FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Rubble, Inc. produced 1,180 backpacks, the company's product in 2020. The

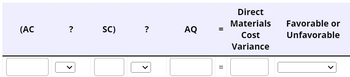

Calculate the direct materials cost variance.

Transcribed Image Text:(AC

?

SC)

?

AQ

=

Direct

Materials

Cost

Variance

Favorable or

Unfavorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Ivanhoe Toys is planning to sell 172 action figures and to produce 164 action figures in July. Each action figure requires 86 grams of plastic and a half hour of direct labor. The cost of the plastic used in each action figure is $5 per 86 grams. Employees of the company are paid at a rate of $15 per hour. Manufacturing overhead is applied at a rate of 120% of direct labor costs. IvanhoeToys has 77400 grams of plastic in its beginning inventory and wants to have 68800 grams in its ending inventory. What is the amount of budgeted direct labor cost for the month of July? $1290. $2580. $1230. $2460.arrow_forwardThe Adam manufacturing company produces a single product which goes through one process only. The manufacturing cycle takes a month. The company started its manufacturing operation on 1st February 2021 and costs of production for this month were as follows: Material Rs. 41,412; Labor Rs. 32,054; FOH Rs. 23,870 The production statistics for the month were as follows: Units completed and transferred to finished goods store were 6,500, while no loss was observed during the process. Units in Process on February 28, 2021 were 1,600 (Material 40%, Labor and FOH 20 per cent) Requirement: Prepare the Cost of Production Report at the end of February 2019arrow_forwardMurry, Inc. produced 1,000 units of the company's product in 2018. The standard quantity of direct materials was three yards of cloth per unit at a standard cost of $1.35 per yard. The accounting records showed that 2,500 yards of cloth were used and the company paid $1.40 per yard. Standard time was two direct labor hours per unit at a standard rate of $10.00 per direct labor hour. Employees worked 1,700 hours and were paid $9.50 per hour. Read the requirements. Requirement 1. What are the benefits of setting cost standards? Standard costing helps managers do the following: 1 Requirements 1. What are the benefits of setting cost standards? 2. Calculate the direct materials cost variance and the direct materials efficiency variance as well as the direct labor cost and efficiency variances. Print Donearrow_forward

- EM Manufacturing Co’s material purchases for June 2020 amounted to 110000 and its cost of goods sold during the month was 480000. Factory overhead was 50% of the direct labor cost. Inventories were as follows. The total cost of work placed in process and cost of goods manufactured during June 2020 is? June 1, 2020 June 30, 2020 Finished goods 102000 105000 Work in process 40000 36000 Materials 20000 26000 The total raw materials consumed is 100000. The total conversion cost is 200000, work in process, end is 30000, and cost of goods manufactured is 285000. The work in process beginning is? What is the total manufacturing cost, total goods placed in process, direct materials used, and cost of goods manufactured? Advertising expense 25000 Depreciation office – building 30000 Depreciation – factory 25000 Direct labor 115200 Direct materials purchases 1500000 Direct materials, beginning 22000 Direct…arrow_forwardSuperior, Inc. produced 1,000 units of the company's product in 2018. The standard quantity of direct materials was three yards of cloth per unit at a standard cost of $1.10 per yard. The accounting records showed that 2,900 yards of cloth were used and the company paid $1.15 per yard. Standard time was two direct labor hours per unit at a standard rate of $10.75 per direct labor hour. Employees worked 1,400 hours and were paid $10.25 per hour. Read the requirements Requirement 1. What are the benefits of setting cost standards? Standard costing helps managers do the following: Requirements 1. What are the benefits of setting cost standards? 2. Calculate the direct materials cost variance and the direct materials efficiency variance as well as the direct labor cost and efficiency variances Print Donearrow_forwardSlapshot Company makes ice hockey sticks and sold 1,880 sticks during the month of June at a total cost of $433,000. Each stick sold at a price of $400. Slapshot also incurred two types of selling costs: commissions equal to 10% of the sales price and other selling expenses of $65,000. Administrative expense totaled $53,800. Must put into a manufacturing firm income statement.arrow_forward

- The Baratheon Company is a manufacturer of golf clothing. During the month, the company cut and assembled 10,000 golf jackets. One hundred of jackets did not meet specifications and were considered “seconds”. Seconds are sold for P1,000.00 per jacket, whereas first quality jackets sell for P2,500.00. During the month, Work in Process was charged for P3,600,000 of materials, P4,000,000 of labor and factory overhead is applied at 120% of direct labor (including allowance of 20% of direct labor for spoiled units) Compute the unit cost of the good units if (round-off your answers to 2 decimal places) Loss is due to spoiled work spread over all jobsarrow_forward13. Alex launched a company with $500K initial investments and 100K shares. Angel X invested $200K through convertible note in a year. Convertible note parameters were: 8.5% coupon yield and 20% discount for conversion at the next round, valuation cap $2mln. In 9 months, a new investment round closed with pre-money valuation $10mln. Angel X converted the note. How many shares did the angel get?arrow_forwardDuring its first year of operations, Silverman Company paid $9,160 for direct materials and $9,700 for production workers' wages. Lease payments and utilities on the production facilities amounted to $8,700 while general, selling, and administrative expenses totaled $4,200. The company produced 5,300 units and sold 3,200 units at a price of $7.70 a unit. What is Silverman's cost of goods sold for the year? Multiple Choice O $27,560 $13,923 $16,640 $23,060arrow_forward

- The cost of direct labor was 58000. The charging rate of the CBS was 25% of the cost of direct labour. The company's expenses during the above period were: depreciation = 1500, exhibition expenses = 800, factory insurance premiums = 650, administrative employees' fees=22000, depreciation of factory machinery = 1400, rent=6500, salesmen's travel expenses = 1500, factory warden salaries = 2200, cleaning costs = 450, subscriptions = 150, maintenance costs = 320, indirect production materials = 750, factory maintenance costs = 1100, advertising costs = 5100, salaries of salesmen = 10000, utility costs = 4800, sample costs = 650, indirect work = 3600, interest debit & related financial expenses = 750, foreman salaries = 4100, other promotion costs = 390, lawyers' fee = 10000, accountants' fee = 11000, miscellaneous production consumables = 900. how much is the CBS?arrow_forwardRubble, Inc. produced 1,100 backpacks, the company's product in 2020. The standard cost was 4 yards of cloth at a standard cost of $0.90 per yard. The accounting records show that 2,700 yards of cloth were used, and the company paid $1.15 per yard. Standard time to make the backpacks was 2 direct labor hours per unit at a standard rate of $9.80 per direct labor hours. Employees worked a total of 1,500 hours and were paid $9.15 per hour.Calculate the direct labor cost variance.arrow_forwardCampbell Manufacturing Company produced 1,400 units of inventory in January Year 2. It expects to produce an additional 9,000 units during the remaining 11 months of the year. In other words, total production for Year 2 is estimated to be 10,400 units. Direct materials and direct labor costs are $74 and $71 per unit, respectively. Campbell expects to incur the following manufacturing overhead costs during the Year 2 accounting period. Production supplies Supervisor salary Depreciation on equipment Utilities Rental fee on manufacturing facilities Required a. Combine the individual overhead costs into a cost pool and calculate a predetermined overhead rate assuming the cost driver is number of units. b. Determine the cost of the 1,400 units of product made in January. Complete this question by entering your answers in the tabs below. Required A Required B $6,500 186,000 126,000 17,000 223,500 Determine the cost of the 1,400 units of product made in January. Allocated Cost Indirect…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education