FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Four independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences:

| ($ in thousands) | ||||

|---|---|---|---|---|

| Situation | ||||

| 1 | 2 | 3 | 4 | |

| Taxable income | $ 116 | $ 248 | $ 260 | $ 356 |

| Future deductible amounts | 16 | 20 | 20 | |

| Future taxable amounts | 16 | 16 | 60 | |

| Balance(s) at beginning of the year: | ||||

| 2 | 17 | 4 | ||

| 8 | 2 |

The enacted tax rate is 25%.

Required:

For each situation, determine the following:

Note: Enter your answers in thousands rounded to one decimal place (i.e. 1,200 should be entered as 1.2). Negative amounts should be indicated by a minus sign. Leave no cell blank, enter "0" wherever applicable.

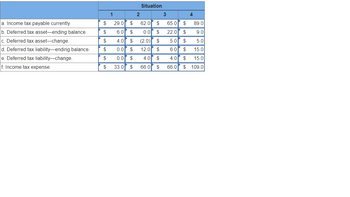

Transcribed Image Text:a. Income tax payable currently.

b. Deferred tax asset-ending balance.

c. Deferred tax asset-change.

d. Deferred tax liability-ending balance.

e. Deferred tax liability-change.

f. Income tax expense.

$

$

$

$

$

S

1

2

Situation

29.0 $

6.0

4.0 $ (2.0)

0.0

$

12.0

0.0 $

4.0

33.0 $ 66.0

62.0

$ 0.0

ام م م م م

kk

3

65.0

22.0

MN

$

$

5.0 $

6.0 $

4

$ 4.0 $

$

89.0

9.0

5.0

15.0

15.0

66.0 $ 109.0

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Eight Independent situations are described below. Each involves future deductible amounts and/or future taxable amounts: 1. 2. 3. 5. 6. 7. 2 The Income Statement Revenue 3 4 5 6 7 8 ($ in millions) Temporary Differences Reported First on: The Tax Return $24 19 19 19 Expense $24 Situations Taxable Income 1 24 24 24 24 Revenue $24 19 9 Expense Required: For each situation, determine taxable income, assuming pretax accounting income is $140 million. (Enter your answers in millions (I.e., 10,000,000 should be entered as 10).) $24 14 14arrow_forwardSubject: acountingarrow_forward10030.arrow_forward

- Hi there, Need help with question, thanks!arrow_forwardThe following table shows tax due for the given taxable income level for a single taxpayer. Taxable income Tax due $97,000 $97,050 $97,100 $97,150 $97,200 $21,913 $21,927 $21,941 $21,955 $21,969 (a) Show that the data in the table are linear. For every change of $50 in the taxable income there is constant change of $ 1.00 in the tax due. These data exhibit a constant rate of change and are linear. (b) How much additional tax is due on each dollar over $97,000? (Round your answer to the nearest cent.) per dollar (c) What would you expect for your tax due if you had a taxable income of $97,000? 24 What would you expect for your tax due if you had a taxable income of $98,000? $ (d) Find a linear formula that gives tax due T if your income is A dollars over $97,000. (Round equation parameters to two decimal places.) T =arrow_forwardDo not give answer in image and hand writingarrow_forward

- Save & Exit Subm Two independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: SITUATION Taxable income Amounts at year-end: Future deductible amounts 2. $46,000 $86,000 5,600 10,600 0 5,600 Future taxable amounts Balances at beginning of year, dr (cr): Deferred tax asset, Deferred tax liability $ 1,000 $ 3,180 0 1,000 The enacted tax rate is 30% for both situations. Required: For each situation determine the: SITUATION 2. (a.) Income tax payable currently. (b.) Deferred tax asset - balance at year-end. (c.) Deferred tax asset change dr or (cr) for the year. (d.) Deferred tax liability - balance at year-end. (e.) Deferred tax liability change dr or (cr) for the year. (f.) Income tax expense for the year. Next > 31 of 39arrow_forwardThank you.arrow_forwardFour independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences reported first on: (1) (2) (3) (4) Income Statement Revenue $ 22,500 $ 15,500 $ 15,500 Accounting income Temporary differences: Income statement first Expense Revenue Expense Tax return first: Revenue Expense Taxable income $ 22,500 $ 22,500 $ Required: For each situation, determine the taxable income assuming pretax accounting income is $100,000. Note: Amounts to be deducted should be indicated by a minus sign. (1) Revenue $ 22,500 Tax Return. 0 $ (2) Expense 0 $ $ 10,500 (3) 0 $ 0arrow_forwardTaxable Income and Total Tax Liability are in thousands. Item Number of returns Taxable income Under $15,000 30,715,203 Total tax liability Average tax rate* $ 5,400,125 $ 529,117 9.80% Ranges of Adjusted Gross Income $15,000 to under $30,000 27,411,021 $ 189,357,926 $ 15,530,244 $30,000 to under $50,000 28,926,896 $ 639,301,718 $ 55,477,985 8.20% 8.68% *The average tax rate is total tax liability divided by taxable income. Required: $50,000 to under $100,000 37,548,054 $ 1,912,937,663 $ 214,989,667 11.24% $100,000 to under $200,000 24,180,826 $ 2,687,830,279 $ 385,058,662 14.33 % $200,000 or more 11,616,732 $ 6,249,277,422 $ 1,591,015,179 25.46% a. If the federal tax system was changed to a proportional tax rate structure with a tax rate of 17.10%, calculate the amount of tax liability for 2021 for all taxpayers. b. What is the amount and nature of difference from actual tax liability specified in the above table? Required A Required B If the federal tax system was changed to a…arrow_forwardVishalarrow_forwardA taxpayer is itemizing their return and they're trying to calculate the deductible amount of state income taxes paid. They have $4,000 from their Form(s) W-2 and they paid an outstanding balance in the current year for the prior year's balance of $2,500. What is the total amount of Line 5 income taxes that they can itemize? (Do not consider SALT limitations for this question) 2500 4000 6500arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education