FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

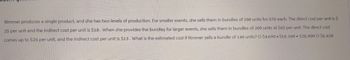

Transcribed Image Text:Rimmer produces a single product, and she has two levels of production. For smaller events, she sells them in bundles of 100 units for 570 each. The direct cost per unit is S

25 per unit and the indirect cost per unit is $18. When she provides the bundles for larger events, she sells them in bundles of 200 units at S65 per unit. The direct cost

comes up to $25 per unit, and the indirect cost per unit is $13. What is the estimated cost if Rimmer sells a bundle of 140 units? O $4.690 $10, 100 $28,000 O $5,620

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Winter Sports manufactures snowboards. Its cost of making 1,800 bindings is as follows in the data table. Suppose Livingston will sell bindings to Winter Sports for $14 each. Winter Sports would pay $1 per unit to transport the bindings to its manufacturing plant, where it would add its own logo at a cost of $0.60 per binding.arrow_forwardHazel Company makes an unassembled product that it currently sells for $55. Production costs are $20. Hazel is considering assembling the product and selling it for $68. The cost to assemble the product is estimated at $12. What decision should Hazel make? A) Sell before assembly; net income per unit will be $12 greater. B) Sell before assembly; net income per unit will be $1 greater. C) Process further; net income per unit will be $13 greater. D) Process further; net income per unit will be $1 greater. 24 E) none of the abovearrow_forwardSEved Spring Corp. has two divisions, Daffodil and Tulip. Daffodil produces a gadget that Tulip could use in its production. Tulip currently purchases 170,000 gadgets for $13.90 on the open market. Daffodil's variable costs are $7 per widget while the full cost is $11.45. Daffodil sells gadgets for $14.40 each. If Daffodil is operating at capacity, what would be the minimum transfer price Daffodil would accept for an internal transfer? Multinic Choice $7.40 $1.45 $13.90 $14.40arrow_forward

- SE Spring Corp. has two divisions, Daffodil and Tulip. Daffodil produces a gadget that Tulip could use in its production. Tulip currently purchases 195,000 gadgets for $14.40 on the open market. Daffodil's variable costs are $7.90 per widget while the full cost is $12.20. Daffodil sells gadgets for $15 each. If Daffodil is operating at capacity, what would be the maximum transfer price Tulip would pay internally? Multiple Choice $7.90 $12.20 $14.40 $14.90arrow_forwardThomas and Theresa work for a company that receives $75 for each unit of output sold. The company has a variable cost of $30 per item and a fixed cost of $12,000.Based on this information, Thomas and Theresa make some projections about potential profit.Thomas states that for every 500 units of output sold, the company will make $11,000 in profit.Theresa states that for every 800 units of output sold, the company will make $24,000 in profit.Determine a function that models the profit for the company based upon the conditions for revenue and expense.Are the claims about profit that Thomas and Theresa made true? Explain why Thomas and Theresa are each correct or incorrect and justify your reasoning.arrow_forwardSweet Taste has the capacity to produce either 45,000 corncob pipes or 21,000 cornhusk dolls per year. The pipes cost $3.00 each to produce and sell for $7.50 each. The dolls sell for $10.00 each and cost $4.00 to produce. Required Calculate the contribution margin per unit and the total contribution margin for Pipes and Dolls. Assuming that Sweet Taste can sell all it produces of either product, should it produce the corncob pipes or the cornhusk dolls? (Round "Contribution margin per unit" answers to 2 decimal places.) Please don't provide answer in image format thank youarrow_forward

- Green Co. incurses cost of $15 per pound to produce Product X, which it sells for $26 per pound. The company can further process Product X to produce Product Y. Product Y would sell for $30 per pound and would require an additional cost of $10 per pound to be produced. The differential cost of producing Product Y is _____.arrow_forwardCool Boards manufactures snowboards. Its cost of making 2,100 bindings is as follows: (Click the icon to view the costs.) Suppose Hemingway will sell bindings to Cool Boards for $16 each. Cool Boards would pay $3 per unit to transport the bindings to its manufacturing plant, where it would add its own logo at a cost of $0.40 per binding. Requirements 1. Cool Boards' accountants predict that purchasing the bindings from Hemingway will enable the company to avoid $2,400 of fixed overhead. Prepare an analysis to show whether Cool Boards should make or buy the bindings. 2. The facilities freed by purchasing bindings from Hemingway can be used to manufacture another product that will contribute $3,500 to profit. Total fixed costs will be the same as if Cool Boards had produced the bindings. Show which alternative makes the best use of Cool Boards' facilities: (a) make bindings, (b) buy bindings and leave facilities idle, or (c) buy bindings and make another product. Print - X Done Data…arrow_forwardAs a boba manufacturer company, Ngeboba supplies boba to Gula Hula and BobaTime. Ngeboba supplies 100 kgs to Gula Hula per month and also 500 kgs to Boba Time per month. Ngeboba as one of the founders of Gula Hula and BobaTime, felt responsible for the supply of boba for both brands. Ngeboba itself has a product cost of IDR 10,000 per kilo. Ngeboba sells to other customers than Gula Hula and BobaTime for IDR 20,000 per kilogram. Gula Hula gets prices from other suppliers at IDR 17,000 per kilogram, while BobaTime gets 2,000 cheaper prices per kilogram than the price obtained by Gula Hula because it buys more. In general, Ngeboba's production capacity is 2 (two) tons per month. During the 3rd quarter, Ngeboba felt that his sales had risen drastically, so Ngeboba was faced with the following conditions: 1. Demand from customers is full up to 2 (two) tons in July because it is the dry season. With Ngeboba, they felt that they couldn't help but they need to supply Gula Hula and BobaTime.…arrow_forward

- As a boba manufacturer company, Ngeboba supplies boba to Gula Hula and BobaTime. Ngeboba supplies 100 kgs to Gula Hula per month and also 500 kgs to Boba Time per month. Ngeboba as one of the founders of Gula Hula and BobaTime, felt responsible for the supply of boba for both brands. Ngeboba itself has a product cost of IDR 10,000 per kilo. Ngeboba sells to other customers than Gula Hula and BobaTime for IDR 20,000 per kilogram. GulaHula gets prices from other suppliers at IDR 17,000 per kilogram, while BobaTime gets 2,000 cheaper prices per kilogram than the price obtained by Gula Hula because it buys more.In general, Ngeboba's production capacity is 2 (two) tons per month. During the 3rd quarter,Ngeboba felt that his sales had risen drastically, so Ngeboba was faced with the following conditions: Demand from customers is full up to 2 (two) tons in July because it is the dry season. With Ngeboba, they felt that they couldn't help but they need to supply Gula Hula and BobaTime. In…arrow_forwardBright Force Inc. produces and sells lightning fixtures. An entry light has a total cost of $90 per unit, of which $50 is product cost and $40 is selling and administrative expenses. In addition, the total cost of $90 is made up of $55 variable cost and $35 fixed cost. The desired profit is $20 per unit. Determine the markup percentage on product cost.arrow_forwardWren Co. manufactures and sells two products with selling prices and variable costs as follows: A) selling price $18.00, variable costs $12.00, and B) selling price $22.00, variable costs $14.00. Wren's total annual fixed costs are $38,400. Wren sells four units of A for every unit of B. If operating income was $28,800 what was the number of units Wren sold?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education