FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

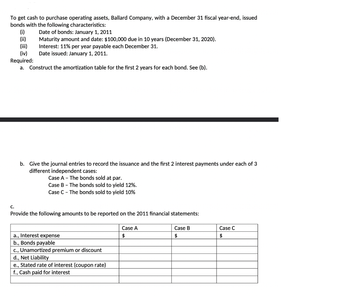

Transcribed Image Text:To get cash to purchase operating assets, Ballard Company, with a December 31 fiscal year-end, issued

bonds with the following characteristics:

(i)

(ii)

(iii)

(iv)

C.

Date of bonds: January 1, 2011

Maturity amount and date: $100,000 due in 10 years (December 31, 2020).

Interest: 11% per year payable each December 31.

Date issued: January 1, 2011.

Required:

a. Construct the amortization table for the first 2 years for each bond. See (b).

b. Give the journal entries to record the issuance and the first 2 interest payments under each of 3

different independent cases:

Case A - The bonds sold at par.

Case B - The bonds sold to yield 12%.

Case C - The bonds sold to yield 10%

Provide the following amounts to be reported on the 2011 financial statements:

a., Interest expense

b., Bonds payable

c., Unamortized premium or discount

d., Net Liability

e., Stated rate of interest (coupon rate)

f., Cash paid for interest

Case A

$

Case B

$

Case C

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Entries for Bonds Payable, induding bond redemption The following transactions were completed by Montague Inc., whose fiscal year is the calendar year:arrow_forwardBlanca Company has the following independent bond issuances. a.) Issues $600,000 bonds at 96. b.) Issues $700,000 bonds at 102. c.) Issues $200,000 bonds at 100. Required: 1.) Prepare the journal entries to record the bond issuances under of the independent situations.arrow_forwardOn March 31, 2011, Gardner Corporation received authorization to issue $50,000 of 9 percent, 30-year bonds payable. The bonds pay interest on March 31 and September 30. The entire issue was dated March 31, 2011, but the bonds were not issued until April 30, 2011. They were issued at face value. a. Prepare the journal entry at April 30, 2011, to record the sale of the bonds. b. Prepare the journal entry at September 30, 2011, torecord the semiannual bond interest payment. c. Prepare the adjusting entry at December 31, 2011, to record bond interest expense accrued since September 30, 2011. (Assume that no monthly adjusting entries to accrue interest expense had been made prior to December 31, 2011.)arrow_forward

- On the day Federer Ltd redeemed its $1,000,000 face value bonds at 98, their carrying value was $1,200,000. Prepare a residual analysis for the bond redemption. Prepare the journal entry for the bond redemption. If you recognise a gain or loss, state where in the Statement of Comprehensive Income the gain or loss should appeararrow_forwardPrepare entry for bonds issued. BE10.9 (LO 3), AP Ravine Company issues $400,000, 20-year, 7% bonds at 101. Prepare the journal entry to record the sale of these bonds on June 1, 2022. Prepare journal entries for bonds issued at face value.arrow_forwardBonds Payable has a balance of $1,091,000 and Discount on Bonds Payable has a balance of $13,092. If the issuing corporation redeems the bonds at 98, what is the amount of gain or loss on redemption?arrow_forward

- Assume the bonds in were issued for $644,636 and the effective-interest rate is 6%, prepare the company's journal entriesarrow_forwardA $291,000 bond was redeemed at 98 when the carrying amount of the bond was $286,635. What amount of gain or loss would be recorded as part of this transaction? Select the correct answer. loss on bond redemption of $4,365. gain on bond redemption of $5,820. gain on bond redemption of $1,455. loss on bond redemption of $1,455.arrow_forwardConcord Hills Ltd. issued five-year bonds with a face value of $180,000 on January 1. The bonds have a coupon interest rate of 5% and interest is paid semi-annually on June 30 and December 31. The market interest rate was 3% when the bonds were issued at a price of 109. Determine the balance in the Bonds Payable account immediately following the first interest payment. Balance in bonds payable accountarrow_forward

- An $800,000 bond issue on which there is an unamortized premium of $57,000 is redeemed for $785,000. Journalize the redemption of the bonds. Refer to the Chart of Accounts for exact wording of account titles.arrow_forward(Use the following information for questions 2 and 3) Always Be Counting Co. issued callable bonds on January 1, 2016. ABC's accountant has created the following amortization schedule from issuance until maturity: olqar zi ning of boong noilmogtoo olosu 12 gnello stated in tra Date 1/1/2016 6/30/2016 12/31/2016 6/30/2017 12/31/2017 6/30/2018 12/31/2018 000 6/30/2019 12/31/2019 Show Transcribed Text Cash as the Effective interest a. 3% b. 3.5% Ⓒ6% d. 7% interest $7,000 7,000 7,000 7,000 7,000 7,000 no 07,000 7,000 a. No gain or loss. b. $3,717 gain. c. $6,000 loss. d. $2,283 loss. $6,211 10 $207,020 Star W $789 206,230 6,187 813 205,417 6.163 837 204,580 6,137 863 203,717 6,112 888 202,829 6,085 vol 915 a 201,913 pent 200,971 200,000 Decrease in Outstanding Carry balance 6,0570943 A 6,029 What was the market rate of interest on ABC's bonds at the time of issuance? G I 971 2. What was the market rate of interest on ABC's bonds at the time of issuance? CV. I Int expense = * J Carrying…arrow_forwardPresent entries to record the selected transactions described below: a. Issued $2,750,000 of 10-year, 8% bonds at 97. If an amount box does not require an entry, leave it blank. b. Amortized bond discount for a full year, using the straight-line method. If an amount box does not require an entry, leave it blank. c. Called bonds at 98. Assume the bonds were carried at $2,692,250 at the time of the redemption. If an amount box does not require an entry, leave it blank.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education