FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

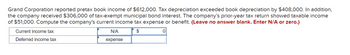

Transcribed Image Text:Grand Corporation reported pretax book income of $612,000. Tax depreciation exceeded book depreciation by $408,000. In addition,

the company received $306,000 of tax-exempt municipal bond interest. The company's prior-year tax return showed taxable income

of $51,000. Compute the company's current income tax expense or benefit. (Leave no answer blank. Enter N/A or zero.)

이

Current income tax

Deferred income tax

N/A

expense

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Am.101.arrow_forwardIn 2025 Vaughn Corporation had pretax financial income of $185,000 and taxable income of $117,000. The difference is due to the use of different depreciation methods for tax and accounting purposes. The effective tax rate is 30%. Compute the amount to be reported as income taxes payable at December 31, 2025arrow_forwardThe SGS Co. had $227,000 in taxable income. Use the rates from Table 2.3. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Calculate the company’s income taxes.arrow_forward

- Baltimore inc reported pretax gaap income of $45,000 in 2020. The company determined it had deducted $5000 in nondeductible fines and added $2800 in tax exempt municipal interest revenue to Gaap income. Given a statutory tax rate of 25%, determine the taxable income, income tax payable, income tax expense, net income, and effective tax rate.arrow_forwarddevarrow_forwardThornton, Inc., had taxable income of $129632 for the year. The company's marginal tax rate was 34 percent and its average tax rate was 24.7 percent. How much did the company have to pay in taxes for the year? a.30432 b.44075 c.30776 d.29074arrow_forward

- ABC Corporation provides you with the following information for the 2020 tax year, which was the company’s first year of operation:Book Income Before Taxes $100,000,000Book Depreciation $ 5,000,000MACRS Depreciation $ 7,500,000Foreign Sourced Income $ 40,000,000Assume a federal tax rate of 21%, disregard state taxes.a. Calculate federal taxable income.b. Calculate the federal tax payable and federal tax expense.c. Given your answer above in b., is a deferred tax asset or a deferred tax liability created? Provide the journal entry needed to reflect this.arrow_forwardNonearrow_forwardBefore considering a tax loss carryforward of $80 million, Aero Corporation reported $200 million of pretax accounting and taxable income in the current year. The income tax rate for all previous years was 40%. On January 1 of the current year a new tax law was enacted, reducing the rate to 35% effective immediately. Aero's income tax payable for the current year would be: Select one: a. $48 million. b. $28 million. c. $36 million. d. $42 million. e. $80 million.arrow_forward

- Range Rover Inc. had taxable income of $152,000 for the year. The GAAP basis of accounts receivable (net) $9,600 less than the tax basis of accounts receivable. Assuming a tax rate of 25%, record the income tax journal entry on December 31. Assume zero beginning balances in deferred tax accounts Note: faline in a journal entry ant required for the transaction select N/A as the account names and leave the Dr. and Cr. answers blank (zero) Dr. Account Name Date Dec 31 income Tax Expose Income Tax Payate Deferred Tax Asset Tocesant incomearrow_forwardam.100arrow_forwardNirvana Corporation reports pretax financial income of $260,000 for 2022. The following items cause taxable income to be different than pretax financial income. Rental income on the 2022 tax return is $65,000 greater than on the income statement. Depreciation expense on the tax return is greater than depreciation on the income statement by $40,000. Interest on an investment in a municipal bond of $6,500 is reported on the income statement. Nirvana's tax rate is 25% for all years. There are no deferred taxes at the beginning of 2022. The company expects to realize only 40% of the benefit of any deferred tax assets. The fiscal year ends December 31, 2022. Required: 1. Prepare the journal entries to record i) income tax expense, income taxes payable, and deferred income taxes for 2022, and ii) any valuation allowance needed. 2. Indicate clearly what would be reported on the income statement beginning with income before income taxes for the year ended December 31, 2022 from just…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education