FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

![### Required Information

**[The following information applies to the questions displayed below.]**

The following data is provided for Garcon Company and Pepper Company for the year ended December 31.

| Description | Garcon Company | Pepper Company |

| ---------------------------------- | -------------- | -------------- |

| Finished goods inventory, beginning| $13,200 | $16,900 |

| Work in process inventory, beginning| 17,900 | 21,150 |

| Raw materials inventory, beginning | 8,600 | 11,250 |

| Rental cost on factory equipment | 33,750 | 26,650 |

| Direct labor | 23,200 | 39,400 |

| Finished goods inventory, ending | 21,350 | 16,900 |

| Work in process inventory, ending | 28,000 | 17,600 |

| Raw materials inventory, ending | 7,900 | 7,400 |

| Factory utilities | 9,150 | 14,250 |

| General and administrative expenses| 23,500 | 44,000 |

| Indirect labor | 14,000 | 14,920 |

| Repairs—Factory equipment | 4,940 | 3,600 |

| Raw materials purchases | 42,500 | 60,000 |

| Selling expenses | 56,400 | 55,300 |

| Sales | 297,270 | 395,040 |

| Cash | 25,000 | 23,200 |

| Accounts receivable, net | 16,000 | 24,700 |

---

**Tasks:**

1. Compute the total prime costs for both Garcon Company and Pepper Company.

2. Compute the total conversion costs for both Garcon Company and Pepper Company.

### Instructions:

Complete this question by entering your answers in the tabs below.

#### Required 1

**Compute the total prime costs for both Garcon Company and Pepper Company.**

**Prime Costs Calculation Table:**

| Description | Garcon Company | Pepper Company |

| ----------------- | -------------- | -------------- |

| (Detail calculations for prime costs go here) | | |

| | | |

| |](https://content.bartleby.com/qna-images/question/0fa544b4-e327-43de-bfc4-701055325d35/fcff9be9-be48-45f2-a48a-e01208dabb23/cpta0yi_thumbnail.png)

Transcribed Image Text:### Required Information

**[The following information applies to the questions displayed below.]**

The following data is provided for Garcon Company and Pepper Company for the year ended December 31.

| Description | Garcon Company | Pepper Company |

| ---------------------------------- | -------------- | -------------- |

| Finished goods inventory, beginning| $13,200 | $16,900 |

| Work in process inventory, beginning| 17,900 | 21,150 |

| Raw materials inventory, beginning | 8,600 | 11,250 |

| Rental cost on factory equipment | 33,750 | 26,650 |

| Direct labor | 23,200 | 39,400 |

| Finished goods inventory, ending | 21,350 | 16,900 |

| Work in process inventory, ending | 28,000 | 17,600 |

| Raw materials inventory, ending | 7,900 | 7,400 |

| Factory utilities | 9,150 | 14,250 |

| General and administrative expenses| 23,500 | 44,000 |

| Indirect labor | 14,000 | 14,920 |

| Repairs—Factory equipment | 4,940 | 3,600 |

| Raw materials purchases | 42,500 | 60,000 |

| Selling expenses | 56,400 | 55,300 |

| Sales | 297,270 | 395,040 |

| Cash | 25,000 | 23,200 |

| Accounts receivable, net | 16,000 | 24,700 |

---

**Tasks:**

1. Compute the total prime costs for both Garcon Company and Pepper Company.

2. Compute the total conversion costs for both Garcon Company and Pepper Company.

### Instructions:

Complete this question by entering your answers in the tabs below.

#### Required 1

**Compute the total prime costs for both Garcon Company and Pepper Company.**

**Prime Costs Calculation Table:**

| Description | Garcon Company | Pepper Company |

| ----------------- | -------------- | -------------- |

| (Detail calculations for prime costs go here) | | |

| | | |

| |

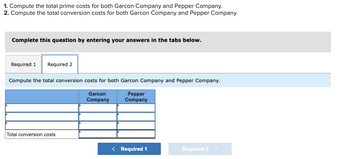

Transcribed Image Text:### Cost Computation Exercise

#### Objectives:

1. Compute the total prime costs for both Garcon Company and Pepper Company.

2. Compute the total conversion costs for both Garcon Company and Pepper Company.

#### Instructions:

Complete this exercise by entering your answers in the tabs below.

#### Required Tasks:

**Required 1** | **Required 2**

**Tab 2:**

Compute the total conversion costs for both Garcon Company and Pepper Company.

#### Input Table:

| | Garcon Company | Pepper Company |

|------------------------|-------------------|-------------------|

| | | |

| | | |

| | | |

| Total conversion costs | | |

**Navigate to Required 1** to address the first task.

### Graph/Diagram Explanation:

The table provided is designed to input the computation fields for Garcon Company and Pepper Company. The columns each represent one of the companies. The rows are for entering specific cost components to calculate the conversion costs. There are blank rows provided for detailed cost entries leading to the final total conversion costs at the bottom.

In the interactive part of the exercise, users are expected to fill in this table with the appropriate cost amounts based on their calculations.

#### Navigation Instructions:

Use the “Required 1” and “Required 2” tabs to toggle between the tasks. The "Required 2" tab focuses specifically on computing the total conversion costs for both companies. After you finish with "Required 1", click the blue button on the left to proceed to "Required 2".

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give image formatarrow_forwardGadubhaiarrow_forwardManufacturing Income Statement, Statement of Cost of Goods Manufactured Several items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of December: Materials inventory, December 1 Materials inventory, December 31 Materials purchased Cost of direct materials used in production Direct labor Factory overhead Total manufacturing costs incurred in December Total manufacturing costs Work in process inventory, December 1 Work in process inventory, December 31 Cost of goods manufactured Finished goods inventory, December 1 Finished goods inventory, December 31 Sales Cost of goods sold Gross profit Operating expenses Net income Required: On Company $66,090 (a) 167,870 177,120 249,160 77,330 (b) 630,500 126,890 107,070 (c) 111,690 116,980 974,170 (d) (e) 126,890 (f) Off Company $83,270 94,100 (a) (b) 187,360 93,260 538,760 630,500 200,680 (c) 533,760 93,260 (d) 832,700 538,760 (e) (f) 184,860 1. Determine the amounts of…arrow_forward

- i need the answer quicklyarrow_forwardAccounting records for Antoinette Designs (AD) for November show the following (each entry is the total of the actual entries for the account for the month): Account Titles Work-in-Process Inventory (Direct Labor) Wages Payable Direct Materials Inventory Accounts Payable Finished Goods Inventory Work-in-Process Inventory Cost of Goods Solda Finished Goods Inventory Debit 7,200 122,130 136,800 131,400 Credit 7,200 Required: a. What was the finished goods inventory balance on November 30? b. How much manufacturing overhead was applied for November? c. What was the manufacturing overhead rate for November? d. How much manufacturing overhead was incurred for November? e. What was the Work-in-Process Inventory on November 1? f. What was the Work-in-Process Inventory on November 30? 122,130 136,800 131,400 aThis entry does not include any over- or underapplied overhead. Over- or underapplied overhead is written off to Cost of Goods Sold once for the month. For November, the amount written…arrow_forwardthe beginning of the Cutting process. The following information is available regarding its May inventories: Ending Inventory Beginning Inventory $ 6,000 43,500 63,300 20,100 The following additional information describes the company's production activities for May. Raw materials inventory Work in process inventory-Cutting Work in process inventory-Stitching Finished goods inventory Direct materials Raw materials purchased on credit Direct materials used-Cutting Direct materials used-Stitching Direct labor Direct labor-Cutting Direct labor-Stitching Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs Factory Overhead Rates Cutting Stitching Sales View transaction list Journal entry worksheet < $ 256,000 Requirement General General Journal Ledger Raw Materials Prepare journal entries for the month of May's transactions. Note: Enter debits before credits. Dato May 31 Record entry $ 25,000 21,750 0 Trial Balance $ 15,600 62,400 (150% of direct…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education