Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

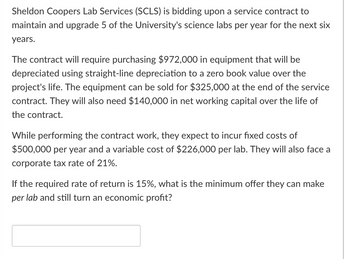

Transcribed Image Text:Sheldon Coopers Lab Services (SCLS) is bidding upon a service contract to

maintain and upgrade 5 of the University's science labs per year for the next six

years.

The contract will require purchasing $972,000 in equipment that will be

depreciated using straight-line depreciation to a zero book value over the

project's life. The equipment can be sold for $325,000 at the end of the service

contract. They will also need $140,000 in net working capital over the life of

the contract.

While performing the contract work, they expect to incur fixed costs of

$500,000 per year and a variable cost of $226,000 per lab. They will also face a

corporate tax rate of 21%.

If the required rate of return is 15%, what is the minimum offer they can make

per lab and still turn an economic profit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- ABC Corporation has hired you to evaluate a new FOUR year project for the firm. The project will require the purchase of a $823,400.00 work cell. Further, it will cost the firm $55,600.00 to get the work cell delivered and installed. The work cell will be straight-line depreciated to zero with a 20-year useful life. The project will require new employees to be trained at a cost of $68,600.00. The project will also use a piece of equipment the firm already owns. The equipment has been fully depreciated, but has a market value of $7,100.00. Finally, the firm will invest $11,400.00 in net working capital to ensure the project has sufficient resources to be successful. The project will generate annual sales of $905,000.00 with expenses estimated at 37.00% of sales. Net working capital will be held constant throughout the project. The tax rate is 38.00%. The work cell is estimated to have a market value of $493,000.00 at the end of the fourth year. The firm expects to reclaim 86.00% of the…arrow_forwardKomoka Enterprises needs someone to supply it with 72,000 cartons of machine screws per year to support its manufacturing needs over the next five years, and you've decided to bid on the contract. It will cost you $950,000 to install the equipment necessary to start production. The equipment will be depreciated at 30% (Class 10), and you estimate that it can be salvaged for $88,000 at the end of the five-year contract. Your fixed production costs will be $320,000 per year, and your variable production costs should be $15.50 per carton. You also need an initial net working capital of $150,000. If your tax rate is 35% and you require a 14% return on your investment, what bid price should you submit? Keep intermediate results to at least 5 decimal places, Minimum Bid price to 2 decimal places is $ LEarrow_forwardABC Corporation has hired you to evaluate a new FOUR year project for the firm. The project will require the purchase of a $843,200.00 work cell. Further, it will cost the firm $51,700.00 to get the work cell delivered and installed. The work cell will be straight-line depreciated to zero with a 20-year useful life. The project will require new employees to be trained at a cost of $59,100.00. The project will also use a piece of equipment the firm already owns. The equipment has been fully depreciated, but has a market value of $5,200.00. Finally, the firm will invest $10,800.00 in net working capital to ensure the project has sufficient resources to be successful. The project will generate annual sales of $917,000.00 with expenses estimated at 38.00% of sales. Net working capital will be held constant throughout the project. The tax rate is 40.00%. The work cell is estimated to have a market value of $489,000.00 at the end of the fourth year. The firm expects to reclaim 85.00% of the…arrow_forward

- Rare Agri-Products Ltd. is considering a new project with a projected life of seven (7) years. The project falls under the government’s subsidy program for encouraging local agricultural products and is eligible for a one-time rebate of 25% on any initial equipment installed for the project. The initial equipment (IE) will cost $41,000,000. An additional equipment (AE) costing $3,500,000 will be needed at the end of year 3. At the end of seven (7) years, the original equipment, IE, will have no resale value but the supplementary equipment, AE, can be sold for $50,000. A working capital of $1,350,000 will be needed.The project is forecast to generate sales of agri-products over the seven years as follows:Year 1 70,000 unitsYear 2 100,000 unitsYears 3-5 250,000 unitsYears 6-7 325,000 unitsA sale price of $150 per unit for the first two years is expected and then decline to $90 per unit thereafter as the newness of the product loses some sheen. The variable expenses will amount to 30% of…arrow_forwardRare Agri-Products Ltd. is considering a new project with a projected life of seven (7) years. The project falls under the government’s subsidy program for encouraging local agricultural products and is eligible for a one-time rebate of 25% on any initial equipment installed for the project. The initial equipment (IE) will cost $41,000,000. An additional equipment (AE) costing $3,500,000 will be needed at the end of year 3. At the end of seven (7) years, the original equipment, IE, will have no resale value but the supplementary equipment, AE, can be sold for $50,000. A working capital of $1,350,000 will be needed. The project is forecast to generate sales of agri-products over the seven years as follows: Year 1 Year 2 Years 3-5 Years 6-7 70,000 units 100,000 units 250,000 units 325,000 units A sale price of $150 per unit for the first two years is expected and then decline to $90 per unit thereafter as the newness of the product loses some sheen. The variable expenses will amount…arrow_forwardBriggs Excavation Company is planning an investment of $932,100 for a bulldozer. The bulldozer is expected to operate for 3,000 hours per year for eight years. Customers will be charged $140 per hour for bulldozer work. The bulldozer operator costs $32 per hour in wages and benefits. The bulldozer is expected to require annual maintenance costing $30,000. The bulldozer uses fuel that is expected to cost $42 per hour of bulldozer operation. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine the equal annual net cash flows from operating the bulldozer. Use a minus sign to indicate cash outflows.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education