FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

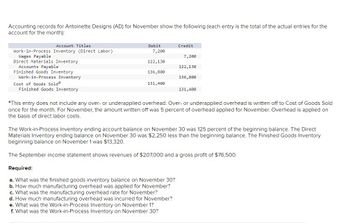

Transcribed Image Text:Accounting records for Antoinette Designs (AD) for November show the following (each entry is the total of the actual entries for the

account for the month):

Account Titles

Work-in-Process Inventory (Direct Labor)

Wages Payable

Direct Materials Inventory

Accounts Payable

Finished Goods Inventory

Work-in-Process Inventory

Cost of Goods Solda

Finished Goods Inventory

Debit

7,200

122,130

136,800

131,400

Credit

7,200

Required:

a. What was the finished goods inventory balance on November 30?

b. How much manufacturing overhead was applied for November?

c. What was the manufacturing overhead rate for November?

d. How much manufacturing overhead was incurred for November?

e. What was the Work-in-Process Inventory on November 1?

f. What was the Work-in-Process Inventory on November 30?

122,130

136,800

131,400

aThis entry does not include any over- or underapplied overhead. Over- or underapplied overhead is written off to Cost of Goods Sold

once for the month. For November, the amount written off was 5 percent of overhead applied for November. Overhead is applied on

the basis of direct labor costs.

The Work-in-Process Inventory ending account balance on November 30 was 125 percent of the beginning balance. The Direct

Materials Inventory ending balance on November 30 was $2,250 less than the beginning balance. The Finished Goods Inventory

beginning balance on November 1 was $13,320.

The September income statement shows revenues of $207,000 and a gross profit of $76,500.

Expert Solution

arrow_forward

Step 1

“Since you have posted a question with multiple sub parts, we will provide the solution only to the first four sub parts as per our Q&A guidelines. Please repost the remaining sub parts separately.”

Manufacturing overheads

The charges that are incurred throughout the production process is referred to as manufacturing overheads. They are not easily traced in the production and are composed of materials, labor and expenses particularly of indirect nature.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

what about quesitons E and F?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

what about quesitons E and F?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A manufacturer reports the information below. Finished goods inventory, beginning Finished goods inventory, ending Depreciation on factory equipment Direct labor Indirect labor Factory utilities Selling expenses Direct materials used Indirect materials used Office rent expense Work in process inventory, beginning Work in process inventory, ending Complete this question by entering your answers in the tabs below. Required A Required B Compute cost of goods sold for the period. Goods available for sale Cost of goods sold $ 8,200 9,140 4,800 84,000 36,700 3,200 750 55,900 700 1,200 1,600 2,400 $ 0arrow_forwardMaterials Inventory Debit Ending Balance 38,200 Credit Work-in-Process Inventory Debit Beginning Credit Finished Goods Inventory Balance 22,100 Debit Credit (9/30) (9/1) Direct Labor Ending Balance 67,700 118,000 (9/30) Cost of Goods Sold Manufacturing Overhead Applied Debit Credit Debit Credit Manufacturing Overhead Control Debit Credit 129,570 Wages Payable Sales Revenue Debit Credit Debit Credit 479,500 Additional Data Sales are billed at 175 percent of Cost of Goods Sold before the over- or underapplied overhead is prorated. • Materials of $76,500 were purchased during the month, and the balance in the Materials Inventory account increased by $5,700 • Overhead is applied at the rate of 210 percent of direct materials cost. The balance in the Finished Goods Inventory account decreased by $19,700 during the month before any proration of under- or overapplied overhead. • Total credits to the Wages Payable account amounted to $135,300 for direct and indirect labor. . Factory…arrow_forward1. The following information was reported for Gray Enterprises on December 31, 2020.Manufacturing Overhead Debit Credit 3,410 51,520 15,030 37,090 Double line4,010 Double line A. What is the actual manufacturing overhead? B. What is the allocated manufacturing overhead? C. Is manufacturing overhead underallocated or overallocated? D. Prepare the adjusting entry.Journal Date Description Debit Credit Dec. 31, 20 Dec. 31, 20 2. The following information was reported for Gray Enterprises on December 31, 2021.Manufacturing Overhead Debit Credit 2,020 56,340 15,540 31,920 Double line Double line6,860 A. What is the actual manufacturing overhead? B. What is the allocated manufacturing overhead? C. Is manufacturing overhead underallocated or overallocated? D. Prepare the adjusting entry.Journal Date Description Debit Credit Dec. 31, 20 Dec. 31, 20arrow_forward

- The following are the transactions for the month of July. Units Unit Cost Unit Selling Price July 1 Beginning Inventory 55 $ 10 July 13 Purchase 275 11 July 25 Sold (100 ) $ 14 July 31 Ending Inventory 230 Calculate cost of goods available for sale and ending inventory, then sales, cost of goods sold, and gross profit, under FIFO. Assume a periodic inventory system is used. How would i creat a FIFO periodic table?arrow_forwardthe beginning of the Cutting process. The following information is available regarding its May inventories: Ending Inventory Beginning Inventory $ 6,000 43,500 63,300 20,100 The following additional information describes the company's production activities for May. Raw materials inventory Work in process inventory-Cutting Work in process inventory-Stitching Finished goods inventory Direct materials Raw materials purchased on credit Direct materials used-Cutting Direct materials used-Stitching Direct labor Direct labor-Cutting Direct labor-Stitching Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs Factory Overhead Rates Cutting Stitching Sales View transaction list Journal entry worksheet < $ 256,000 Requirement General General Journal Ledger Raw Materials Prepare journal entries for the month of May's transactions. Note: Enter debits before credits. Dato May 31 Record entry $ 25,000 21,750 0 Trial Balance $ 15,600 62,400 (150% of direct…arrow_forwardPrepare Statements for a Manufacturing CompanyThe following balances are from the accounts of Hill Components:January 1 (Beginning) December 31 (Ending)Direct materials inventory ............... $48,100 $44,200Work-in-process inventory .............. 67,730 71,500Finished goods inventory ................ 15,600 18,200Direct materials used during the year amount to $59,800, and the cost of goods sold for the year was $68,900.RequiredFind the following by completing a cost of goods sold statement:a. Cost of direct materials purchased during the year.b. Cost of goods manufactured during the year.c. Total manufacturing costs incurred during the year.arrow_forward

- Adelphia Manufacturing issued $70,000 of direct materials and $9,000 of indirect materials for production. Which of the following journal entries would correctly record the transaction? O A. Work-in- Process Inventory Raw Materials Inventory B. Manufacturing Overhead Raw Materials Inventory OC. Work-in - Process Inventory Manufacturing Overhead Raw Materials Inventory D. Raw Materials Inventory Finished Goods Inventory Work-in - Process Inventory 79,000 79,000 70,000 9,000 79,000 79,000 79,000 79,000 70,000 9,000arrow_forwardThe following information has been taken from the perpetual inventory system of Elite Manufacturing Company for the month ended August 31: Purchases of direct materials. Direct materials used Direct labor costs assigned to production Manufacturing overhead costs incurred (and applied) Balances in inventory Materials Work in Process Finished Goods Multiple Choice The cost of finished goods manufactured in August is: $147,000. $92,000. $57,000. August 31 August 1 $ 25,000 $ 47,000 $ 43,000 Some other amount. $ 65,000 $ 60,000 $ 60,000 $ 50,000 $ 25,000 $ 35,000arrow_forwarde. What was the Work-in-Process f. What was the Work-in-Process Inventory on November 1? Inventory on November 30?arrow_forward

- Selected information regarding a company's most recent quarter follows (all data in thousands). Beginning work in process inventory Cost of goods manufactured Direct materials used Direct labor Ending work in process inventory What was manufacturing overhead for the quarter? OA. $180 B. $500 C. $150 D. $780 $280 $650 $220 $120 $150arrow_forwardGayner Corporation is an oil well service company that measures its output by the number of wells serviced. The company has provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results of operations for November. Variable Actual Fixed Element Element per Total for per Month November Well Serviced 4,300 $ 148,400 Revenue Employee salaries and 1,000 $ 006 wages 009 2$ 20,200 Servicing materials $29,600 30,300 Other expenses When the company prepared its planning budget at the beginning of November, it assumed that 30 wells would have been serviced. However, 34 wells were actually serviced during November. The spending variance for "Servicing materials" for November would have been closest to: MacBook Air い DD 888 delete 8. 6 9 %24 %24 %24 %24 %24arrow_forwardNeed some help with this one..arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education