FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

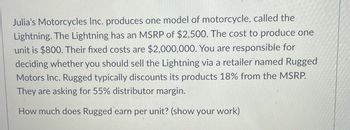

Transcribed Image Text:Julia's Motorcycles Inc. produces one model of motorcycle, called the

Lightning. The Lightning has an MSRP of $2,500. The cost to produce one

unit is $800. Their fixed costs are $2,000,000. You are responsible for

deciding whether you should sell the Lightning via a retailer named Rugged

Motors Inc. Rugged typically discounts its products 18% from the MSRP.

They are asking for 55% distributor margin.

How much does Rugged earn per unit? (show your work)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- JCBilco Manufacturing produces and sells oil filters for $3.30 each. A retailer has offered to purchase 25,000 oil filters for $1.36 per filter. Of the total manufacturing cost per filter of $2.15, $1.35 is the variable manufacturing cost per filter. For this special order, JCBilco would have to buy a special stamping machine that costs $8,500 to mark the customer's logo on the special-order oil filters. The machine would be scrapped when the special order is complete. This special order would use manufacturing capacity that would otherwise be idle. No variable nonmanufacturing costs would be incurred by the special order. Regular sales would not be affected by the special order. Would you recommend that JCBilco accept the special order under these conditions?arrow_forwardA potential supplier has offered to sell Reuben the rolls for $0.90 each. If the rolls are purchased, 30% of the fixed overhead could be avoided. If Reuben accepts the offer, what will the effect on profit be? Increase in profit of $1,600 if he buys the rolls Increase in profit of $1,200 if he buys the rolls Decline in profit of $1,200 if he buys the rolls Decline in profit of $1,600 if he buys the rollsarrow_forwardWildhorse Cash, Ltd. operates a chain of exclusive ski hat boutiques in the western United States. The stores purchase several hat styles from a single distributor at $13 each. All other costs incurred by the company are fixed. Wildhorse Cash, Ltd. sells the hats for $49 each. (a) If fixed costs total $630,000 per year, what is the breakeven point in units? In sales dollars? (Use your answer of breakeven units to calculate the breakeven point in dollars.) The breakeven point hats The breakeven sales $arrow_forward

- Fish Finder Company manufactures sonars for fishing boats. Model 100 sells for $400. They produce and sell 6,000 units per year. Cost data are as follows: $25 $65 $15 $280,000 An offer has come in for a one-time sale of 300 units at a special price of $130 per unit. The marketing manager says. that the sale will not affect the company's regular sales activities, and that it will not require any variable selling and administrative costs. The production manager says that there is plenty of excess capacity and the sale will not impact fixed costs in any way. What is the effect this deal on operating income? Direct Materials Direct Labor Variable manufacturing overhead Fixed manufacturing overhead increases by $7,500 increases by $2,100 O increases by $400 decreases by $7,500 per unit per unit per unit per yeararrow_forwardTupper Inc. and Victory Inc. are two small clothing companies that are considering leasing a dyeing machine together. The companies estimated that in order to meet production, Tupper needs the machine for 950 hours and Victory needs it for 700 hours. If each company rents the machine on its own, the fee will be $85 per hour of usage. If they rent the machine together, the fee will decrease to $80 per hour of usage. Read the requirements. Requirement 1. Calculate Tupper's and Victory's respective share of fees under the stand-alone cost-allocation method. (Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar.) Stand-alone Tupper Victoryarrow_forwardYou have a business selling and delivering pizzas to businesses for lunch. You pay $4,000 per month in rent, $320 for utilities, and $2,000 a month for salaries. You also have delivery cars that cost $1,000 per month. Your variable costs are $8 per pizza for ingredients and $4 per pizza for delivery costs. You sell the pizzas for $20 each. Round up if necessary What is the number of pizzas you need to sell to break even for the month If you want to make a profit of 2,000 per month, how many pizzas do you need to sell? Round up if necessary Go back to the original numbers If the price of cheese goes up and your variable costs go by $3 what is your new break even in pizzas if you increase your price to $21 Round up if necessary Golden Company has a fleet of delivery trucks and has the following Overhead costs per month with the miles driven Miles Driven Total Costs March 50.000 194.000 Aprill 40.000 170.200 this is the low May 60.000 217.600 June 70.000 241.000 Use the High-Low method to…arrow_forward

- Steve's scooters plans to sell a standard scooter for $160 and a chrome scooter for $200.00. Steve's purchases the standard scooter for $40 and the chrome scooter for $50. Steve expects to sell one standard scooter for every three chrome scooters. Steve's monthly fixed costs are $102, 600. How many of each type of scooter must Steve's scooters sell each month to break even?arrow_forwardIt costs a coat manufacturer $8750 to make 125 coats and it costs $6500 to make 80 coats. Each coat is sold for $350. a. How much is the marginal cost? b. What is the slope of the Profit function, P(x)? c. How many coats must be sold in order to break even?arrow_forwardPlease explain your answerarrow_forward

- Monica is a manufacturer of handcrafted wooden signs. The variable cost of each wooden sign Monica produces is $40. Monica sells her wooden signs to a wholesaler at a 50% margin, who then sells the wooden signs to the retailer at an undisclosed markup (%). The retailer then adds a 30% margin and sells the product to the consumer at $160. Based on this information, what is the markup (%) of the wholesaler? 40% 20% 60 50%arrow_forwardHenry Sweet Company currently makes 6-inch candy sticks that it sells for $0.20 each. Henry can make 12-inch candy sticks out of two 6-inch candy sticks by melting them together, which costs an additional $0.03 per 12-inch stick. Henry can sell the 12-inch sticks for $0.45. Henry has enough capacity to make 10,000 6-inch candy sticks per month, and enough demand to sell all of the candy sticks it can manufacture, whether 6- inch or 12-inch. Should Henry sell 6-inch or 12-inch candy sticks, and how much additional profit will its decision bring in per month? Multiple Choice O O Sell 6-inch sticks, additional $100 Sell 6-inch sticks, additional $250 Sell 12-inch sticks, additional $100 Sell 12-inch sticks, additional $250arrow_forwardMiller Books is considering publishing a book about meditation. The fixed costs to publish the book is estimated at $160,000. Variable material costs are estimated at $6 per book. Demand over the life of the textbook is estimated at 4,000 copies. Miller books anticipates that they can sell the books for $46 per unit. a) Write an expression for total revenue b) Write an expression for total cost c) Write an expression for total profit d) Find the break-even point e) Recommend a strategy if Miller will not be able to sell more than 3,500 copies.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education