FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

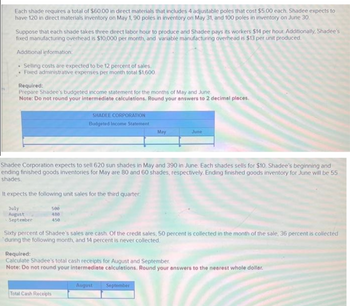

Required: Prepare Shadee's budgeted income statement for the months of May and June Note: Do not round your intermediate calculations. Round your answers to 2 decimal places.

Required: Calculate Shadee's total cash receipts for August and September Note: Do not round your intermediate calculotions. Round your onswers to the nearest whole dollor.

![SB Exercise E8-5 to E8-10

[The following information applies to the questions displayed below]

E8-6 (Algo) Preparing Direct Materials Purchases Budget [LO 8-3c, e]

Each shade requires a total of $60.00 in direct materials that includes 4 adjustable poles that cost $5.00 each. Shadee expects to

have 120 in direct materials inventory on May 1, 90 poles in inventory on May 31, and 100 poles in inventory on June 30.

Shadee Corporation expects to sell 620 sun shades in May and 320 in June. Each shade sells for $155. Shadee's

beginning and ending finished goods inventories for May are 90 and 60 shades, respectively. Ending finished goods

inventory for June will be 60 shades.

Required:

Prepare Shadee's May and June purchases budget for the adjustable poles.

.

.

Budgeted Cost of Closures Purchased

E8-9 (Algo) Preparing Selling and Administrative Expense Budget [LO 8-3g]

Each shade requires a total of $60.00 in direct materials that includes 4 adjustable poles that cost $5.00 each. Shadee expects to

have 120 in direct materials inventory on May 1, 90 poles in inventory on May 31, and 100 poles in inventory on June 30.

May

Suppose that each shade takes three direct labor hour to produce and Shadee pays its workers $14 per hour. Additionally, Shadee

fixed manufacturing overhead is $10,000 per month, and variable manufacturing overhead is $13 per unit produced.

Additional information:

Selling costs are expected to be 12 percent of sales.

Fixed administrative expenses per month total $1,600.

June

Budgeted Selling and Administrative Expenses

Required:

Prepare Shadee's selling and administrative expense budget for May and June

Note: Do not round your intermediate calculations. Round your answers to 2 decimal places.

May

June](https://content.bartleby.com/qna-images/question/e27fe8aa-42dc-4abb-95e4-76dcbb550513/c740c735-1aeb-4e87-b48f-8ed663868cff/w7q1bq_thumbnail.png)

Transcribed Image Text:SB Exercise E8-5 to E8-10

[The following information applies to the questions displayed below]

E8-6 (Algo) Preparing Direct Materials Purchases Budget [LO 8-3c, e]

Each shade requires a total of $60.00 in direct materials that includes 4 adjustable poles that cost $5.00 each. Shadee expects to

have 120 in direct materials inventory on May 1, 90 poles in inventory on May 31, and 100 poles in inventory on June 30.

Shadee Corporation expects to sell 620 sun shades in May and 320 in June. Each shade sells for $155. Shadee's

beginning and ending finished goods inventories for May are 90 and 60 shades, respectively. Ending finished goods

inventory for June will be 60 shades.

Required:

Prepare Shadee's May and June purchases budget for the adjustable poles.

.

.

Budgeted Cost of Closures Purchased

E8-9 (Algo) Preparing Selling and Administrative Expense Budget [LO 8-3g]

Each shade requires a total of $60.00 in direct materials that includes 4 adjustable poles that cost $5.00 each. Shadee expects to

have 120 in direct materials inventory on May 1, 90 poles in inventory on May 31, and 100 poles in inventory on June 30.

May

Suppose that each shade takes three direct labor hour to produce and Shadee pays its workers $14 per hour. Additionally, Shadee

fixed manufacturing overhead is $10,000 per month, and variable manufacturing overhead is $13 per unit produced.

Additional information:

Selling costs are expected to be 12 percent of sales.

Fixed administrative expenses per month total $1,600.

June

Budgeted Selling and Administrative Expenses

Required:

Prepare Shadee's selling and administrative expense budget for May and June

Note: Do not round your intermediate calculations. Round your answers to 2 decimal places.

May

June

Transcribed Image Text:Each shade requires a total of $60.00 in direct materials that includes 4 adjustable poles that cost $5.00 each. Shadee expects to

have 120 in direct materials inventory on May 1, 90 poles in inventory on May 31, and 100 poles in inventory on June 30.

Suppose that each shade takes three direct labor hour to produce and Shadee pays its workers $14 per hour. Additionally, Shadee's

fixed manufacturing overhead is $10,000 per month, and variable manufacturing overhead is $13 per unit produced.

Additional information:

Selling costs are expected to be 12 percent of sales.

Fixed administrative expenses per month total $1,600

.

Required:

Prepare Shadee's budgeted income statement for the months of May and June

Note: Do not round your intermediate calculations, Round your answers to 2 decimal places.

500

480

450

SHADEE CORPORATION

Budgeted Income Statement

Shadee Corporation expects to sell 620 sun shades in May and 390 in June. Each shades sells for $10. Shadee's beginning and

ending finished goods inventories for May are 80 and 60 shades, respectively. Ending finished goods inventory for June will be 55

shades.

It expects the following unit sales for the third quarter:

July

August

September

May

Total Cash Receipts

June

Sixty percent of Shadee's sales are cash. Of the credit sales, 50 percent is collected in the month of the sale, 36 percent is collected

during the following month, and 14 percent is never collected.

Required:

Calculate Shadee's total cash receipts for August and September.

Note: Do not round your intermediate calculations. Round your answers to the nearest whole dollar.

August

September

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please dont give solutio in an image format thanksarrow_forwardPrepare a schedule of expected cash collections from sales by month and in total for quater 2. Whats hs the accounts receivable balance on june 30? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Jayden's Carryout Stores has eight locations. The firm wishes to expand by two more stores and needs a bank loan to do this. Mrs. Wilson, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. The following are actual and forecast sales figures: November December Actual $ 240,000 January 260,000 February March Forecast Additional Information $ 320,000 April forecast $360,000 360,000 370,000 Of the firm's sales, 60 percent are for cash and the remaining 40 percent are on credit. Of credit sales, 30 percent are paid in the month after sale and 70 percent are paid in the second month after the sale. Materials cost 30 percent of sales and are purchased and received each month in an amount sufficient to cover the following month's expected sales. Materials are paid for in the month after they are received. Labor expense is 40 percent of sales and is paid for in the month of sales. Selling and administrative expense…arrow_forwardAnswer these questionsarrow_forwardRecord the entry for the annual budget at the beginning of the year. (General Fund) Record the end-of-year removal of budget entry. (General Fund)arrow_forward

- if your supervisor tells you to change the aging category of a large account from over 120 days to current status and prepare a new invoice to the customer with the revised date that agrees with this new category this will change the required allowance from for uncollectible accounts from $180, 000 to $235,000 how do you think this misstatement of funds will impact your income statement and your balance sheet?arrow_forwardPlease no handwriting and no plagiarism pleasearrow_forwardSonoma Housewares Inc. Cash Budget For the Three Months Ending July 31 May June July Estimated cash receipts from: Cash sales $ $ Collection of accounts receivable Total cash receipts $ Estimated cash payments for: Manufacturing costs Selling and administrative expenses Capital expenditures Other purposes: Income tax Dividends Total cash payments Cash increase or (decrease) $ bala at beginning Cash balance at end of month Minimum cash balance Excess (deficiency) $arrow_forward

- c. Prepare a monthly cash budget with borrowings and repayments for January, February, and March. Note: Negative amounts should be indicated by a minus sign. Assume the January beginning loan balance is $0. Leave no cells blank be certain to enter O wherever required. Total cash receipts Total cash payments Net cash flow Beginning cash balance Cumulative cash balance Monthly loan (or repayment) Ending cash balance Cumulative loan balance Jayden's Carryout Stores. Cash Budget January 0 0 0 February 0 0 0 March 0 0arrow_forwardAssume that the custodian of a $450 petty cash fund has $57.10 in coins and curency plus $387.00 in recipts at the end of the month. The entry to replenish the petty cash fund will include:?arrow_forwardRecord the entry for the annual budget at the beginning of the year. (General Fund) Record the end of year removal of budget entry. (General Fund)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education