FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

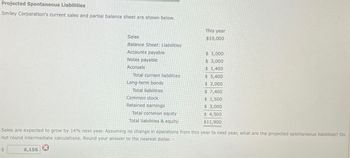

Transcribed Image Text:Projected Spontaneous Liabilities

Smiley Corporation's current sales and partial balance sheet are shown below.

This year

Sales

$10,000

Balance Sheet: Liabilities

Accounts payable

$ 1,000

Notes payable

$ 3,000

Accruals

$ 1,400

Total current liabilities

$ 5,400

Long-term bonds

$ 2,000

Total liabilities

$ 7,400

$ 1,500

$ 3,000

Common stock

Retained earnings

Total common equity

Total liabilities & equity

$ 4,500

$11,900

Sales are expected to grow by 14% next year. Assuming no change in operations from this year to next year, what are the projected spontaneous liabilities? Do

not round intermediate calculations. Round your answer to the nearest dollar. -

S

6,156

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Debt Management Ratios Trina's Trikes, Inc. reported a debt-to-equity ratio of 1.94 times at the end of 2018. If the firm's total debt at year-end was $10.60 million, how much equity does Trina's Trikes have? Multiple Choice $5.46 million $20.56 million $10.60 million $1.94 millionarrow_forwardLast year Atlantic Richfield had sales of $325000 Net income of $27200 The firm finances using only debt and common equity and total assets equal total invested capital. Year ended assets $250000 Debt ration was 15% What was their roe?arrow_forwardBerman & Jaccor Corporation's current sales and partial balance sheet are shown below. This year Sales $ 1,000 Balance Sheet: Assets Cash $ 150 Short-term investments $ 110 Accounts receivable $ 200 Inventories $ 250 Total current assets $ 710 Net fixed assets $ 500 Total assets $ 1,210 Sales are expected to grow by 14% next year. Assuming no change in operations from this year to next year, what are the projected total operating assets? Do not round intermediate calculations. Round your answer to the nearest dollar. $arrow_forward

- Calculate debt to equity, long-term debt to equity and specify as a percent to 2 decimal placesarrow_forwardCalculate current ratio from the following information: $ $ Stock 50,000 Cash 30,000 Debtors 40,000 Creditors 60,000 Bills Receivable 10,000 Bills Payable 40,000 Advance Tax 4,000 Bank Overdraft 4,000arrow_forwardBerman & Jaccor Corporation's current sales and partial balance sheet are shown below. This year Sales $1,000 Balance Sheet: Assets Cash $150 Short-term investments $140 Accounts receivable $300 Inventories $300 Total current assets $890 Net fixed assets $600 Total assets $1,490 Sales are expected to grow by 12% next year. Assuming no change in operations from this year to next year, what are the projected total operating assets? Do not round intermediate calculations. Round your answer to the nearest dollar.arrow_forward

- Assume the company is operating at 85%capacity. The company pays out in dividends 60% of its net income and moves 40% of its net income into retained earnings. ASSETS 2020 2019 CASH AND MARKETABLE SECURITIES ACCOUNTS RECEIVABLE INVENTORIES 29,000 25,000 116,000 100,000 145,000 125,000 290,000 250,000 362,000 350,000 130,000 100,000 232,000 250,000 TOTAL ASSETS 522,000 500,000 CURRENT ASSETS GROSS PLANT AND EQUIPMENT LESS: ACCUMULATED DEPRECIATION NET FIXED ASSETS LIABILİTIES AND EQUITY ACCOUNTS PAYABLE ACCRURALS NOTES PAYABLE 90,480 34,800 25,420 CURRENT LAIBILITIES 150,700 142,000 145,000 140,000 TOTAL LIABILITIES 295,700 282,000 150,000 150,000 76,300 78,000 30,000 34,000 LONG TERM DEBT COMMON STOCK ($1.00 par). RETAINED EARNINGS 68,000 TOTAL OWNER'S EQUITY 226,300 218,000 TOTAL LIABILITIES AND EQUITY 522,000 500,000| INCOME STATEMENT 2020 2019 NET REVENUES & SALES (100,000 UNITS) COST OF GOODS SOLD GROSS PROFIT FIXED OPERATING EXPENSES (pre depreciation) EBITDA Earnings before…arrow_forwardBinomial Tree Farm's financing includes $5 million of bank loans. Its common equity is shown in Binomial's Annual Report at $6.67 million. It has 500,000 shares of common stock outstanding, which trade on the Wichita Stock Exchange at $18 per share. What debt ratio should Binomial use to calculate its company cost of capital or asset beta? Note: Enter your answer as a percent rounded to 2 decimal places. Debt ratio %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education