FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

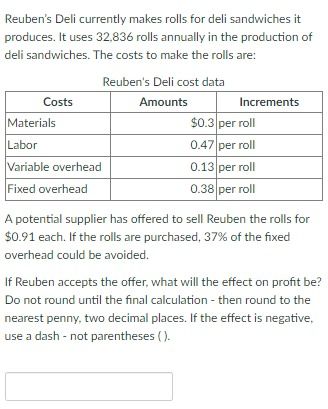

Transcribed Image Text:Reuben's Deli currently makes rolls for deli sandwiches it

produces. It uses 32,836 rolls annually in the production of

deli sandwiches. The costs to make the rolls are:

Costs

Materials

Labor

Variable overhead

Fixed overhead

Reuben's Deli cost data

Amounts

Increments

$0.3 per roll

0.47 per roll

0.13 per roll

0.38 per roll

A potential supplier has offered to sell Reuben the rolls for

$0.91 each. If the rolls are purchased, 37% of the fixed

overhead could be avoided.

If Reuben accepts the offer, what will the effect on profit be?

Do not round until the final calculation - then round to the

nearest penny, two decimal places. If the effect is negative,

use a dash - not parentheses ().

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Wood Chuck Furniture currently manufactures rocking chairs as its main product. Each chair uses one seat cushion and one back CUSHIO and one back): Direct materials Direct labor Variable overhead Fixed overhead Total $ 1 10 Wood Chuck should 5 8 $24 Shepert Company has contacted Wood Chuck with an offer to sell it 5,000 sets of cushions for $18 each. If Wood Chuck buys the cushions, $2 of the fixed overhead per unit will be allocated to other products. Should Wood Chuck make or buy the cushions? buy to save $ per set. SUPPORTarrow_forwardReuben's Deli currently makes rolls for deli sandwiches it produces. It uses 33,000 rolls annually in the production of deli sandwiches. The costs to make the rolls are: Materials $0.23 per roll Labor 0.40 per roll Variable overhead 0.15 per roll Fixed overhead 0.20 per roll A potential supplier has offered to sell Reuben the rolls for $0.88 each. If the rolls are purchased, 30% of the fixed overhead could be avoided. If Reuben accepts the offer, what will the effect on profit be? Reuben would see a $ in profit if he buys the rolls.arrow_forwardMesa Verde manufactures unpainted furniture for the do-it-yourself (DIY) market. It currently sells a table for $75. Production costs per unit are $40 variable and $10 fixed. Mesa Verde is considering staining and sealing the table to sell it for $100. Unit variable costs to finish each table are expected to be an additional $19 per table, and fixed costs are expected to be an additional $3 per table.Prepare an analysis showing whether Mesa Verde should sell stained or finished tables. Please solve this if any more information is needed let me know.arrow_forward

- Reuben's Dell currently makes rolls for dell sandwiches it produces. It uses 33,000 rolls annually in the production of dell sandwiches. The costs to make the rolls are: Materials $0.24 per roll 0.39 per roll 0.16 per roll 0.20 per roll Labor Variable overhead Fixed overhead A potential supplier has offered to sell Reuben the rolls for $0.89 each. If the rolls are purchased, 30% of the fixed overhead could be avoided. If Reuben accepts the offer, what will the effect Reuben would see a s In profit if he buys the rolls. profit be?arrow_forwardNeed help with homework.arrow_forwardJov Co sells three products: A, B and C. It can either make the products itself or purchase them from a subcontractor. The following information is available: Machine hours to manufacture Product A B C O 0 O 2,500 5 3 2 O 4,500 Variable cost ($) 30 20 15 For the coming period, Jov Co has received orders from its customers for 5,000 units of each product but it only has 20,000 machine hours available. What is the optimum number of units of product B which Jov Co should purchase from the subcontractor? O 5,000 Purchase cost from subcontractor ($) 40 35 20arrow_forward

- Reuben's Deli currently makes rolls for deli sandwiches it produces. It uses 30,000 rolls annually in the production of deli sandwiches. The costs to make the rolls are: Costs Reuben's Deli cost data Amounts Materials Labor Variable overhead Fixed overhead Increments $0.24 per roll 0.40 per roll 0.16 per roll 0.20 per roll A potential supplier has offered to sell Reuben the rolls for $0.90 each. If the rolls are purchased, 30% of the fixed overhead could be avoided. If Reuben accepts the offer, what will the effect on profit be?arrow_forwardTupper Inc. and Victory Inc. are two small clothing companies that are considering leasing a dyeing machine together. The companies estimated that in order to meet production, Tupper needs the machine for 950 hours and Victory needs it for 700 hours. If each company rents the machine on its own, the fee will be $85 per hour of usage. If they rent the machine together, the fee will decrease to $80 per hour of usage. Read the requirements. Requirements 1. Calculate Tupper's and Victory's respective share of fees under the stand-alone cost-allocation method. 2. Calculate Tupper's and Victory's respective share of fees using the incremental cost-allocation method assuming (a) Tupper ranked as the primary party and (b) Victory ranked as the primary party. 3. Calculate Tupper's and Victory's respective share of fees using the Shapley value method. 4. Which method would you recommend Tupper and Victory use to share the fees? - Xarrow_forwardReuben's Deli currently makes rolls for deli sandwiches it produces. It uses 31,000 rolls annually in the production of deli sandwiches. The costs to make the rolls are: Materials $0.24 per roll Labor 0.39 per roll Variable overhead 0.16 per roll Fixed overhead 0.20 per roll A potential supplier has offered to sell Reuben the rolls for $0.89 each. If the rolls are purchased, 30% of the fixed overhead could be avoided. If Reuben accepts the offer, what will the effect on profit be? decline in profit if he buys the rolls. Reuben would see a $arrow_forward

- Werner Company produces and sells disposable foil baking pans to retailers for $2.65 per pan. The variable cost per pan is as follows: Direct materials Direct labor Variable factory overhead Variable selling expense Fixed manufacturing cost totals $143,704 per year. Administrative cost (all fixed) totals $19,596. Required: $0.27 0.51 0.69 0.18 Compute the number of pans that must be sold for Werner to break even. pans Conceptual Connection: What is the unit variable cost? What is the unit variable manufacturing cost? Round your answers to the nearest cent. Unit variable cost Unit variable manufacturing cost Which is used in cost-volume-profit analysis? Unit variable cost ✓ How many pans must be sold for Werner to earn operating income of $7,000? pans How much sales revenue must Werner have to earn operating income of $7,000?arrow_forwardTulsa Milling buys oats at $0.60 per pound and produces TPM Oat Flour, TPM Oat Flakes, and TPM Oat Bran. The process of separating the oats into oat flour and oat bran costs $0.30 per pound. The oat flour can be sold for $1.50 per pound, the oat bran for $2.00 per pound. Each pound of oats has 0.2 pounds of oat bran and 0.8 pounds of oat flour. A pound of oat flour can be made into oat flakes for a fixed cost of $240,000 plus a variable cost of $0.60 per pound. Tulsa Milling plans to process 1 million pounds of oats in 20X0, at a purchase price of $600,000. Requirements 1. Allocate all the joint costs to oat flour and oat bran using the physical-units method. 2. Allocate all the joint costs to oat flour and oat bran using the relative-sales-value method. 3. Suppose there were no market for oat flour. Instead, it must be made into oat flakes to be sold. Oat flakes sell for $2.90 per pound. Allocate the joint cost to oat bran and oat flakes using the relative-sales-value method.…arrow_forwardSurf Company can sell all of the two surfboard models it produces, but it has only 416 direct labor hours available. The Glide model requires 2 direct labor hours per unit. The Ultra model requires 4 direct labor hours per unit. Contribution margin per unit is $216 for Glide and $332 for Ultra. (a) Compute the contribution margin per direct labor hour for each product. (b) Determine the best sales mix and the resulting contribution margin. Complete this question by entering your answers in the tabs below. Required A Required B Compute the contribution margin per direct labor hour for each product. Glide Ultra Contribution margin per direct labor hour $ $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education