FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Finished goods inventory, ending

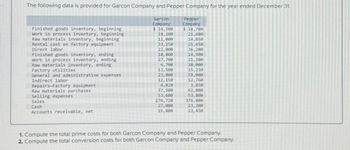

The following data is provided for Garcon Company and Pepper Company for the year ended December 31.

Finished goods inventory, beginning

Work in process inventory, beginning

Raw materials inventory, beginning

Rental cost on factory equipment

Direct labor

Garcon

Company

$ 14,500

Pepper

Company

$ 18,700

18,200

21,600

11,000

14,850

33,250

25,450

22,000

36,200

18,800

14,900

Work in process inventory, ending

27,700

21,200

Raw materials inventory, ending

6,700

10,000

Factory utilities

13,500

15,250

General and administrative expenses

23,000

59,000

Indirect labor

12,150

12,760

Repairs-Factory equipment

4,820

3,850

Raw materials purchases

37,500

62,000

Selling expenses

Sales

53,600

53,800

276,720

376,880

Cash

Accounts receivable, net

27,000

23,200

15,800

23,450

1. Compute the total prime costs for both Garcon Company and Pepper Company.

2. Compute the total conversion costs for both Garcon Company and Pepper Company.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Use the following selected account balances of Delray Manufacturing for the year ended December 31. Sales Raw materials inventory, beginning Work in process inventory, beginning Finished goods inventory, beginning Raw materials purchases Direct labor Indirect labor Repairs-Factory equipment Rent cost of factory building Selling expenses General and administrative expenses Raw materials inventory, ending Work in process inventory, ending Finished goods inventory, ending $ 1,250,000 37,000 53,900 62,700 175,600 225,000 47,000 23,000 57,000 94,000 129,300 42,700 41,500 67,300 Prepare its schedule of cost of goods manufactured for the year ended December 31.arrow_forwardRequired information [The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Work in process inventory, beginning Raw materials inventory, beginning Rental cost on factory equipment Direct labor Finished goods inventory, ending Work in process inventory, ending Raw materials inventory, ending Factory utilities General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net Garcon Company $ 12,500 16,100 7,400 34,750 19,800 21,800 26,200 7,200 12,600 27,000 14,750 4,940 41,500 58,000 296,220 26,000 13,600 Pepper Company $ 17,350 22,050 9,450 25,150 39,400 14,600 20, 200 8,000 15,750 43,000 14,320 3,750 60,500 46,000 388,450 18,700 21,950 1. Prepare income statements for both Garcon Company and Pepper Company. 2. Prepare the current assets section of…arrow_forwardSurfsUp Specialty Products has the following inventory account balances and related manufacturing cost flow information for the month of October: Raw Materials, October 1 $ 20,000 Raw Materials, October 31 $ 25,000 Work in Process, October 1 $ 45,000 Work in Process, October 31 $ 40,000 Finished Goods, October 1 $ 68,000 Finished Goods, October 31 $ 62,000 Raw materials purchased ? Raw materials used $ 75,000 Direct labor incurred ? Manufacturing overhead incurred $ 120,000 Cost of goods manufactured $ 300,000 Cost of goods sold ? Direct labor incurred in October is:arrow_forward

- Required information [The following information applies to the questions displayed below.] The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Finished goods inventory, beginning Garcon Pepper Company Company $ $ 13,200 18,550 Work in process inventory, beginning 17,700 22,500 Raw materials inventory, beginning 7,700 14,100 Rental cost on factory equipment 31,000 24,100 Direct labor 24,200 43,800 Finished goods inventory, 19,700 13,800 ending Work in process inventory, ending 24,400 21,000 Raw materials inventory, ending 6,700 7,600 Factory utilities General and administrative expenses Indirect labor Repairs-Factory equipment Raw materials purchases Selling expenses Sales Cash Accounts receivable, net 12,300 17,000 34,000 53,500 13,000 14,000 6,500 3,550 36,000 68,000 50,400 56,800 297,600 379,360 27,000 24,200 15,000 20,950 1. Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the…arrow_forwardThe following data were taken from the records of Blossom Manufacturing Company for the fiscal year ended December 31, 2022: Raw Materials Inventory (1/1/22) Raw Materials Inventory (12/31/22) Finished Goods Inventory (1/1/22) Finished Goods Inventory (12/31/22) Work in Process Inventory (1/1/22) Work in Process Inventory (12/31/22) Direct Labour Indirect Labour Accounts Receivable Factory Insurance $47,950 Factory Machinery Depreciation Factory Utilities Office Utilities Sales Sales Discounts Plant Manager's Salary Factory Property Taxes Factory Repairs Raw Materials Purchases Cash 44,350 85,700 77,600 9,850 6,550 145,100 18,200 27,250 7,600 $7,820 13,220 9,000 465,880 2,050 40,500 7,020 940 62,800 28,300arrow_forwardSterling's records show the work in process inventory had a beginning balance of $4,000 and an ending balance of $3,000. The records also showed the following data for the month: Materials used Overhead applied Cost of goods manufactured $1,500 50 7,500 Entry labels available for this problem: Beginning inventory Manufacturing costs incurred Materials available for use Overhead applied Ending inventory Materials used in production Cost of goods manufactured Direct labor Purchases Using the entry labels listed above, complete the following T-account to determine how much direct labor was incurred during the month? PLEASE NOTE: You must enter the entry labels exactly as written above and all entry amounts will be rounded to whole dollar amounts with "$" and commas as needed (i.e. $12,345). If no entry label is needed, please use "None" and if no entry amount is needed, please use "$0" - no quotation marks for either. You are to fill in cells beginning at the top of the T-account with any…arrow_forward

- The following balances are from the accounts of Tappan Parts: January 1 (Beginning) December 31 (Ending) Direct materials inventory $ 22,300 $ 24,500 Work-in-process inventory 32,800 29,100 Finished goods inventory 5,800 7,100 Direct materials used during the year amount to $46,300 and the cost of goods sold for the year was $53,200. Required: Prepare a cost of goods sold statement.arrow_forwardNeed help for this questionarrow_forwardFrom the account balances listed below, prepare a schedule of cost of goods manufactured for Crane Manufacturing Company for the month ended December 31, 2022. (Assume all raw materials used were direct materials.) Finished Goods Inventory, December 31 Factory Supervisory Salaries Income Tax Expense Raw Materials Inventory, December 1 Work In Process Inventory, December 31 Sales Salaries Expense Factory Depreciation Expense Finished Goods Inventory, December 1 Raw Materials Purchases Work In Process Inventory, December 1 Factory Utilities Expense Direct Labor Raw Materials Inventory, December 31 Sales Returns and Allowances Indirect Labor Account Balances $52,920 15,120 22,680 15,120 18,900 17,640 10,080 44,100 132,300 31,500 7,560 88,200 23,940 6,300 26,460arrow_forward

- On April 1, Sangvikar Company had the following balances in its inventory accounts: Materials Inventory $12,730 21,340 Work-in-Process Inventory Finished Goods Inventory Work-in-process inventory is made up of three jobs with the following costs: Direct materials Direct labor Job 114 8,700 $2,411 1,800 1,170 Job 115 $2,640 1,560 1,014 Job 116 $3,650 4,300 2,795 Applied overhead During April, Sangvikar experienced the transactions listed below. a. Materials purchased on account, $29,000. b. Materials requisitioned: Job 114, $16,500; Job 115, $12,200; and Job 116, $5,000. c. Job tickets were collected and summarized: Job 114, 150 hours at $12 per hour; Job 115, 220 hours at $14 per hour; and Job 116, 80 hours at $18 per hour. d. Overhead is applied on the basis of direct labor cost. e. Actual overhead was $4,415. f. Job 115 was completed and transferred to the finished goods warehouse. g. (1) Job 115 was shipped, and (2) the customer was billed for 125 percent of the cost.arrow_forwarddsl.3arrow_forwardNeed answer of the questionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education