Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Need answer to the following

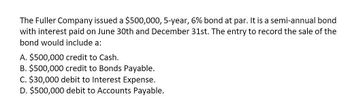

Transcribed Image Text:The Fuller Company issued a $500,000, 5-year, 6% bond at par. It is a semi-annual bond

with interest paid on June 30th and December 31st. The entry to record the sale of the

bond would include a:

A. $500,000 credit to Cash.

B. $500,000 credit to Bonds Payable.

C. $30,000 debit to Interest Expense.

D. $500,000 debit to Accounts Payable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2018, Wawatosa Inc. issued 5-year bonds with a face value of $200,000 and a stated interest rate of 12% payable semi-annually on July 1 and January 1. The bonds were sold to yield 10%. Assuming the bonds were sold at 107.732, what is the selling price of the bonds? Were they issued at a discount or a premium?arrow_forwardPiedmont Corporation issued $200,000 of 10-year bonds at par. The bonds have a stated rate of 6% and pay interest annually. What is the journal entry to record the first interest payment to the bondholders?arrow_forwardOn Jan. 1, Year 1, Foxcroft Inc. issued 100 bonds with a face value of $1,000 for $104,000. The bonds had a stated rate of 6% and paid interest semiannually. What is the journal entry to record the issuance of the bonds?arrow_forward

- Roo Incorporated issued 50 bonds with a face value of $1,000 and a stated rate of 6% when the market rate was 6%. What is the journal entry to record the sale of the bonds?arrow_forwardKeys Inc. issued 100 bonds with a face value of $1,000 and a rate of 8% at $1,025 each. The journal entry to record this transaction includes ________. A. a credit to Bonds Payable for $102,500 B. a credit to cash for $102,500 C. a debit to cash for $100,000 D. a credit to Premium on Bonds Payable for $2,500arrow_forwardAggies Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018, and received $540,000. Interest is payable semi-annually. The premium is amortized using the straight-line method. Prepare journal entries for the following transactions. A. July 1, 2018: entry to record issuing the bonds B. Dec. 31, 2018: entry to record payment of interest to bondholders C. Dec. 31, 2018: entry to record amortization of premiumarrow_forward

- A company issued bonds with a $100,000 face value, a 5-year term, a stated rate of 6%, and a market rate of 7%. Interest is paid annually. What is the amount of interest the bondholders will receive at the end of the year?arrow_forwardOn July 1, Somerset Inc. issued $200,000 of 10%, 10-year bonds when the market rate was 12%. The bonds paid interest semi-annually. Assuming the bonds sold at 58.55, what was the selling price of the bonds? Explain why the cash received from selling this bond is different from the $200,000 face value of the bond.arrow_forwardHuang Inc. issued 100 bonds with a face value of $1,000 and a 5-year term at $960 each. The journal entry to record this transaction includes ________. A. a debit to Bonds Payable for $100,000 B. a debit to Discount on Bonds Payable for $4,000 C. a credit to cash for $96,000 D. a credit to Discount on Bonds Payable for $4,000arrow_forward

- Medhurst Corporation issued $90,000 in bonds for $87,000. The bonds had a stated rate of 8% and pay interest quarterly. What is the journal entry to record the first interest payment?arrow_forwardVolunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018 and received $540,000. Interest is payable annually. The premium is amortized using the straightline method. Prepare journal entries for the following transactions. A. July 1, 2018: entry to record issuing the bonds B. June 30, 2019: entry to record payment of interest to bondholders C. June 30, 2019: entry to record amortization of premium D. June 30, 2020: entry to record payment of interest to bondholders E. June 30, 2020: entry to record amortization of premiumarrow_forwardOn October 1 a company sells a 3-year, $2,500,000 bond with an 8% stated interest rate. Interest is paid quarterly and the bond is sold at 89.35. On October 1 the company would collect ________. A. $200,000 B. $558,438 C. $2,233,750 D. $6,701,250arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning