FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

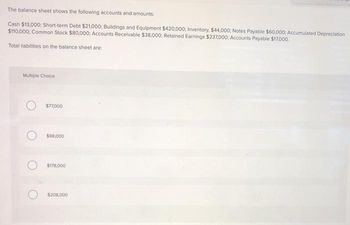

Transcribed Image Text:The balance sheet shows the following accounts and amounts:

Cash $13,000; Short-term Debt $21,000; Buildings and Equipment $420,000; Inventory, $44,000; Notes Payable $60,000, Accumulated Depreciation

$110,000; Common Stock $80,000; Accounts Receivable $38,000; Retained Earnings $237,000; Accounts Payable $17,000.

Total liabilities on the balance sheet are:

Multiple Choice

$77,000

$98,000

$178,000

$208,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For the year 2000, Young, Inc has cash $121, Accounts Receivables $425, Inventory $410, Net Fixed Assets $1,704, Total Assets $2,660, Accounts Payable $350, Notes Payable $370, Long-term Debt $550, Common Stock $580, Retained Earnings $810, Net Sales $1,384, Cost of Goods Sold $605, Depreciation $180, EBIT $599, Interest paid $80, Taxable Income $519, Taxes $156, Net Income $363, Addition to Retained Earnings $254, Dividends Paid $109. What is the cash coverage ratio for 2000? A) 5.2 B) 6.8 C) 8.7 D) 9.7arrow_forwardThe Coffman Company has provided the following account balances: Cash $380,000 Short-term investments $40,000 Accounts receivable $60,000 Inventory $480,000 Long-term notes receivable $20,000 Equipment $960,000 Factory Building $1,800,000 Intangible assets $60,000 Accounts payable $300,000 Accrued liabilities payable $40,000 Short-term notes payable $95,000 Income taxes payable $55,000 Long-term notes payable $920,000 Stockholders’ equity $2,400,000What is Coffman's current ratio? Group of answer choices a)2.00 b)2.17 c)2.71 d)1.96 e)None of the abovearrow_forwardThe balance sheet shows the following accounts and amounts: Inventory, $84.000; Long-term Debt 125,000; Common Stock $60,000, Accounts Payable $44,000; Cash $132,000, Buildings and Equipment $390,000: Short-term Debt $48,000, Accounts Receivable $109,000; Retained Earnings $204,000; Notes Payable $54,000; Accumulated Depreciation $180,000. Total current assets on the balance sheet are Multiple Choice $216,000 $325,000 $535.000 $715,000 1 www Literarrow_forward

- 14 )arrow_forwardThis is the financial position of Hospital AMIH, Inc. regarding the repayment of its debts. These are the most relevant data of its financial statements: Total revenues $ 245,000 Total expenses $ 145,000 Depreciation $ 10,000 Changes in receivable accounts +$ 50,000 Changes in inventory ($ 20,000) Changes in accounts payable ($ 25,000) Total current liabilities $ 30,000 Total long-term debt $ 45,000 cash flow (total margin + depreciation expense) + interest expense/principal payment + interest expense Calculate the operating cash flow.arrow_forwardProfile Co has the following assets and liabilities: Assets: Cash $100 , account receivable,$150 ; Inventory,$240 ,land $200, plant net of accumulated amortization $300 : liabilities short term bank loan, $60 : accounts payable long term loan mortage loan ,$160 ,profolio co long term assets total wasarrow_forward

- Determine the amount of long-term debt for ABC Co. using the following balance sheet information: cash balance of $24,700, accounts payable of $96,526, common stock of $401,347, retained earnings of $501,930, inventory of $205,420, other assets equal to $77,911, net plant and equipment of $706,520, short-term notes payable of $30,000, and accounts receivable of $142,714. Long-Term Debt %24arrow_forwardBalance Sheet as of December 31, 2021 (Thousands of Dollars) Cash $ 1,080 Accounts payable $ 4,320 Receivables 6,480 Accruals 2,880 Inventories 9,000 Line of credit Total current assets $16,560 Notes payable 2,100 Net fixed assets 12,600 Total current liabilities $ 9,300 Mortgage bonds 3,500 Common stock 3,500 Retained earnings 12,860 Total assets $29,160 Total liabilities and equity $29,160 Income Statement for December 31, 2021 (Thousands of Dollars) Sales $36,000 Operating costs 34,000 Earnings before interest and taxes $ 2,000 Interest 160 Pre-tax earnings $ 1,840 Taxes (25%) 460 Net income $ 1,380 Dividends 552 Addition to retained earnings 2$ 828arrow_forward1. The following accounts appeared on the partial Balance Sheet of Brandy Inc.: Accounts Payable Accounts Receivable $ 5,500 2,300 2,820 3,000 8,140 18,560 18,760 100 Bank Loan Cash Common Stock Inventory Long-term debt Machinery What is the total amount of all assets (rounded to the nearest dollar)?arrow_forward

- i need the answer quicklyarrow_forwardDetermine the amount of long-term debt for ABC Co. using the following balance sheet information: cash balance of $24,429, accounts payable of $97,423, common stock of $400,517, retained earnings of $500,749, inventory of $207,068, other assets equal to $77,098, net plant and equipment of $706,191, short-term notes payable of $30,000, and accounts receivable of $142,586.arrow_forwardUse the following information to answer the questions: Assets Liabilities and Equity Cash 13,000 Accounts payable 18,000 Marketable securities 2,000 Notes payable 6,000 Accounts receivable 3,000 Current liabilities 24,000 Inventory 27,000 Long-term debt 95,000 Current assets 45,000 Total liabilities 119,000 Machines 34,000 Paid-in capital 20,000 Real estate 80,000 Retained earnings 20,000 Fixed assets 114,000 Equity 40,000 Total assets 159,000 Total liab. & equity 159,000 What is the quick ratio (aka the acid test)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education