Concept explainers

6)

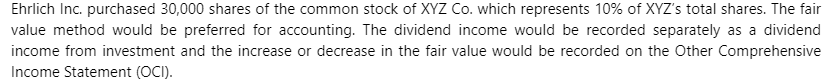

On 1/18/20, Ehrlich Inc. purchased 30,000 shares of the common stock of XYZ Co. for $16 per share. Ehrlich’s ownership represents 10% of XYZ’s total shares.

On 6/15/20, XYZ Co. paid dividends of $3.00 a share.

On 12/31/20, the fair market value of the XYZ stock was $20 a share.

On 3/3/21, Ehrlich sold 10,000 shares of XYZ stock for $21 per share.

On 6/15/21, XYZ Co. paid dividends of $3.50 a share.

On 12/31/21, the fair market value of the XYZ stock was $21 per share.

Instructions:

Prepare the 6

AND determine the amount of the investment in XYZ that would be shown on the

Step by stepSolved in 2 steps with 3 images

- am. 133.arrow_forwardOn January 23, 15,000 shares of Tolle Company are acquired at a price of $25 per share plus a $145 brokerage commission. On April 12, a $0.30-per-share dividend was received on the Tolle Company stock. On June 10, 6,200 shares of the Tolle Company stock were sold for $34 per share less a $130 brokerage commission. Prepare the journal entries for the original purchase, the dividend, and the sale under the cost method. Refer to the Chart of Accounts for exact wording of account titles. When required, round your answers to the nearest dollar.arrow_forwardAnswer..arrow_forward

- WW Corp. resells 400 shares of its own common stock for $20 per share. WW had acquired these shares two months before for $14 per share. The resale of this stock would be recorded with a: Select one: a. Debit to Common Stock for $8,000 b. Credit to Additional Paid-In Capital for $800 c. Credit to Treasury Stock for $8,000 d. Credit to Additional Paid-In Capital for $2,400 e. Credit to Additional Paid-In Capital for $2,000arrow_forwardAs a long-term investment, Painters' Equipment Company purchased 20% of AMC Supplies Incorporated's 430,000 shares for $510,000 at the beginning of the fiscal year of both companies. On the purchase date, the fair value and book value of AMC's net assets were equal. During the year, AMC earned net income of $280,000 and distributed cash dividends of 15 cents per share. At year-end, the fair value of the shares is $538,000. Required: 1. Assume no significant influence was acquired. Prepare the appropriate journal entries from the purchase through the end of the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet 1 2 3 4 Record the purchase of AMC Supplies shares for $510,000 as a long-term investment. Note: Enter debits before credits. Transactions General Journal Debit Creditarrow_forwardValaarrow_forward

- The securities owned by Jane Company were held as a long-term investment. During the currentyear, the following transactions occurred:Jan. 1 Purchased 15,000 shares of ABC Company at P70 per share.May 1 Purchased 8,000 shares of XYZ Corporation for P660,000.Apr 1 Received a cash dividend of P6 per share from ABC Company.July 1 Received a share for a share dividend from XYZ Corporation.Aug 1 Purchased 10,000 shares of GHI Enterprises at P75 each.Oct 1 Received a cash dividend of P6 per share from ABC Company.Oct 31 XYZ Corporation offered shareholders rights to subscribe to one new share for every tenrights tendered at P25. At the time of issuance, the market value of the right is P4. Sharerights are not accounted for separately.Nov 15 Exercised the XYZ Corporation’s share rights.Dec. 1 Sold 10,000 shares of XYZ Corporation at P35 per share. Use the FIFO approach indetermining the cost of the shares sold.Dec. 31 The fair values of the portfolio is as follows:ABC Company – P73 per…arrow_forwardSunshine Inc. has the following transactions pertaining to the common stock. Jan. 1 Bought 40% of Sealand’ 60,000 outstanding shares of common stock at a cost of $12 per share, obtaining significant influence over Sealand Corp April 15 Sealand declared and paid a cash dividend of $45,000. May18 Acquired 5% of the 400,000 shares of common stock of Bluewater Corp. at a total cost of $6 per share June 1 Purchased 500 shares (2% ownership) of Young Company common stock for $30 per share plus brokerage fees of $400. July 1 Sold 100 shares of Young stock for $3,300, less a $50 brokerage fee. Aug.30 Bluewater declared and paid a $75,000 dividend. Oct.1 Received a dividend of $1.25 per share of Young Company. Dec.31 Bluewater Corp. reported net income of $244,000 for the year Dec.31 Sealand reported net income of $120,000 for the year At December 31, the market price of Bluewater Corp was $13 per share and the Young Company was $…arrow_forwardElroy Corporation repurchased 3,800 shares of its own stock for $55 per share. The stock has a par of $5 per share. A month later Elroy resold 950 shares of the treasury stock for $63 per share. Required: What is the balance of the Treasury Stock account after these transactions are recognized?arrow_forward

- On January 2, 20Y4, Whitworth Company acquired 40% of the outstanding stock of Aloof Company for $340,000. For the year ended December 31, 20Y4, Aloof Company earned income of $180,000 and paid dividends of $10,000. On January 31 20Y5, Whitworth Company sold all of its investment in Aloof Company stock for $405,000. Journalize the entries for Whitworth Company for the purchase of the stock, the share of Aloof income, the dividends received from Aloof Company, and the sale of the Aloof Company stock. If an amount box does not require an entry, leave it blank. Jan. 2, 20Y4 - Purchase Dec. 31, 20Y4 - Income Dec. 31, 20Y4 - Dividends Jan. 31, 20Y5 - Salearrow_forwardDec 1: ABC Inc. repurchased 15,000 shares of stock when the market price was $1 per share. Dec 5: ABC Inc. resold 4,000 shares of the reacquired stock when the market price was $1.50 per share. Dec 23: ABC Inc. resold 5,000 shares of the reacquired stock when the market price was $0.25 per share. Prepare any necessary journal entries.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education