of $1.10 per square foot. The labor standard was 0.026 direct labor hour

per fender, at a standard cost of $14.00 per hour. Compute the cost and efficiency variances for direct

materials and direct labor. Does the pattern of variances suggest Pro Fender's managers have been

making trade-offs? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rubble, Inc. produced 1,100 backpacks, the company's product in 2020. The standard cost was 4 yards of cloth at a standard cost of $0.90 per yard. The accounting records show that 2,700 yards of cloth were used, and the company paid $1.15 per yard. Standard time to make the backpacks was 2 direct labor hours per unit at a standard rate of $9.80 per direct labor hours. Employees worked a total of 1,500 hours and were paid $9.15 per hour.Calculate the direct labor cost variance.arrow_forwardRubble, Inc. produced 1,100 backpacks, the company's product in 2020. The standard cost was 4 yards of cloth at a standard cost of $0.90 per yard. The accounting records show that 2,700 yards of cloth were used, and the company paid $1.15 per yard. Standard time to make the backpacks was 2 direct labor hours per unit at a standard rate of $9.80 per direct labor hours. Employees worked a total of 1,500 hours and were paid $9.15 per hour.Calculate the direct labor cost variance.arrow_forwardCinturon Corporation produces high-quality leather belts. The company's plant in Boise uses a standard costing system and has set the following standards for materials and labor: Leather (3 strips @ $5.00) Direct labor (0.25 hr. @ $8.00) Total prime cost $15.00 2.00 $17.00 During the first month of the year, the Boise plant produced 39,000 belts. Actual leather purchased was 130,000 strips at $3.40 per strip. There were no beginning or ending inventories of leather. Actual direct labor was 34,000 hours at $14.50 per hour. Required: 1. Compute the costs of leather and direct labor that should be incurred for the production of 39,000 leather belts. Materials $ 397,800 X Labor $ 493,000 X 2. Compute the total budget variances for materials and labor. Total Budget Variance Materials -397,785 X Labor -492,998 X Favorable Unfavorable 3. Conceptual Connection: Would you consider these variances material with a need for investigation? Yesarrow_forward

- Leeds Corp. produces product BR500. Shamokin expects to sell 10,000 units of BR500 and to have an ending finished inventory of 2,000 units. Currently, it has a beginning finished inventory of 800 units. Each unit of BR500 requires two labor operations, one labor hour of assembling and two labor hours of polishing. The direct labor rate for assembling is $10 per assembling hour and the direct labor rate for polishing is $12.50 per polishing hour. The expected number of hours of direct labor for BR500 for this period are O 8,800 hours of assembling; 17,600 hours of polishing O 11,200 hours of assembling: 22,400 hours of polishing 17,600 hours of assembling: 8,800 hours of polishing O 22,400 hours of assembling: 11,200 hours of polishingarrow_forwardBoxer Manufacturing produces luxury dog houses. Each dog house requires 4.0 hours of machine time for its elaborate trim and finishing. For the current year, Boxer calculated its predetermined fixed manufacturing overhead (MOH) rate to be $20 per machine hour. The company budgets its fixed MOH to be $202,000 per month. Last month, Boxer produced 2,000 dog houses and incurred $196,400 (actual) of fixed MOH. Read the requirements. Requirement 1. Calculate the fixed overhead budget variance Begin by determining the formula for the fixed overhead budget variance, then compute the variance. (Enter the variance as a positive number. Label the variance as favorable (F) or unfavorable (U) in the input field after the amount you enter.) Fixed MOH budget variancearrow_forwardFive Card Draw manufactures and sells 24,000 units of Diamonds, which retails for $180, and 26,000 units of Clubs, which retails for $190. The direct materials cost is $24 per unit of Diamonds and $31 per unit of Clubs. The labor rate is $20 per hour, and Five Card Draw estimated 226,000 direct labor hours. It takes 4 direct labor hours to manufacture Diamonds and 5 hours for Clubs. The total estimated overhead is $678,000. Five Card Draw uses the traditional allocation method based on direct labor hours. A. What is the gross profit per unit for Diamonds and Clubs? Gross Profit Diamonds $ per unit per unit B. What is the total gross profit for the year? Total gross profit $ Clubsarrow_forward

- Anemone Company produces picture frames. During the year, 200,000 picture frames were produced. Materials and labor standards for producing the picture frames are as follows: Direct materials (2 pieces of wood @ $3) $6.00 Direct labor (2 hours @ $12) $24.00 Anemone purchased and used 600,000 pieces of wood at $4.00 each, and its actual labor hours were 320,000 hours at a wage rate of $13. What is Anemone's labor rate variance? a. $450,000 F b. $320,000 U c. $445,000 U d. $660,500 Farrow_forwardScotch Brand Products produces packaging tape and has determined the following to be its standard cost of producing one case of budget packaging tape: Material (3.50 ounces at $1.30 per ounce) $4.55 Labor (0.30 hour at $12.00 per hour) 3.60 Overhead 2.40 Total $10.55 At the start of 2021, Scotch Brand planned to produce 80,000 cases of tape during the year. Overhead is allocated based on the number of cases of tape produced. Annual fixed overhead is budgeted at $64,000 and the variable overhead costs are budgeted at $1.60 per case. The following information summarizes the results for 2021: Actual production, 81,000 cases Purchased 275,000 ounces of material at a total cost of $343,750 Used 266,250 ounces of material in production Employees worked 22,000 hours, total labor cost $275,000 Actual overhead incurred,…arrow_forwardUniversity Rings produces class rings. Its best-selling model has a direct materials standard of 15 grams of a special alloy per ring. This special alloy has a standard cost of $65.50 per In the past month, the company purchased 15,800 grams of this alloy at a total cost of $1,030,160. A total of 15,500 grams were used last month to produce 1,000 rings. gram.arrow_forward

- Rubble, Inc. produced 1,000 backpacks, the company's product in 2020. The standard cost was 3 yards of cloth at a standard cost of $1.00 per yard. The accounting records show that 2,900 yards of cloth were used, and the company paid $1.05 per yard. Standard time to make the backpacks was 2 direct labor hours per unit at a standard rate of $9.75 per direct labor hours. Employees worked a total of 1,800 hours and were paid $9.25 per hour.1. Calculate the direct materials cost variance and the direct materials efficiency variance.arrow_forwardSeaside Company produces picture frames. During the year 190,000 picture frames were produced. Materials and labor standards for producing the picture frames are as follows: Direct materials (2 pieces of wood @ $2.25) $4.50 Direct labor (2 hours @ $10) $20.00 Seaside purchased and used 400,000 pieces of wood at $2.00 each and its actual labor hours were 360,000 hours at a wage rate of $10.50. Refer to Figure 10-5. What is Seaside's labor rate variance? $180,000 F $180,000 U $225,000 U $217,500 Farrow_forwardModern Lighting Inc. manufactures lighting fixtures, using lean manufacturing methods. Style Omega has a materials cost per unit of $24. The budgeted conversion cost for the year is $148,200 for 2,600 production hours. A unit of Style Omega requires 10 minutes of cell production time. The following transactions took place during June: Materials were acquired to assemble 930 Style Omega units for June. Conversion costs were applied to 930 Style Omega units of production. 860 units of Style Omega were completed in June. 810 units of Style Omega were sold in June for $70 per unit. Question Content Area a. Determine the budgeted cell conversion cost per hour. If required, round to the nearest cent.fill in the blank 1 of 1$ per hour b. Determine the budgeted cell conversion cost per unit. If required, round to the nearest cent.fill in the blank 1 of 1$ per unit Feedback Area Feedback Question Content Area c. Journalize the summary transactions (1)–(4) for…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education