FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

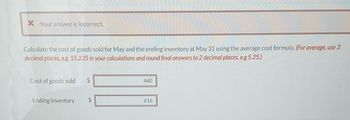

Transcribed Image Text:X Your answer is incorrect.

Calculate the cost of goods sold for May and the ending inventory at May 31 using the average cost formula. (For average, use 3

decimal places, e.g. 15.235 in your calculations and round final answers to 2 decimal places, e.g 5.25.)

Cost of goods sold

Ending Inventory

440

616

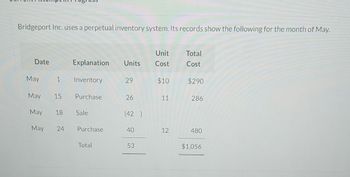

Transcribed Image Text:Bridgeport Inc. uses a perpetual inventory system. Its records show the following for the month of May.

Date

May

May

May

May

1 Inventory

Purchase

15

18

Unit

Explanation Units Cost

24

Sale

Purchase

Total

-29

26

(42 )

40

53

$10

11

12

Total

Cost

$290

286

480

$1,056

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vishnuarrow_forwardGiven the following: Numberpurchased Costper unit Total January 1 inventory 39 $ 5 $ 195 April 1 59 8 472 June 1 49 9 441 November 1 54 10 540 201 $ 1,648 a. Calculate the cost of ending inventory using the FIFO (ending inventory shows 60 units). b. Calculate the cost of goods sold using the FIFO (ending inventory shows 60 units).arrow_forwardSolve for the missing information designated by "?" in the following table. (Use 365 days in a year. Round the inventory turnover ratio to one decimal place before computing days to sell. Round days to sell to one decimal place.) Case Beginning Inventory Purchases Cost of Goods Sold Ending Inventory Inventory Turnover Ratio Days to Sell a. $ 190 $ 925 $ 870 $ 245 4.0 91.3 b. C. $ 290 $ 1,380 $ 1,560 $ 110 7.8 46.8 $ 1,360 $ 105 26.8arrow_forward

- Please do not give solution in image format thankuarrow_forwardGiven the following: Numberpurchased Costper unit Total January 1 inventory 41 $ 5 $ 205 April 1 61 8 488 June 1 51 9 459 November 1 56 10 560 209 $ 1,712 a. Calculate the cost of ending inventory using the LIFO (ending inventory shows 62 units). b. Calculate the cost of goods sold using the LIFO (ending inventory shows 62 units).arrow_forwardGiven the following: Numberpurchased Costper unit Total January 1 inventory 30 $ 5 $ 150 April 1 50 8 400 June 1 40 9 360 November 1 45 10 450 165 $ 1,360 a. Calculate the cost of ending inventory using the LIFO (ending inventory shows 51 units). b. Calculate the cost of goods sold using the LIFO (ending inventory shows 51 units).arrow_forward

- Your Answer Correct Answer (Used) Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO methods. The ending inventory at September 30 (b) Cost of goods sold 69 FIFO 1,890 The sum of ending inventory and cost of goods sold $ 12,785 6A For both FIFO and LIFO, calculate the sum of ending inventory and cost of goods sold. FIFO $ LIFO LA 1,710 12,965 LIFOarrow_forwardGiven the following: January 1 inventory April 1 June 1 November 1 Cost of ending inventory Number purchased 42 62 52 57 213 Cost per unit $ 3 6 7 8 Cost of goods sold Total a. Calculate the cost of ending inventory using the FIFO (ending inventory shows 63 units). $ 126 372 364 456 $ 1,318 b. Calculate the cost of goods sold using the FIFO (ending inventory shows 63 units).arrow_forwardPlease do not give image formatarrow_forward

- Please help mearrow_forward22 PLEASE SOLVE!!arrow_forwardWhispering Winds Corp. reports the following for the month of June. Units Unit Cost Total Cost June 1 Inventory 300 $4 $1,200 12 Purchase 600 $9 $5400 23 Purchase 450 $10 $4500 30 Inventory 150 Calculate Weighted Average Unit Cost. (Round answer to 2 decimal places, e.g. 15.25.) Weighted Average Unit Cost ? Compute the cost of the ending inventory and the cost of goods sold using the average-cost method. (Round answers to 0 decimal places, e.g. 1,250.) The ending inventory ? The cost of goods sold ? Will the results in (a) be higher or lower than the results under FIFO and LIFO? Ending inventory is (higher or lower) than FIFO $? and (higher or lower) than LIFO $? In contrast, cost of goods sold is (higher or lower) than FIFO $? and (higher or lower) than LIFO $?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education