Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

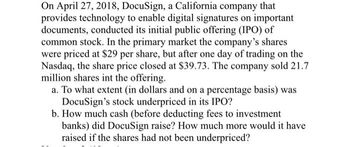

Transcribed Image Text:On April 27, 2018, DocuSign, a California company that

provides technology to enable digital signatures on important

documents, conducted its initial public offering (IPO) of

common stock. In the primary market the company's shares

were priced at $29 per share, but after one day of trading on the

Nasdaq, the share price closed at $39.73. The company sold 21.7

million shares int the offering.

a. To what extent (in dollars and on a percentage basis) was

DocuSign's stock underpriced in its IPO?

b. How much cash (before deducting fees to investment

banks) did DocuSign raise? How much more would it have

raised if the shares had not been underpriced?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Cool Company has decided to take their company public on January 1, 2014. Cool company had 1,000 shares authorized. The following transactions occurred. a.) Jean grey issues 5,000 shares for $15 per share during their IPO on January 1, 2014. each share has a par value of $5. Record the journal entry for this transaction. Please label debits and credits and include classification of each account. b.) On January 1, 2015, Cool company bought back 2,000 shares from the open market at a price of $25 per share. Record the journal entry for this share repurchase. Label debits and credits and include classification of each account.arrow_forwardDuring May, 2016, Nevling Outdoor Corporation announced a 3-for-1 forward stock split. This brought the number of shares outstanding from 25,792,000 shares to shares, and its $1.80 par value to per share. A) 8,897,334; $0.60 B) 77,376,000; $0.60 C) 8,597,334; $5.40 D) 77,376,000; $5.40arrow_forwardRiverbed Corporation is a regional company which is an SEC registrant. The corporation's securities are thinly traded on NASDAQ. Riverbed Corp. has issued 17,000 units. Each unit consists of a $850 par, 12% subordinated debenture and 17 shares of $9 par common stock. The units were sold to outside investors for cash at $1,496 per unit. Prior to this sale, the 2-week ask price of common stock was $68 per share. Twelve percent is a reasonable market yield for the debentures, and therefore the par value of the bonds is equal to the fair value. (a) Prepare the journal entry to record Riverbed's transaction, under the following conditions. (Round answers to 0 decimal places, e.g. $38,487. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (1) Employing the incremental method. (2) Employing the proportional method, assuming the recent price quote on…arrow_forward

- Copley Corporation is preparing their financial statements for the year ending February 28, 2022. Copley Corporation has two categories of stock: Preferred and Common. The preferred stock is structured such that the holders of the preferred stock may convert one share of preferred stocks into one share of common stock if the market price of the common stock is greater than $1,000. As of February 28, 2022, the market price of the common stock had never reached $1,000. In the preparation of the 2/28/22 Income Statement Copley’s staff accountant was calculating the Basic and Diluted EPS. While calculating the diluted EPS the staff accountant is unsure of whether to include the potential impact of the convertible preferred stock since the trigger conversion price had not been met as of 2/28/22. Accounting Issue: In the calculation for Diluted EPS should Copley Corporation include the impact of the convertible preferred stock since the trigger conversion price of $1,000 had not…arrow_forwardAutomatic Data Processing recently issued $150 million of 61/2 percent convertible debentures maturing in 2011. The debentures are convertible into common stock at $83.45 a share. The company's common stock was trading at about $67 a share when the convertibles were issued. How many shares of common stock can be obtained by converting one $1,000 par value debenture; that is, what is the conversion ratio?arrow_forward.arrow_forward

- Rahularrow_forwardCullumber, Inc., a high-technology firm in Portland, raised a total of $60 million in an IPO. The company received $27 of the $30 per share offering price. The firm’s legal fees, SEC registration fees, and other out-of-pocket costs were $350,000. The firm’s stock price increased 17 percent on the first day of trading. What was the total cost to the firm of issuing the securities?arrow_forwardGlen Tay Inc. had issued 24,000 shares of its no-par common shares on April 1, 2017 for property with an appraisal value of $320,000. The common shares of the company were being traded at $13.15 each on that day. What is the journal entry required to record the issuance of the shares? Select one: a. DR Common Shares Receivable, $320,000; CR Common Share Capital, $315,600; CR Gain On Issue Of Shares, $4,400. b. DR Common Shares Receivable, $320,000; CR Common Share Capital, $315,600; CR Contributed Surplus - Common Shares, $4,400. c. DR Property, $320,000; CR Common Share Capital, $315,600; CR Retained Earnings -Issue Of Shares, $4,400. d. DR Property, $320,000; CR Common Share Capital, $315,600; CR Gain On Issue Of Shares, $4,400. e. None of the above entries.arrow_forward

- In 2007, Xero Ltd. offered a subscription of 15 million shares at an offer price of $1.00 per share with the ability to accept oversubscriptions of up to $3 million. The prospectus detailed the requirement that all applications must be accompanied by payment in full for the total number of shares applied for and stated that application monies will be banked upon receipt into a designated bank account and held on trust pending the allocation of shares. Required: Assuming all 18 million shares were applied for, prepare the journal entry to record the receipt of application monies. Apart from recording a cash inflow, explain whether Xero should also record another asset, a liability, revenue or an expense upon collection of application monies, and explain why.arrow_forwardBernard Corporation wants to obtain P4 million in its first public issue of common stock. After the issuance, the total market value of a stock is estimated at $10 million. At present, there are 120,000 closely-held shares. REQUIREMENTS: (a) What is the amount of new shares that must be issued to obtain the P4 million? (b) After the stock issuance, what will be the expected price per share?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education