FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

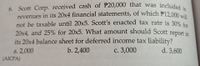

Transcribed Image Text:6. Scott Corp. received cash of P20,000 that was included in

revenues in its 20x4 financial statements, of which P12,000 will

not be taxable until 20x5. Scott's enacted tax rate is 30% fo

20x4, and 25% for 20x5. What amount should Scott report in

its 20x4 balance sheet for deferred income tax liability?

d. 3,600

b. 2,400

с. 3,000

a. 2,000

(AICPA)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gudubhaiarrow_forwardAccounting income or loss for Aberdeen Corporation, following IFRS, is below: Year Accounting income/(loss) Tax rate percent Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 $160,000 250,000 80,000 (160,000) (380,000) 130,000 145,000 30 30 25 25 25 25 25 Assume that there were no permanent or temporary differences between accounting and taxable income. Required Prepare the tax-related journal entries for Year 3 to Year 7. Aberdeen Corporation believes that it will be able to use any loss carryforward in future years. Aberdeen Corporation will apply the available carryback provisions to the earliest years first. Include your calculations.arrow_forwardBeaver Dam Inc. (BDI) listed the following items to prepare a reconciliation between book and taxable income. GAAP net income before tax $700,000 Meal and entertainment expense 100,000 GAAP depreciation expense 110,000 Depreciation expense for tax purposes 120,000 c. Compute the net increase in BDI’s deferred tax assets or deferred tax liabilities for the year. d. Prepare the journal entry to record taxes for the year.arrow_forward

- Grand Corporation reported pretax book income of $612,000. Tax depreciation exceeded book depreciation by $408,000. In addition, the company received $306,000 of tax-exempt municipal bond interest. The company's prior-year tax return showed taxable income of $51,000. Compute the company's current income tax expense or benefit. (Leave no answer blank. Enter N/A or zero.) 이 Current income tax Deferred income tax N/A expense $arrow_forwardThe XYZ, Inc. reported $50 million of taxable income. Its federal tax rate was 21% (ignore any possible state corporation taxes). What is the company’s federal income tax bill for the year? Question 1 options: a) $11,500,000 b) $10,500,000 c) $12,100,000 d) $11,100,000arrow_forwardGrand Corporation reported pretax book income of $621,000. Tax depreciation exceeded book depreciation by $414,000. In addition, the company received $310,500 of tax-exempt municipal bond interest. The company’s prior-year tax return showed taxable income of $51,750. Compute the company's current income tax expense or benefit. (Leave no answer blank. Enter N/A or zero.) Current income tax N/A $0 Deferred income tax Expense ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education