FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

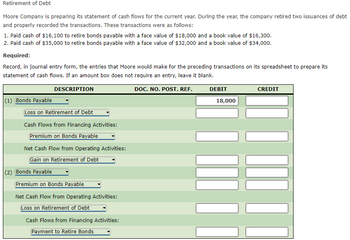

Transcribed Image Text:Retirement of Debt

Moore Company is preparing its statement of cash flows for the current year. During the year, the company retired two issuances of debt

and properly recorded the transactions. These transactions were as follows:

1. Paid cash of $16,100 to retire bonds payable with a face value of $18,000 and a book value of $16,300.

2. Paid cash of $35,000 to retire bonds payable with a face value of $32,000 and a book value of $34,000.

Required:

Record, in journal entry form, the entries that Moore would make for the preceding transactions on its spreadsheet to prepare its

statement of cash flows. If an amount box does not require an entry, leave it blank.

DESCRIPTION

DOC. NO. POST. REF.

(1) Bonds Payable

Loss on Retirement of Debt

Cash Flows from Financing Activities:

Premium on Bonds Payable

Net Cash Flow from Operating Activities:

Gain on Retirement of Debt

(2) Bonds Payable

Premium on Bonds Payable

Net Cash Flow from Operating Activities:

Loss on Retirement of Debt

Cash Flows from Financing Activities:

Payment to Retire Bonds

DEBIT

18,000

CREDIT

| III

||||||

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following transactions were completed by Winklevoss Inc., whose fiscal year is the calendar year: 20Y1 July 1 Issued $74,000,000 of 20-year, 11% callable bonds dated July 1, 20Y1, at a market (effective) rate of 13%, receiving cash of $63,532,267. Interest is payable semiannually on December 31 and June 30. Dec. 31 Paid the semiannual interest on the bonds. The bond discount amortization of $261,693 is combined with the semiannual interest payment. 20Y2 June 30 Paid the semiannual interest on the bonds. The bond discount amortization of $261,693 is combined with the semiannual interest payment. Dec. 31 Paid the semiannual interest on the bonds. The bond discount amortization of $261,693 is combined with the semiannual interest payment. 20Y3 June 30 Recorded the redemption of the bonds, which were called at 98. The balance in the bond discount account is $9,420,961 after payment of interest and amortization of discount have been recorded. (Record the…arrow_forwardOn January 1, Year 1, Platte Corporation issues a 5-year note payable for $5,000. The interest rate is 5% and the annual payment of $1,156, due each December 31, includes both interest and principal. Which of the following correctly shows the effect of the issuance of the note on Platte's financial statements? Assets = Liabilities + n/a n/a (5,000) 5,000 A. 5,000 B. 5,000 C. (5,000) D. 5,000 Multiple Choice O Option A O 0 0 Option B Option D Balance Sheet Option C Stockholders' Equity 5,000 5,000 n/a n/a Revenue 5,000 5,000 n/a n/a Income Statement - Expense n/a n/a n/a n/a = Net Income 5,000 5,000 n/a n/a Statement of Cash Flows. 5,000 FA 5,000 IA (5,000) IA 5,000 FAarrow_forwardKier Company issued $740,000 in bonds on January 1, Year 1. The bonds were issued at face value and carried a 3-year term to maturity. The bonds have a 5.50% stated rate of interest interest is payable in cash on December 31 each year. Based on this information alone, what are the amounts of interest expense and cash flows from operating activities, respectively, that will be reported in the financial statements for the year ending December 31, Year 1? Multiple Choice O Zero and $40,700 $40,700 and $40,700 Zero and Zero $40,700 and Zeroarrow_forward

- Current portion of long-term debt Connie's Bistro, Inc. reported the following information about its long-term debt in the notes to a recent financial statement (in millions): Long-term debt consists of the following: Total long term-debt Current portion December 31 Current Year C. $685,100 (198,700) $486,400 million December 31 Prior Year Long-term debt a. How much of the long-term debt was disclosed as a current liability on the current year's December 31 balance sheet? $ $376,800 (185,000) $191,800 b. How much did the total current liabilities change between the preceding year and the current year as a result of the current portion of long-term debt? million If Connie's Bistro did not issue additional long-term debt next year, what would be the total long-term debt on December 31 of the upcoming year? millionarrow_forwardIn the past year, Blossom Corporation reported assets of $230229000. Liabilities reported on the balance sheet on the same date were reported at $69091655. Blossom issued a new note payable for cash during the year. The 8%, 5-year note was issued at a face value of $5008000. What is the company's debt to asset ratio after the refinance? O 29.37% 31.50% 32.18% O 30.01%arrow_forwardCable Company reported bond interest expense of $40,000 for the current year. During the year, the balance in the premium on bonds payable account decreased by $1,500. What was the amount of cash paid for interest expense during the year? Cash paid for interest expensearrow_forward

- Prepare Natura Company's journal entries to record the following transactions involving its short-term investments in held-to-maturity debt securities, all of which occurred during the current year. a. On June 15, paid $180,000 cash to purchase Remed's 90-day short-term debt securities ($180,000 principal), dated June 15, that pay 7% interest. b. On September 16, received a check from Remed in payment of the principal and 90 days' interest on the debt securities purchased in transaction a. Note: Use 360 days in a year. Do not round your intermediate calculations. View transaction list Journal entry worksheet < 1 2 On June 15, paid $180,000 cash to purchase Remed's 90-day short-term debt securities ($180,000 principal), dated June 15, that pay 7% interest. Note: Enter debits before credits. Transaction a. Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardSeaview Company issued $200,000 of 15-year, 9% callable bonds payable on July 31, 2025, at 97. On July 31, 2028, Seaview Company called the bonds at 101. Assume annual interest payments. Requirements 1. Without making journal entries, compute the carrying amount of the bonds payable at July 31, 2028. 2. Assume all amortization has been recorded properly. Journalize the retirement of the bonds on July 31, 2028. No explanation is required. Requirement 1. Without making journal entries, compute the carrying amount of the bonds payable at July 31, 2028. (Assume bonds payable are amortized using the straight-line amortization method.) First, complete the sentences below. The carrying amount of the bonds payable at issuance (July 31, 2025) is issuance amounts to $ 6,000 $ 194,000. The discount on the bonds at The carrying amount of the bonds payable at July 31, 2028 is $ 195,200 Requirement 2. Assume all amortization has been recorded properly. Journalize the retirement of the bonds on July…arrow_forwardNeed complete and correct answer for all parts with all workings and steps in text form please show calculation narrations and explanation clearly for all steps answer in text formarrow_forward

- abardeen corporation borrowed 58,000 from the bank on october 1, year 1. The note had a 4 percent annual rate of interest and matured on march 31, year 2. interest and principal were paid in cash on the maturity date. a. what amount of cash did abardeen pay for interest in year 1? b. what amount of interest expense was recognized on the year 1 income statement? c. what amount of total liabilities was reported on december 31, year 1, balance sheet?arrow_forwardTHIS QUESTION WILL ALSO BE CHECKED MANUALLY (to make adjustments for typos). QUESTION 9 On the first day of the fiscal year, a company issues a $828,000, 12%, 10-year bond that pays semiannual interest of $49,680, receiving cash of $869,400. Journalize the entry for the first interest payment and amortiation of premium using the straight-line method and the chart of accounts below. Bonds Payable Cash Discount on Bonds Payable Interest Revenue Gain on Redemption of Bonds Interest Expense Interest Payable Loss on Redemption of Bonds Premiun on Bonds Payable Enter your answers into the table below. Key the account names carefully (exactly as shown above) and follow formatting instructions below. DO NOT USE A DECIMAL WITH ZEROES FOR WHOLE DOLLAR AMOUNTS AND USE COMMAS APPROPRIATELY. WHEN THE DEBIT/CREDIT DOES NOT REQUIRE AN ENTRY, LEAVE IT BLANK. Account Debit Credit THIS QUESTION WILL ALSO BE CHECKED MANUALLY (to make adjustments for typos). Click Save and Submit to save and submit. Click…arrow_forwardTo get cash to purchase operating assets, Ballard Company, with a December 31 fiscal year-end, issued bonds with the following characteristics: (i) (ii) (iii) (iv) C. Date of bonds: January 1, 2011 Maturity amount and date: $100,000 due in 10 years (December 31, 2020). Interest: 11% per year payable each December 31. Date issued: January 1, 2011. Required: a. Construct the amortization table for the first 2 years for each bond. See (b). b. Give the journal entries to record the issuance and the first 2 interest payments under each of 3 different independent cases: Case A - The bonds sold at par. Case B - The bonds sold to yield 12%. Case C - The bonds sold to yield 10% Provide the following amounts to be reported on the 2011 financial statements: a., Interest expense b., Bonds payable c., Unamortized premium or discount d., Net Liability e., Stated rate of interest (coupon rate) f., Cash paid for interest Case A $ Case B $ Case C $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education