Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Transcribed Image Text:27²

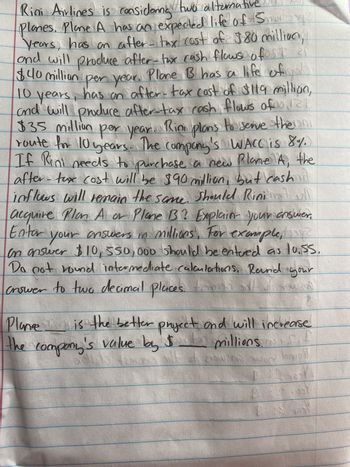

Riai Airlines is considering two alternative

Planes. Plane A has an expected life of Sures

Years, has an after-tax cost of $80 millian,

and will produce after-tax cash flows ofst 21

$40 million per year. Plane B has a life of

10 years, has an after-tax cast of $119 million,

and will produce after-tax cash flows of 121

$35 million per year. Rim plans to serve the uni

route for 10 years. The company's WACC is 8%.

If Rini needs to purchase a new Plane A, the

after-tux cost will be $90 million, but cash

inflows will remain

the

Should Rini all

acquire Plan A or Plane B? Explain your answer,

Enter your answers in millions. For example,

same.

on answer $10, 550,000 should be entered as lo.ss.

Do not round intermediate calculations. Round your

criswer to two decimal places.

2004200

Plane

is the better project and will increase

$ -

$

the company's value by 5 millions.

millions f

ex boll

19

E

TOUS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Sons Inc. management is considering purchasing a new machine at a cost of $4,390,000. They expect this equipment to produce cash flows of $845,890, $819,250, $917,830, $1,103,400, $1,093,260, and $1,306,800 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) The NPV is $arrow_forwardMETL is evaluating a project projected to have a 7-year life. The initial investment of $4.2 million will be depreciated to zero using straight-line over the project life. The project is expected to create incremental sales of $2.4 million per year and incremental expenses of $1.4 million per year. What is the incremental after-tax operating cash flow (OCF) associated with this project if METL's tax rate is 32%? Enter answer in dollars, rounded to the nearest dollar.arrow_forwardPeng Company is considering buying a machine that will yield income of $2,400 and net cash flow of $16,000 per year for three years. The machine costs $48,900 and has an estimated $8,100 salvage value. Compute the accounting rate of return for this investment. Numerator: Accounting Rate of Return Denominator: = Accounting Rate of Return Accounting rate of returnarrow_forward

- the to be In 2 years, XYZ is considering buying a new, high efficiency interception system. The new system would be purchased today for $46,500.00. It would be depreciated straight-line to $0 over 2 years. system would be sold for an after-tax cash flow of $14,700.00. Without the system, costs are expected to be $100,000.00 in 1 year and $100,000.00 in 2 years. With the system, $79,700.00 in 1 year and $67,000.00 in 2 years. If the tax rate is 48.30% and the cost of capital is 8.30%, what is the net present value of the new interception system project? costs are expected O $13344.34 (plus or minus $50) O $14279.01 (plus or minus $50) O $10213.60 (plus or minus $50) O $11718.49 (plus or minus $50) None of the above is within $50 of the correct answerarrow_forwardCrockett Graphic Designs Inc. is considering two mutually exclusive projects. Both projects require an initial after-tax investment of $11,000 and are typical average-risk projects for the firm. Project A has an expected life of 2 years with after-tax cash inflows of $6,000 and $8,000 at the end of Years 1 and 2, respectively. Project B has an expected life of 4 years with after-tax cash inflows of $5,000 at the end of each of the next 4 years. The firm's WACC is 10%. a. If the projects cannot be repeated, which project should be selected if Crockett uses NPV as its criterion for project selection? Project should be selected. b. Assume that the projects can be repeated and that there are no anticipated changes in the cash flows. Use the replacement chain analysis to determine the NP of the project selected. Do not round intermediate calculations. Round your answer to the nearest cent. Since Project 's extended NPV = $ , it should be selected over Project A ~ with an…arrow_forwardNiagra Falls Power and Light is considering a project that will produce annual cash flows of $37,500, $46,200, $56,900, and $22,400 over the next four years, respectively. What is the internal rate of return if the project has an initial cost of $113,500?arrow_forward

- XYZ is evaluating a project that would require the purchase of a piece of equipment for $440,000 today. During year 1, the project is expected to have relevant revenue of $786,000, relevant costs of $201,000, and relevant depreciation of $132,000. XYZ would need to borrow $440,000 today to pay for the equipment and would need to make an interest payment of $33,000 to the bank in 1 year. Relevant net income for the project in year 1 is expected to be $337,000. What is the tax rate expected to be in year 1? A rate equal to or greater than 21.96% but less than 26.61% A rate less than 21.96% or a rate greater than 46.34% A rate equal to or greater than 31.02% but less than 38.39% A rate equal to or greater than 38.39% but less than 46.34% A rate equal to or greater than 26.61% but less than 31.02%arrow_forwardXYZ is evaluating a project that would require the purchase of a piece of equipment for $560,000 today. During year 1, the project is expected to have relevant revenue of $761,000, relevant costs of $205,000, and relevant depreciation of $130,000. XYZ would need to borrow $560,000 today to pay for the equipment and would need to make an interest payment of $38,000 to the bank in 1 year. Relevant net income for the project in year 1 is expected to be $337,000. What is the tax rate expected to be in year 1? O A rate less than 16.43% or a rate greater than 52.83% O A rate equal to or greater than 16.43% but less than 21.92% O A rate equal to or greater than 21.92% but less than 24.67% O A rate equal to or greater than 24.67% but less than 35.22% O A rate equal to or greater than 35.22% but less than 52.83%arrow_forwardA project with a life of 6 years is expected to provide annual sales of $260,000 and costs of $173,000. The project will require an investment in equipment of $490,000, which will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/-15 percent. The tax rate is 21 percent. What is the annual operating cash flow for the best-case scenario?arrow_forward

- Sparky Inc. is evaluating a project that costs $150 using the WACC method. Their WACC is 11.5% and the project has EBIT of $75 per year each year for six years. The tax rate is 30%. Calculate the NPV of the project.arrow_forwardBadRock Corp is evaluating a project with revenues will be $3.5 million and cash expenses will be $1.5 million while depreciation expense will be $400 000 per year, then what is the expected free cash flow per year from taking the project if the company's tax rate is 30 per cent?arrow_forwardCourses/88945/quizzes/289708/take Van Nuys Company Year Cash Flow Cost of Capital 12% %24 (7,370) 24 1 4,000 (2,000) 24 24 4,000 (2,000) 24 4,000 24 (2,000) $4 4,000 24 (2,000) 5 $4 4,000 (2,000) 24 24 6. 4,000 24 (2,000)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education