FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

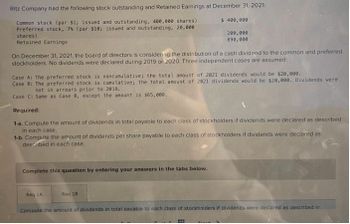

Transcribed Image Text:Ritz Company had the following stock outstanding and Retained Earnings at December 31, 2021:

Common stock (par $1; issued and outstanding, 400,000 shares)

Preferred stock, 7% (par $10; issued and outstanding, 20,000

shares)

Retained Earnings

$ 400,000

200,000

890,000

On December 31, 2021, the board of directors is considering the distribution of a cash dividend to the common and preferred

stockholders. No dividends were declared during 2019 or 2020. Three independent cases are assumed:

Case A: The preferred stock is noncumulative; the total amount of 2021 dividends would be $20,000.

Case B: The preferred stock is cumulative; the total amount of 2021 dividends would be $20,000. Dividends were

not in arrears prior to 2019.

Case C: Same as Case B, except the amount is $65,000.

Required:

1-a. Compute the amount of dividends in total payable to each class of stockholders if dividends were declared as described

in each case.

1-b. Compute the amount of dividends per share payable to each class of stockholders if dividends were declared as

described in each case.

Complete this question by entering your answers in the tabs below.

Req 1A

Req 18 1

Compute the amount of dividends in total payable to each class of stockholders if dividends were declared as described in

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Alexander Corporation reports the following components of stockholders' equity at December 31, 2019. Common stock-$25 par value, 60,000 shares authorized, 39,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity During 2020, the following transactions affected its stockholders' equity accounts. January 2 Purchased 3,900 shares of its own stock at $25 cash per share. January 7 Directors declared a $1.50 per share cash dividend payable on February 28 to the February 9 stockholders of record February 28 Paid the dividend declared on January 7. July 9 Sold 1,560 of its treasury shares at $30 cash per share. August 27 Sold 1,950 of its treasury shares at $20 cash per share. September 9 Directors declared a $2 per share cash dividend payable on October 22 to the September 23 stockholders of record.. October 22 Paid the dividend declared on September 9. December 31 Closed the $61,000 credit balance (from net income)…arrow_forwardManner, Inc. has 5,000 shares of 6%, $100 par value, noncumulative preferred stock and 20,000 shares of $1 par value common stock outstanding at December 31, 2018. There were no dividends declared in 2017. The board of directors declares and pays a $55,000 dividend in 2018. What is the amount of dividends received by the common stockholders in 2018? Note: show calculation. Essay Toolbar navigation I Uarrow_forwardWheaton Tire Inc., [WTI] reported the following excerpts from shareholders’ equity on January 1, 2021: Preferred shares, 0.90, 300,000 issued and outstanding $6,000,000 Common shares, 400,000 issued and outstanding $4,400,000 For This Question Only, assume that the company declared/distributed a 5% stock dividend on January 2, 2021 when the market price of the common shares was $10.50 each, prior to this dividend. What entry, if any, should WTI make to record this transaction? Select one: a. No Journal Entry required for this transaction. Only a Proforma Entry should be made. b. DR Retained Earnings, $210,000; CR Common Shares, $210,000 c. DR Retained Earnings, $200,000; CR Common Shares, $200,000 d. DR Retained Earnings, $220,000; CR Common Shares, $220,000 e. DR Retained Earnings, $225,000; CR Common Stock Dividend Distributable, $225,000.arrow_forward

- Marigold Corp. had 307000 shares of common stock issued and outstanding at December 31, 2020. During 2021, no additional common stock was issued. On January 1, 2021, Marigold issued 395000 shares of nonconvertible preferred stock. During 2021, Marigold declared and paid $174000 cash dividends on the common stock and $154000 on the nonconvertible preferred stock. Net income for the year ended December 31, 2021, was $959000. What should be Marigold's 2021 earnings per common share, rounded to the nearest penny? $2.62 $3.12 $1.07 $2.06arrow_forwardCarlos Company had the following stock outstanding and Retained Earnings at December 31, 2018: Common Stock (par $1; outstanding, 400,000 shares) Preferred Stock, 9% (par $10; outstanding, 18,100 shares) Retained Earnings $ 400,000 181,000 957,000 On December 31, 2018, the board of directors is considering the distribution of a cash dividend to the common and preferred stockholders. No dividends were declared during 2016 or 2017. Three independent cases are assumed: The preferred stock is noncumulative; the total amount of 2018 dividends would be $18,000. The preferred stock is cumulative; the total amount of 2018 dividends would be $15,000. Dividends were not in arrears prior to 2016. Same as Case B, except the amount is $58,000. Case A: Case B: Case C: Required: 1-a. Compute the amount of 2018 dividends, in total, that would be payable to each class of stockholders if dividends were declared as described in each case. 1-b. Compute the amount of 2018 dividends per share payable to…arrow_forwardOn January 1, 2021, Nash Corp. had 502,000 shares of common stock outstanding. During 2021, it had the following transactions that affected the Common Stock account. February 1 March 1 May 1 June 1 October 1 (a) Issued 125,000 shares Issued a 10% stock dividend Acquired 97,000 shares of treasury stock Issued a 3-for-1 stock split Reissued 62,000 shares of treasury stock * Your answer is incorrect. Determine the weighted-average number of shares outstanding as of December 31, 2021. The weighted-average number of shares outstanding 123083arrow_forward

- Wheaton Tire Inc., [WTI] reported the following excerpts from shareholders’ equity on January 1, 2021: Preferred shares, 0.90, 300,000 issued and outstanding $6,000,000 Common shares, 400,000 issued and outstanding $4,400,000 The company declared and paid a cash dividend on February 1, 2021 of $1,400,000. Dividends had not been declared for the past two years, 2019 and 2020. now assume that for this question only that the preferred shares were non cumulative and fully participating. How much will each shareholder group receive? Select one: a. All $1,400,000 to Common since the Preferred are non-participating. b. Each group receives an equal amount of $700,000 per group. c. $270,000 to Preferred and $1,130,000 to Common. d. $807,692 to Preferred and $592,308 to Common. e. None of the above.arrow_forwardLenore, Inc. declared a cash dividend of $90,000 in 2021 when the following stocks were outstanding: Common stock 30,000 shares, $5 par value $150,000 Preferred stock, 6%, 6,000 shares, $50 par value $300,000 No dividends were declared or paid during the prior two years. Required: Compute the amount of dividends that would be paid to each stockholder group if the preferred stock is noncumulative. Compute the amount of dividends that would be paid to each stockholder group if the preferred stock is cumulative.arrow_forwardWheaton Tire Inc., [WTI] reported the following excerpts from shareholders’ equity on January 1, 2021: Preferred shares, 0.90, 300,000 issued and outstanding $6,000,000 Common shares, 400,000 issued and outstanding $4,400,000 The company declared and paid a cash dividend on February 1, 2021 of $1,400,000. Dividends had not been declared for the past two years, 2019 and 2020. However, now assume that for this question only that the preferred shares were cumulative and participating in excess distributable dividends after allocating common shareholders a minimum dividend of $0.80 per share. How much will each shareholder group receive?arrow_forward

- Tower Corp. had the following stock outstanding and Retained Earnings at December 31, 2018: $ 304,000 68,000 288,000 Common Stock (par $8; outstanding, 38,000 shares) Preferred Stock, 7% (par $10; outstanding, 6,800 shares) Retained Earnings On December 31, 2018, the board of directors is considering the distribution of a cash dividend to the common and preferred stockholders. No dividends were declared during 2016 or 2017, and none have been declared yet in 2018. Three independent cases are assumed: The preferred stock is noncumulative; the total amount of 2018 dividends would be $13,400. The preferred stock is cumulative; the total amount of 2018 dividends would be $14,280. Dividends were not in arrears prior to 2016. Same as Case B, except the total dividends are $74,000. Case A: Case B: Case C: Required: 1-a. Compute the amount of 2018 dividends, in total that would be payable to each class of stockholders if dividends were declared as described in each case. TIP: Preferred…arrow_forwardWheaton Tire Inc., [WTI] reported the following excerpts from shareholders’ equity on January 1, 2021: Preferred shares, 0.90, 300,000 issued and outstanding $6,000,000 Common shares, 400,000 issued and outstanding $4,400,000 For This Question Only, assume that the preferred shares were non-cumulative and non-participating. The company declared and paid a cash dividend on February 1, 2021 of $1,400,000. Dividends had not been declared for the past two years, 2019 and 2020. How much will each shareholder group receive? Select one: a. $270,000 to Preferred and $1,130,000 to Common. b. $360,000 to Preferred and $1,040,000 to Common. c. $807,692 to Preferred and $592,308 to Common as the common share holders carry more risk and so they must receive based on pro-rata share contribution d. Each group receives an equal amount of $700,000 per group. e. None of the above.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education