FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

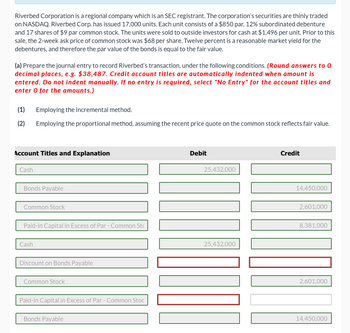

Transcribed Image Text:Riverbed Corporation is a regional company which is an SEC registrant. The corporation's securities are thinly traded

on NASDAQ. Riverbed Corp. has issued 17,000 units. Each unit consists of a $850 par, 12% subordinated debenture

and 17 shares of $9 par common stock. The units were sold to outside investors for cash at $1,496 per unit. Prior to this

sale, the 2-week ask price of common stock was $68 per share. Twelve percent is a reasonable market yield for the

debentures, and therefore the par value of the bonds is equal to the fair value.

(a) Prepare the journal entry to record Riverbed's transaction, under the following conditions. (Round answers to 0

decimal places, e.g. $38,487. Credit account titles are automatically indented when amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and

enter 0 for the amounts.)

(1) Employing the incremental method.

(2) Employing the proportional method, assuming the recent price quote on the common stock reflects fair value.

Account Titles and Explanation

Cash

Bonds Payable

Common Stock

Paid-in Capital in Excess of Par - Common St

Cash

Discount on Bonds Payable

Common Stock

Paid-in Capital in Excess of Par - Common Stoc

Bonds Payable

Debit

25,432,000

25,432,000

Credit

14,450,000

2,601,000

8,381,000

2,601,000

14,450,000

Expert Solution

arrow_forward

Step 1

Common stock

The value of common stock can be determined the product of number of shares held by a company with the par value of each share. This is one of the most important head of stockholder's equity in priority to retained profits.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Riverbed Inc's $10 par value common stock is actively traded at a market price of $16 per share. Riverbed issues 6,000 shares to purchase land advertised for sale at $77,500. Journalize the issuance of the stock in acquiring the land. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forwardCaswell Corporation is authorized to issue 10,000 shares of common stock on December 31. It sells 8,000 shares at $16 per share. Required: Record the sale of the common stock, given the following independent assumptions: 1. The stock has a par value of $10 per share.arrow_forwardRahularrow_forward

- Dengararrow_forwardNovak Inc. issues 500 shares of $10 par value common stock and 100 shares of $100 par value preferred stock for a lump sum of $125,000. a. b. Prepare the journal entry for the issuance when the market price of the common shares is $181 each and market price of the preferred is $226 each. Prepare the journal entry for the issuance when only the market price of the common stock is known and it is $220 per share.arrow_forwardPronghorn Corporation purchased from its stockholders 5,400 shares of its own previously issued stock for $275,400. It later resold 2,160 shares for $54 per share, then 2,160 more shares for $49 per share, and finally 1,080 shares for $43 per share. Prepare journal entries for the purchase of the treasury stock and the three sales of treasury stock. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation I (To record purchase from stockholders.) (To record sales of shares at $54 per share.) (To record sales of shares at $49 per share.) Debit Creditarrow_forward

- 1arrow_forwardHuntington Power Co. has issued following three securities as its long-term source of capital. Calculate the weights of each source of capital (kd, kp, ke). Debt: 2,500 bonds outstanding, current market price of the bond is $1,080. Preferred Stock: 3,000 shares outstanding, selling for $98. Common Stock: 60,000 shares outstanding, selling for $55 per share. a. 42.90%; 4.67%; 52.43% b. 45.63%; 1.72%; 59.67% c. 42.90%; 4.67%; 55.71% d. 59.67%; 5.08%; 35.24% e. 45.63%; 1.72%; 52.65% f. 42.90%; 2.23%; 52.14%arrow_forward7. On January 3, Russet Corporation purchased 2,250 shares of the company's $3 par value common stock as treasury stock, paying cash of $11 per share. On January 30, Russet Corporation sold 1,400 shares of the treasury stock for cash of $14 per share. Journalize these transactions. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Journalize the purchase of the treasury stock. Date Jan. 3 Accounts and Explanation Debit Creditarrow_forward

- In 2007, Xero Ltd. offered a subscription of 15 million shares at an offer price of $1.00 per share with the ability to accept oversubscriptions of up to $3 million. The prospectus detailed the requirement that all applications must be accompanied by payment in full for the total number of shares applied for and stated that application monies will be banked upon receipt into a designated bank account and held on trust pending the allocation of shares. Required: Assuming all 18 million shares were applied for, prepare the journal entry to record the receipt of application monies. Apart from recording a cash inflow, explain whether Xero should also record another asset, a liability, revenue or an expense upon collection of application monies, and explain why.arrow_forward(19) Miller Corporation issued 7,000 shares of its $5 par value common stock in payments for attorney services billed at $70,000. Miller Corporation's stock has been actively trading at $10 per share. The journal entry for this transaction would include a credit to: A. Legal expenses for $70,000 B. Common stock for $70,000 C. Paid - in Capital in Excess of Par-Common for $70,000. D. Paid - in Capital in Excess of Par-Common for $35,000.arrow_forwardPlease help mearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education