FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

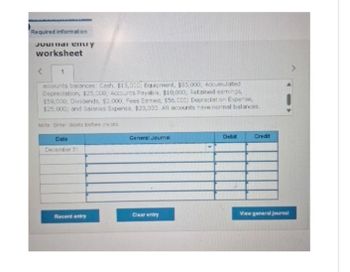

Transcribed Image Text:Required information

Journal entry

worksheet

<

1

accounts balances: Cash, $15,000: Equipment, $85,000; Accumulated

Depreciation, $25,000, Accounts Payable, $10,000; Retained earnings,

$59,000, Dividends, $2,000, Fees Earned, $56,000: Depreciation Expense,

$25,000; and Salaries Expense, $23,000. All accounts have normal balances.

Note: Enter debits before credits

Date

December 31

General Journal

Debit

Credit

Clear entry

View general journal

Record entry

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Complete the followin Common Size Balance Sheet: Amount Percent Cash $ 600 (c) _____________________________ Accounts Receivable 1,400 (d)_____________________________ Total Aseets $ 2,000 (e) _______________________________ Accounts Payable 400 (f) _______________________________ Notes Payable 800 (g)________________________________ Total Liabilities 1,200 (h)…arrow_forwardNeed Help with Statement Matchingarrow_forwardHow do I create and start a balance sheet for this data?arrow_forward

- A company settles a long-term note payable plus interest by paying $68,000 cash toward the principal amount and $5,440 cash for interest. The amount reported as a use of cash under cash flows from financing activities is:arrow_forwardJ. P. Robard Mfg., Inc. Balance Sheet ($000) Cash $470 Accounts receivable 2,100 Inventories 940 Current assets $3,510 Net fixed assets 4,590 Total assets $8,100 Accounts payable $1,120 Accrued expenses 580 Short-term notes payable 280 Current liabilities $1,980 Long-term debt 2,040 Owners' equity 4,080 Total liabilities and owners' equity $8,100 (Click on the icon in order to copy its contents into a spreadsheet.) J. P. Robard Mfg., Inc. Income Statement ($000) Net sales (all credit) $8,010 Cost of goods sold (3,300) Gross profit $4,710 Operating expenses (includes $500 depreciation) (3,090) Net operating income $1,620 Interest expense (360) Earnings before taxes $1,260 Income taxes (35%) (441) Net income $819arrow_forwardPrivett Company Accounts payable Accounts receivable Accrued liabilities Cash $36,632 72,986 6,134 15,305 38,400 71,968 119,728 79,667 31,336 20,560 662,428 2,681 Based on the data for Privett Company, what is the amount of quick assets? Oa. $119,627 Ob. $781,037 Oc. $46,641 Od. $1,601,593 Intangible assets Inventory Long-term investments Long-term liabilities Marketable securities Notes payable (short-term) Property, plant, and equipment Prepaid expensesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education