Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

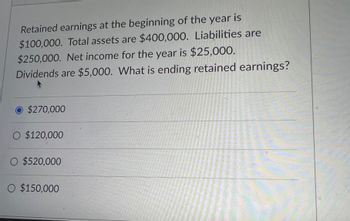

Transcribed Image Text:Retained earnings at the beginning of the year is

$100,000. Total assets are $400,000. Liabilities are

$250,000. Net income for the year is $25,000.

Dividends are $5,000. What is ending retained earnings?

A

O $270,000

O $120,000

O $520,000

O $150,000

Expert Solution

arrow_forward

Step 1

The retained earnings indicate the balance of undistributed profits. The retained earnings mean the profit left to the company after paying for all the expenses taxes and dividends. The retained earnings are one of the major sources of funds for the company which it can use to expand the business and achieve growth.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Five Measures of Solvency or Profitability The balance sheet for Garcon Inc. at the end of the current fiscal year indicated the following: Bonds payable, 8% $900,000 Preferred $5 stock, $100 par $228,000 Common stock, $8 par $319,200.00 Income before income tax was $201,600, and income taxes were $30,600 for the current year. Cash dividends paid on common stock during the current year totaled $33,516. The common stock was selling for $28 per share at the end of the year. Determine each of the following. Round answers to one decimal place, except for dollar amounts which should be rounded to the nearest whole cent. Use the rounded answers for subsequent requirements, if required. a. Times interest earned ratio times b. Earnings per share on common stock $ c. Price-earnings ratio d. Dividends per share of common stock $ e. Dividend yieldarrow_forwardRetained earnings at the beginning of the year is $100,000. Total assets are $400,000. Liabilities are $250,000. Net income for the year are $25,000. Dividends are $5,000. What is ending retained earnings? Group of answer choices $120,000 $150,000 $520,000 $270,000arrow_forwardDetermining Retained Earnings and Net Income The following information appears in the records of Bock Corporation at year-end: Accounts Receivable $23,000 Retained Earnings ? Accounts Payable 00 Supplies Cash Common Stock 110,000 9,000 8,000 Equipment, net 154,000 a. Calculate the balance in Retained Earnings at year-end $ 0 b. If the amount of the retained earnings at the beginning of the year was $30,000 and $12,000 in dividends is paid during the year, calculate net income for the year. $42,000arrow_forward

- 4. PG Merchandising, a general partnership earned a net profit of P98,000 for the calendar year 2020. The capital account of the partners for the year ended December 31, 2020 is shown below: Pinto Capital (Mar 1) P25,000 (Jan 1) P150,000 (Nov 1) P37,000 (Jul 1) 50,000 (Oct 1) 50,000arrow_forwardFive Measures of Solvency or Profitability The balance sheet for Garcon Inc. at the end of the current fiscal year indicated the following: Bonds payable, 6% $1,500,000 Preferred $10 stock, $100 par $88,000 Common stock, $14 par $954,800.00 Income before income tax was $171,000, and income taxes were $25,800 for the current year. Cash dividends paid on common stock during the current year totaled $16,368. The common stock was selling for $16 per share at the end of the year. Determine each of the following. Round answers to one decimal place, except for dollar amounts which should be rounded to the nearest whole cent. Use the rounded answers for subsequent requirements, if required. a. Times interest earned ratio times b. Earnings per share on common stock c. Price-earnings ratio d. Dividends per share of common stock 2$ е. Dividend yield %arrow_forwardDetermine Fisher’s return on stockholders’ equity if its Year 1 earnings after tax are $9,000(000). Round your answer to two decimal places. %arrow_forward

- Assume the company is operating at 85%capacity. The company pays out in dividends 60% of its net income and moves 40% of its net income into retained earnings. ASSETS 2020 2019 CASH AND MARKETABLE SECURITIES ACCOUNTS RECEIVABLE INVENTORIES 29,000 25,000 116,000 100,000 145,000 125,000 290,000 250,000 362,000 350,000 130,000 100,000 232,000 250,000 TOTAL ASSETS 522,000 500,000 CURRENT ASSETS GROSS PLANT AND EQUIPMENT LESS: ACCUMULATED DEPRECIATION NET FIXED ASSETS LIABILİTIES AND EQUITY ACCOUNTS PAYABLE ACCRURALS NOTES PAYABLE 90,480 34,800 25,420 CURRENT LAIBILITIES 150,700 142,000 145,000 140,000 TOTAL LIABILITIES 295,700 282,000 150,000 150,000 76,300 78,000 30,000 34,000 LONG TERM DEBT COMMON STOCK ($1.00 par). RETAINED EARNINGS 68,000 TOTAL OWNER'S EQUITY 226,300 218,000 TOTAL LIABILITIES AND EQUITY 522,000 500,000| INCOME STATEMENT 2020 2019 NET REVENUES & SALES (100,000 UNITS) COST OF GOODS SOLD GROSS PROFIT FIXED OPERATING EXPENSES (pre depreciation) EBITDA Earnings before…arrow_forwardPacquired a 70% of S on January 1, 2020, for S380,000. During 2020 S had a net income of $30,000 and paid a cash dividend of $10,000. Applying the cost method would give a balance in the Investment account at the end of 2020 of: Select one: $394,000 $400,000 O $380,000 $373,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education