FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

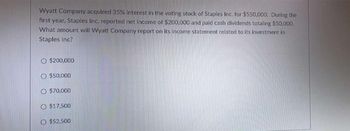

Transcribed Image Text:Wyatt Company acquired 35% interest in the voting stock of Staples Inc. for $550,000. During the

first year, Staples Inc. reported net income of $200,000 and paid cash dividends totaling $50,000.

What amount will Wyatt Company report on its income statement related to its investment in

Staples Inc?

O $200,000

O $50,000

O $70,000

O $17,500

O$52,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Garrison holds a controlling interest in Robertson’s outstanding stock. For the current year, the following information has been gathered about these two companies: Garrison RobertsonSeparate $300,000 $200,000operating income (includes $50,000 intra-entity gross profit in ending inventory)Dividends paid ...32,000 50,000Tax rate . . . . . . . . . 40% 40% Garrison uses the initial value method to account for the investment in Robertson. Garrison’s separate operating income figure does not include dividend income for the current year.a. Assume that Garrison owns 80 percent of Robertson’s voting stock. On a consolidated tax return, what amount of income tax is paid?b. Assume that Garrison owns 80 percent of Robertson’s voting stock. On separate tax returns, what total amount of income tax is paid?c. Assume that Garrison owns 70 percent of Robertson’s voting stock. What total amount of income…arrow_forwardAn investor company owns 40% of the outstanding common stock of an investee company, which allows the investor to exercise significant influence over the investee. The Equity Investment was reported at $1,050,000 as of the end of the previous year. During the year, the investor received dividends of $110,000 from the investee. The investee reports the following income statement for the year: Revenues Expenses $2,700,000 1,800,000 900,000 100,000 Comprehensive income $1,000,000 a. How much equity income should the investor report in its net income (i.e., as part of the current year income statement)? Net income Other comprehensive income $0 b. What amount should the investor report for the Equity Investment in its balance sheet at the end of the year? $0arrow_forwardSituation 1: Novak Cosmetics acquired 10% of the 193,000 shares of common stock of Martinez Fashion at a total cost of $14 per share on March 18, 2025. On June 30, Martinez declared and paid $67,500 cash dividends to all stockholders. On December 31, Martinez reported net income of $118,700 for the year. At December 31, the market price of Martinez Fashion was $15 per share. Situation 2: Splish, Inc. obtained significant influence over Seles Corporation by buying 40% of Seles's 30,700 outstanding shares of common stock at a total cost of $8 per share on January 1, 2025. On June 15, Seles declared and paid cash dividends of $38,300 to all stockholders. On December 31, Seles reported a net income of $84,200 for the year. Prepare all necessary journal entries in 2025 for both situations. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account…arrow_forward

- garrow_forwardMozart Co. owns 35% of Melody Inc. Melody pays $50,000 in cash dividends to its shareholders for the period. Mozart's entry to record the Melody dividend includes a? O Debit to Cash for $50,000 O Credit to Cash for $17,500 Credit to Investment Revenue for $50,000 O Credit to Equity Method Investments for $17,500arrow_forwardOn January 2, 20Y4, Whitworth Company acquired 37% of the outstanding stock of Aloof Company for $320,000. For the year ended December 31, 20Y4, Aloof Company earned income of $83,000 and paid dividends of $26,000. On January 31 20Y5, Whitworth Company sold all of its investment in Aloof Company stock for $338,090. Journalize the entries for Whitworth Company for the purchase of the stock, the share of Aloof income, the dividends received from Aloof Company, and the sale of the Aloof Company stock. If an amount box does not require an entry, leave it blank. Jan. 2, 20Y4 - Purchase - Select - - Select - - Select - - Select - Dec. 31, 20Y4 - Income - Select - - Select - - Select - - Select - Dec. 31, 20Y4 - Dividends - Select - - Select - - Select - - Select - Jan. 31, 20Y5 - Sale - Select - - Select - - Select - - Select - - Select - - Select -arrow_forward

- Dengararrow_forwardRamiro Company purchased 40% of the outstanding stock of Marco Company on January 1. Marco reported net income of $76,000 and declared dividends of $17,800 during the year. How much would Ramiro adjust its investment in Marco Company under the equity method? of $fill in the blank 2arrow_forwardOn January 2, 20Y4, Whitworth Company acquired 40% of the outstanding stock of Aloof Company for $340,000. For the year ended December 31, 20Y4, Aloof Company earned income of $180,000 and paid dividends of $10,000. On January 31 20Y5, Whitworth Company sold all of its investment in Aloof Company stock for $405,000. Journalize the entries for Whitworth Company for the purchase of the stock, the share of Aloof income, the dividends received from Aloof Company, and the sale of the Aloof Company stock. If an amount box does not require an entry, leave it blank. Jan. 2, 20Y4 - Purchase Dec. 31, 20Y4 - Income Dec. 31, 20Y4 - Dividends Jan. 31, 20Y5 - Salearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education