FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

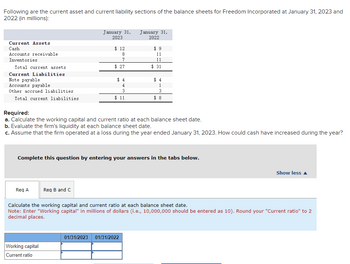

Transcribed Image Text:Following are the current asset and current liability sections of the balance sheets for Freedom Incorporated at January 31, 2023 and

2022 (in millions):

Current Assets

Cash

Accounts receivable

Inventories

Total current assets

Current Liabilities

Note payable

Accounts payable

Other accrued liabilities

Total current liabilities

Req A

January 31,

2023

$12

8

7

$ 27

Req B and C

Working capital

Current ratio

4

3

$ 11

January 31,

2022

Required:

a. Calculate the working capital and current ratio at each balance sheet date.

b. Evaluate the firm's liquidity at each balance sheet date.

c. Assume that the firm operated at a loss during the year ended January 31, 2023. How could cash have increased during the year?

$ 9

11

11

$ 31

Complete this question by entering your answers in the tabs below.

1

3

01/31/2023 01/31/2022

$8

Calculate the working capital and current ratio at each balance sheet date.

Note: Enter "Working capital" in millions of dollars (i.e., 10,000,000 should be entered as 10). Round your "Current ratio" to 2

decimal places.

Show less

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Explain well with proper answer with step by step.arrow_forwardDetermine Total Current Liabilities as of December 31, 2023: Select one: a. $27,300 b. $39,900 c. $144,900 d. $132,300 e. $247,350arrow_forward10. Powell Corporation includes the following selected accounts in its general ledger at December 31, 2025: View the selected accounts. Prepare the liabilities section of Powell Corporation's balance sheet at December 31, 2025. Plus: Total Liabilities Powell Corporation Balance Sheet (Partial) December 31, 2025 ☐☐☐ ☐ ☐ ...arrow_forward

- Presented below are data taken from the records of Sheffield Company. December 31,2020 December 31,2019 Cash $15,100 $7,900 Current assets other than cash 85,800 59,800 Long-term investments 10,100 53,000 Plant assets 335,200 214,500 $446,200 $335,200 Accumulated depreciation $20,200 $40,200 Current liabilities 39,600 22,000 Bonds payable 75,800 –0– Common stock 252,800 252,800 Retained earnings 57,800 20,200 $446,200 $335,200 Additional information: 1. Held-to-maturity debt securities carried at a cost of $42,900 on December 31, 2019, were sold in 2020 for $33,600. The loss (not unusual) was incorrectly charged directly to Retained Earnings. 2. Plant assets that cost $49,600 and were 80% depreciated were sold during 2020 for $7,900. The loss was incorrectly charged directly to Retained Earnings. 3. Net income as reported on the…arrow_forwardPresented below are data taken from the records of Wildhorse Company. December 31,2020 December 31,2019 Cash $15,200 $8,100 Current assets other than cash 84,700 60,600 Long-term investments 10,000 52,900 Plant assets 332,400 215,200 $442,300 $336,800 Accumulated depreciation $20,100 $40,100 Current liabilities 39,600 22,100 Bonds payable 74,800 –0– Common stock 254,500 254,500 Retained earnings 53,300 20,100 $442,300 $336,800 Additional information: 1. Held-to-maturity debt securities carried at a cost of $42,900 on December 31, 2019, were sold in 2020 for $33,600. The loss (not unusual) was incorrectly charged directly to Retained Earnings. 2. Plant assets that cost $50,500 and were 80% depreciated were sold during 2020 for $8,000. The loss was incorrectly charged directly to Retained Earnings. 3. Net income as reported on the…arrow_forwardGiven the following financial statement information: $ in millions Income Statement Net Income: $559 Depreciation Expense: $55 Balance Sheet Dec. 31, 2022 Accounts Receivable $38 Total Inventory $122 Accounts Payable $79 Calculate the cash from operating activities. Your Answer: Dec. 31, 2023 $64 $152 $108arrow_forward

- The current sections of Famous’s statements of financial position at December 31, 2019 and 2020, are presented here. Famous’s net income for 2020 was €147,000. Depreciation expense was €21,000. 2020 2019 Current assets Prepaid expenses €25,000 €27,000 Inventory 158,000 172,000 Accounts receivable 79,000 110,000 Cash 105,000 99,000 Total current assets €367,000 €408,000 Current liabilities Accrued expenses payable € 15,000 € 9,000 Accounts payable 85,000 95,000 Total current liabilities €100,000 €104,000 Instructions Prepare the net cash provided by operating activities section of the company’s statement of cash flows for the year ended December 31, 2020, using the indirect method.arrow_forwardssarrow_forwardPlease calculate the debts to assets ratio for the years 2022 and 2021, also please show your work.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education