FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

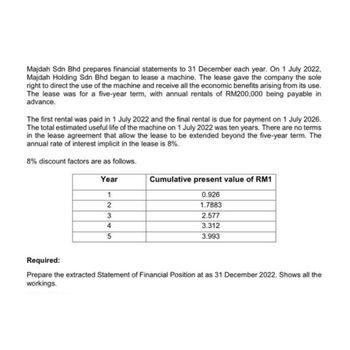

Transcribed Image Text:Majdah Sdn Bhd prepares financial statements to 31 December each year. On 1 July 2022,

Majdah Holding Sdn Bhd began to lease a machine. The lease gave the company the sole

right to direct the use of the machine and receive all the economic benefits arising from its use.

The lease was for a five-year term, with annual rentals of RM200,000 being payable in

advance.

The first rental was paid in 1 July 2022 and the final rental is due for payment on 1 July 2026.

The total estimated useful life of the machine on 1 July 2022 was ten years. There are no terms

in the lease agreement that allow the lease to be extended beyond the five-year term. The

annual rate of interest implicit in the lease is 8%.

8% discount factors are as follows.

Year

1

2345

2

Cumulative present value of RM1

0.926

1.7883

2.577

3.312

3.993

Required:

Prepare the extracted Statement of Financial Position at as 31 December 2022. Shows all the

workings.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Joseph Bright lists the following transactions for the period ended 30 September 2017. Classify EACH item as follows: i. Write either capital or revenue in the expenditure type column to indicate the type of expenditure involved or EACH item. ii. Insert a-check mark (√) in the appropriate column to indicate whether the item is reported-in the Statement of profit or loss or in the Statement of financial position. The first one is done as an example. Description CLASSIFICATION OF EXPENDITURE Expenditure Type Statement where item should be reported Statement of Profit Statement of Example Wages of the computer operators 1 Cost of customizing software for use in business 2 Installing thief detection equipment 3 Cost of paper used for printing receipts during the year 4 Cost of toner used by the computer printer 5 Cost of adding extra memory to the compute or loss Revenue financial positionarrow_forwardDefine the elements of financial statements identified in SFAC No. 3 and SFAC No.6.arrow_forwardDetermine the WACC, and determine whether the company generated value or not, and what the amount was for both years ANSWER 2020 2021 WACC EVA ROICarrow_forward

- What are the steps to be completed in preparing the opening IFRS statement of financial position?arrow_forwardA revenue was earned in 2019 but payment is not received until 2020. Using the accrual basis of accounting, the revenue should appear on: A. the 2020 income statement B. the 2019 income statement C. both the 2019 and 2020 income statements D. neither the 2019 nor 2020 income statementarrow_forward1.32. Creating Balance Sheets and Income Statements. Using the information in the below table, prepare a classified balance sheet for Erie Company as of December 31, 2019 and December 31, 2020, along with multi-step income statements for the years then endedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education