FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

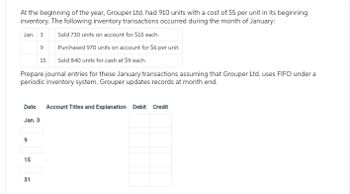

Transcribed Image Text:At the beginning of the year, Grouper Ltd. had 910 units with a cost of $5 per unit in its beginning

inventory. The following inventory transactions occurred during the month of January:

Jan. 3

Sold 730 units on account for $10 each.

9

Purchased 970 units on account for $6 per unit.

15

Sold 840 units for cash at $9 each.

Prepare journal entries for these January transactions assuming that Grouper Ltd. uses FIFO under a

periodic inventory system. Grouper updates records at month end.

Date Account Titles and Explanation Debit Credit

Jan. 3

9

15

31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- [The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 355 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Activities Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost @ $ 14.00 = 215 units 160 units 355 units 730 units @ @ $ 13.00 = $ 11.00 = $ 3,010 2,080 3,905 $ 8,995 Units sold at Retail 165 units 190 units 355 units @ @ $23.00 $ 23.00 Required: 1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. 2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. 3. Determine the cost assigned to ending inventory and…arrow_forwardXYZ company prepares financial statements monthly and the company uses FIFO method under a perpetual inventory system. The begining inventory for the month of december was 2500 TL (2.500 units at unit cost of 1TL). Journalize the below transactions of XYZ company for the month of December. 1. Purchased 5000 units of inventory on account, FOB destination, at a unit cost of 1.5 TL per unit 2. Sold 4500 units of inventory on account to Customer A, FOB shipping point, for 3 TL per unit. 3. XYZ granted credit to the customer A, who returned 100 units of inventory as they did not match the required specifications. The items were returned to inventory from the most recent purchase price. 4. XYZ bought 1000 units of inventory at a unit cost of 2 TL. The journal entry for item 4 involves a debit to for 2000 TL and the balance of the inventory account equals units, a total of TL. inventory 6650 4100 3100 4650 Purchasesarrow_forwardOrion Iron Corporation tracks the number of units purchased and sold throughout each year but applies its inventory costing method at the end of the year, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Transactions a. Inventory, Beginning For the year: Units 350 Unit Cost $ 12 b. Purchase, April 11 c. Purchase, June 1 d. Sale, May 1 (sold for $40 per unit) e. Sale, July 3 (sold for $40 per unit) f. Operating expenses (excluding income tax expense), $18,300 Required: 1. Calculate the number and cost of goods available for sale. 2. Calculate the number of units in ending inventory. 3. Compute the cost of ending inventory and cost of goods sold under (a) FIFO, (b) LIFO, and (c) weighted average cost. 4. Prepare an income statement that shows under the FIFO method, LIFO method and weighted average method. 6. Which inventory costing method minimizes income taxes? 800 850 350…arrow_forward

- Kirtland Corporation uses a periodic inventory system. At the end of the annual accounting period, December 31, the accounting records for the most popular item in inventory showed the following: Transactions Units Unit Cost Beginning inventory, January 1 360 $5.00 Transactions during the year: a. Purchase, January 30 260 3.00 b. Purchase, May 1 420 6.00 c. Sale ($7 each) (120) d. Sale ($7 each) (660) Required: a. Compute the amount of goods available for sale. b. &c. Compute the amount of ending inventory and cost of goods sold at December 31, under Average cost, First in, first out, Last-in, first-out and Specific identification inventory costing methods. For Specific identification, assume that the first sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the second sale was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1.arrow_forwardThe beginning inventory was 490 units at a cost of $8 per unit. Goods available for sale during the year were 1, 870 units at a total cost of $16,930. In May, 790 units were purchased at a total cost of $7,110. The only other purchase transaction occurred during October. Ending inventory was 835 units. Required: Calculate the number of units purchased in October and the cost per unit purchased in October. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using FIFO method. Assume the periodic inventory system is used. Calculate cost of goods sold and ending inventory using LIFO method.arrow_forwardGladstone Company tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Transactions Units Unit Cost Beginning inventory, January 1 3,200 $ 45 Transactions during the year: a. Purchase, January 30 4,550 55 b. Sale, March 14 ($100 each) (2,850 ) c. Purchase, May 1 3,250 75 d. Sale, August 31 ($100 each) (3,300 ) Assuming that for the Specific identification method (item 1d) the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the sale of August 31 was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1.arrow_forward

- Chess Top uses the periodic inventory system. For the current month, the beginning inventory consisted of 200 units that cost $65 each. During the month, the company made two purchases: 300 units at $68 each and 150 units at $70 each. Chess Top also sold 500 units during the month. Using the LIFO method, what is the amount of cost of goods sold for the month? $arrow_forwardSheffield uses the periodic inventory system. For the current month, the beginning inventory consisted of 7100 units that cost $14.00 each. During the month, the company made two purchases: 2800 units at $15.00 each and 11900 units at $15.50 each. Sheffield also sold 13000 units during the month. Using the FIFO method, what is the ending inventory?arrow_forwardZonkey Enterprises uses LIFO with a periodic inventory system to keep track of its inventory. It began the year with 100 units that cost $10 each. It made the following purchases: January 7, 100 for $12 each; January 22, 100 for $13 each. During the month it sold 120 units. How much ending inventory should be reported on the balance sheet, COGS on the January income statement, and cost of goods available for sale during the month? How is ending inventory being calculated?arrow_forward

- Penultimate Company uses a perpetual inventory system and has a December 31 year-end. Its records show the following data for the current year: Inventory beginning of year per General Ledger - 36,450 Inventory end of year unadjusted per General Ledger - $35,000 Purchases during the year - $60,000 Physical inventory count end of year - 43,900 Accounts Payable invoices dated December for inventory purchases ordered but in transit at year end - $6,000 Trade terms with suppliers – Net 30 days, FOB destination Required 1: Assuming no other transaction happened, what value will show on Penultimate's year end balance sheet for inventory? $ Required 2: Assuming no other transaction happened, what value will show on Ultimate's Income Statement as the Cost of Goods Sold? $ Required 3: Assuming no other transaction happened, what was the amount of Merchandise Available For Sale? $arrow_forwardBeech Soda, Incorporated uses a perpetual inventory system. The company's beginning inventory of a particular product and its purchases during the month of January were as follows: Beginning inventory (January 1) Purchase (January 11) Purchase (January 20) Total Quantity 23 26 37 86 Unit Cost $ 25 $31 $ 33 Total Cost $ 575 806 1,221 $ 2,602 On January 14, Beech Soda, Incorporated sold 39 units of this product. The other 47 units remained in inventory at January 31. Assuming that Beech Soda uses the LIFO cost flow assumption, the cost of goods sold to be recorded at January 14 is:arrow_forwardBeech Soda, Incorporated uses a perpetual inventory system. The company's beginning inventory of a particular product and its purchases during the month of January were as follows: Quantity Unit Cost Total Cost Beginning inventory (January 1) 24 $ 19 $ 456 Purchase (January 11) 20 $ 25 500 Purchase (January 20) 31 $ 27 837 Total 75 $ 1,793 On January 14, Beech Soda, Incorporated sold 33 units of this product. The other 42 units remained in inventory at January 31. i) Assuming that Beech Soda uses the first-in, first-out (FIFO) cost flow assumption: The cost of goods sold to be recorded at January 14 is: $_______________________________ The cost of ending inventory at January 31 is: $ _____________________________ ii). Assuming that Beech Soda uses the Last-in, first-out (LIFO) cost flow assumption: The cost of goods sold to be recorded at January 14 is:…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education