FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

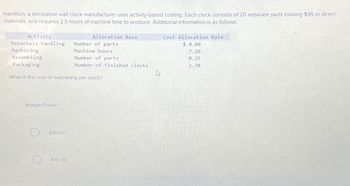

Transcribed Image Text:Hamilton, a decorative wall clock manufacturer uses activity-based costing. Each clock consists of 20 separate parts totaling $95 in direct

materials, and requires 2.5 hours of machine time to produce. Additional information is as follows:

Activity

Materials handling Number of parts

Machining

Machine hours

Assembling

Packaging

What is the cost of machining per clock?

Multiple Choice

$144.00

Allocation Base

$180.00

Number of parts

Number of finished clocks

Cost Allocation Rate

$ 0.08

7.20

0.35

2.70

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- BatCo makes baseball bats. Each bat requires 1.00 pounds of wood at $18 per pound and 0.35 direct labor hour at $30 per hour. Overhead is assigned at the rate of $60 per direct labor hour.arrow_forwardOne of Concord Company's activity cost pools is machine setups with estimated overhead of $220000. Concord produces sparklers (320 setups) and lighters (680 setups). How much of the machine setup cost pool should be assigned to sparklers? $220000 $70400 O $110000 O $149600arrow_forwardConspicuous Limo uses activity-based costing for its two models of stretch Hummer limousines: Big and Too Big. There are three activity cost pools related to production, with estimated costs and expected activity as follows: Amount of Activity Activity Cost Pool Estimated Cost Activity cost driver Big Too Big Fabrication $181,500 Labor hours 600 500 Painting $650,000 Machine hours 1,600 300 Finishing $2,750,000 Units 470 530 What are the activity rates for fabrication and painting?arrow_forward

- Advanced Miniature Development manufactures computer graphics cards (GPUs). Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 4,160 GPUs were as follows: Cost Driver Direct materials Direct labor Factory overhead Instructions Determine the: Each GPU requires 0.5 hour of direct labor. f. Standard Costs 110,000 lbs. at $6.30 2,080 hours at $15.80 Rates per direct labor hr., based on 100% of normal capacity of 2,000 direct labor hrs.: Variable cost, $4.25 Fixed cost, $6.00 a. direct materials price variance b. direct materials quantity variance c. total direct materials cost variance d. direct labor rate variance direct labor time variance total direct labor cost variance g. the variable factory overhead controllable variance h. fixed factory overhead volume variance i. total factory overhead cost variance. Actual Costs 115,000 lbs. at $6.50 2,000 hours at $15.40 $8,200 variable cost $12,000 fixed costarrow_forwardO&G Company manufactures console tables and uses an activity-based costing system to allocate all manufacturing conversion costs. Each console table consists of 40 separate parts totaling $250 in direct materials and requires 5.0 hours of machine time to produce. Additional information follows: Activity Materials handling Allocation Base Number of parts Machine hours Number of parts Number of finished units Machining Assembling Packaging What is the number of finished console tables? OA 200 OB. 467 OC. 25 OD. Cannot be determined from the information given Cost Allocation Rate $3.00 per part $4.80 per machine hour $1.00 per part $4.00 per finished unitarrow_forwardLovell Variety Seeds mass produces wildflower seed packs. Relevant information used for the process costing system is provided below: Beginning physical units 2,300 Physical units started 22,600 Units in ending WIP 9,500, 40% complete Beginning costs $3,100 Added direct materials costs $12,000 Added direct labor costs $19,500 Added manufacturing overhead costs $8,600 What is the costs completed and transferred out? Please round your answer to the nearest whole dollar.arrow_forward

- Skyline Florists uses an activity-based costing system to compute the cost of making floral bouquets and delivering the bouquets to its commercial customers. Company personnel who earn $220,000 typically perform both tasks; other firm-wide overhead is expected to total $80,000. These costs are allocated as follows: Bouquet Production Delivery Other Wages and salaries 70 % 20 % 10 % Other overhead 50 % 30 % 20 % Skyline anticipates making 20,000 bouquets and 5,000 deliveries in the upcoming year.What is the cost of wages and salaries and other overhead that would be charged to each bouquet made?arrow_forwardReynoso Corporation manufactures titanium and aluminum tennis racquets. Reynoso’s total overhead costs consist of assembly costs and inspection costs. The following information is available: Cost Titanium Aluminum Total Cost Assembly 500 mach. hours 500 mach. hours $27000 Inspections 350 150 $80000 2100 labor hours 1900 labor hours Reynoso is considering switching from one overhead rate based on labor hours to activity-based costing.Using activity-based costing, how much inspections cost is assigned to titanium racquets? $24000. $40000. $56000. $29000.arrow_forwardDeoro Company has identified the following overhead activities, costs, and activity drivers for the coming year: Activity Expected Cost Activity Driver Activity Capacity Setting up equipment Number of setups Ordering costs Number of orders Machine costs Receiving Direct materials Direct labor Deoro produces two models of dishwashers with the following expected prime costs and activity demands: Model A Units completed Direct labor hours Number of setups Number of orders $627,000 481,000 16,200 6,400 370 5,800 24,900 3,700 The company's normal activity is 7,900 direct labor hours. Machine hours Receiving hours Required: Model A Model B $482,510 372,000 864,000 410,000 Receiving hours Model A Machine hours $ del B Model B Unit Cost $836,000 497,000 8,500 1,500 240 1. Determine the unit cost for each model using direct labor hours to apply overhead. Round intermediate calculations and final answers to nearest cent. 12,800 18,300 6,300 610 18,600 43,200 10,000 2. Determine the unit cost for…arrow_forward

- narubhaiarrow_forwardVikramarrow_forwardXie Company identified the following activities, costs, and activity drivers for this year. The company manufactures two types of go- karts: Deluxe and Basic. Activity Handling materials Inspecting product Processing purchase orders Paying suppliers Insuring the factory. Designing packaging Activity Required: Compute the activity rate for each activity, assuming the company uses activity-based costing. (Round activity rate answers to 2 decimal places.) Handling material Inspecting product Processing orders Paying suppliers Insuring factory Designing packaging Expected Costs $700,000 975,000 180,000 250,000 375,000 150,000 Expected Costs $ $ Expected Activity 100,000 parts 1,500 batches 700 orders 500 invoices 40,000 square feet 2 models. 700,000 975,000 180,000 250,000 375,000 150,000 2,630,000 Activity Driver 100,000 parts 1,500 batches 700 orders 500 invoices 40,000 square feet 2 models Activity Ratearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education