FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text::59

ces

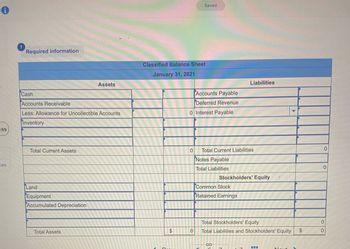

Required information

Cash

Accounts Receivable

Less: Allowance for Uncollectible Accounts

Inventory

Total Current Assets

Land

Equipment

Accumulated Depreciation

Assets

Total Assets

Classified Balance Sheet

January 31, 2021

$

Saved

0

Accounts Payable

Deferred Revenue

0 Interest Payable

Total Current Liabilities

Notes Payable

Total Liabilities

Liabilities

Stockholders' Equity

Common Stock

Retained Earnings

Total Stockholders' Equity

0 Total Liabilities and Stockholders' Equity $

0

0

0

0

Transcribed Image Text:38

es

Maps

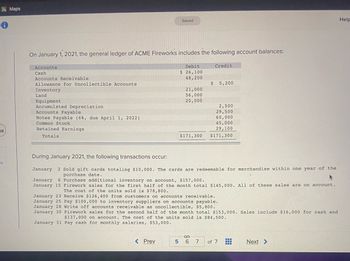

On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:

Accounts

Cash

Accounts Receivable

Allowance for Uncollectible Accounts

Inventory

Land

Equipment

Accumulated Depreciation

Accounts Payable

Notes Payable (6%, due April 1, 2022)

Common Stock

Retained Earnings

Totals

Saved

< Prev

5

Debit

$ 26,100

48,200

21,000

56,000

20,000

Credit

During January 2021, the following transactions occur:

January 2 Sold gift cards totaling $10,000. The cards are redeemable for merchandise within one year of the

purchase date.

January 6 Purchase additional inventory on account, $157,000.

January 15 Firework sales for the first half of the month total $145,000. All of these sales are on account.

The cost of the units sold is $78,800.

January 23 Receive $126,400 from customers on accounts receivable.

January 25 Pay $100,000 to inventory suppliers on accounts payable.

January 28 Write off accounts receivable as uncollectible, $5,800.

January 30 Firework sales for the second half of the month total $153,000. Sales include $16,000 for cash and

$137,000 on account. The cost of the units sold is $84,500.

January 31 Pay cash for monthly salaries, $53,000.

$ 5,200

2,500

29,500

60,000

45,000

29,100

$171,300 $171,300

S

6

7 of 7 H

Next >

Help

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- vvk.2arrow_forward3 ook rences Exercise 16-21B (Algo) Direct: Preparing statement of cash flows and supporting note LO P5 Cash and cash equivalents, December 31 prior year-end Cash and cash equivalents, December 31 current year-end Cash received as interest Cash paid for salaries Bonds payable retired by issuing common stock (no gain or loss on retirement) Cash paid to retire long-term notes payable Cash received from sale of equipment Land purchased by issuing long-term notes payable Cash paid for store equipment Cash dividends paid Cash paid for other expenses Cash received from customers Cash paid for inventory FERRON COMPANY Statement of Cash Flows For Year Ended December 31 Use the above information about Ferron Company to prepare a complete statement of cash flows (direct method) for the current year ended December 31. Use a note disclosure for any noncash investing and financing activities. Note: Amounts to be deducted should be indicated with a minus sign. Cash flows from operating activities $…arrow_forwardam. 157.arrow_forward

- solve yellow blanks thank you!arrow_forwardAccounts Payable Accounts Receivable Accumulated Depreciation (Equip) Allowance for Doubtful Accounts Bonds Payable Cash Cash Dividends Common Stock Cost of Goods Sold Depreciation expense Equipment Interest Expense Inventory Adjusted Trial Balance 12/31/2020 Gain on Sale of Equipment Notes Payable (due 9/30/22) PIC in Excess of Par - Common PIC from Treasury Stock Preferred Stock Prepaid Rent Retained Earnings Salary Expense Sales Returns & Allowances Sales Revenue Supplies Treasury Stock Unearned Sales Revenue Utilities Expense TOTALS Debit $4,000 $12,400 $2,800 $16,400 $1,400 $50,000 $400 $4,800 $600 $4,600 $2,000 $400 $600 $2,000 Credit $9,000 $10,000 $200 $10,000 $600 $600 $600 $20,000 $1,400 $6,000 $6,400 $36,800 $800 $102,400 $102,400 Total Assets Total Current Assets Total Liabilities Total Current Liabilities Total Stockholders' Equity Total Paid-in Capital Gross Profit Income from Operations Net Income Intangible Assetsarrow_forwardNeed Help with Statement Matchingarrow_forward

- Balance Sheet for Bearcat Hathaway, 2022 2021 2022 Cash Accounts. Receivable $5,268,485 $10,268,485 Inventory $529,062 $696,685 Current Assets $8,371,777 $13,279,842 Less $2,574,230 $2,314,672 Gross Fixed Assets $16,251,665 $20,567,330 Accum.Depreciation Total Assets $7,460,897 $10,117,819 Accounts Payable Notes. Payable Current Liabilities Calculate the net working capital in 2022. Long Termi Debt Total Liabilities, None of these options are correct $10,572,740 $5,664,675 $8,854,338 $3,946,273 Total $17,162,545 $23,729,353 Liabilities and Equity Capital Surplus Retained. Earnings 2021 2022 $1,673,992 $2,438,271 Common Net Fixed Assets $8,790,768 $10,449,511 Stock ($0.50 $1,300,000 $1,600,000 par) $1,033,110 $1,987,233 $2,707,102 $4,425,504 $9,242,830 $11,468,302 $11,949,932 $15,893,806 $1,148,120 $1,800,969 $2,764,493 $4,434,578 $17,162,545 $23,729,353arrow_forwardRequired information [The following information applies to the questions displayed below] Golden Corporation's current year income statement, comparative balance sheets, and additional information follow. For the year, (1) all sales are credit sales, (2) all credits to Accounts Receivable reflect cash receipts from customers, (3) all purchases of inventory are on credit. (4) all debits to Accounts Payable reflect cash payments for inventory, and (5) any change in Income Taxes Payable reflects the accrual and cash payment of taxes. Assets Cash Accounts receivable. Inventory Total current assets GOLDEN CORPORATION Comparative Balance Sheets December 31 Equipment Accumulated depreciation-Equipment Total assets Liabilities and Equity Accounts payable. Income taxes payable. Total current liabilities Equity Common stock, $2 par value Paid-in capital in excess of par value, common stock Retained earnings Total liabilities and equity GOLDEN CORPORATION Income Statement For Current Year Ended…arrow_forwardDo not give answer in imagearrow_forward

- Please do not give image formatarrow_forwardAccount Titles Debit CreditCash $ 7Accounts Receivable 3Supplies 3Equipment 9Accumulated Depreciation $ 2Software 6Accumulated Amortization 2Accounts Payable 4Notes Payable (short-term) 0Salaries and Wages Payable 0Interest Payable 0Income Taxes Payable 0Deferred Revenue 0Common Stock 15Retained Earnings 5Service Revenue 0Depreciation Expense 0Amortization Expense 0Salaries and Wages Expense 0Supplies Expense 0Interest Expense 0Income Tax Expense 0Totals $ 28 $ 28Transactions during 2018 (summarized in thousands of dollars) follow:Borrowed $25 cash on July 1, 2018, signing a six-month note payable.Purchased equipment for $28 cash on July 2, 2018.Issued additional shares of common stock for $5 on July 3.Purchased software on July 4, $3 cash.Purchased supplies on July 5 on account for future use, $7.Recorded revenues on December 6 of $58, including $8 on credit and $50 received in…arrow_forwardRITTER CORPORATION Income Statement 2021 Revenue Expenses $ 860 620 Depreciation 101 Net income $ 139 Dividends $ 119 RITTER CORPORATION Balance Sheet December 31 2020 2021 Assets Cash $66 $ 87 Other current assets 176 192 Net fixed assets Total assets Liabilities and Equity Accounts payable 381 401 $ 623 $ 680 Long-term debt Stockholders' equity $ 126 $ 147 151 167 346 366 $ 680 Total liabilities and equity $623 a. What is the change in cash during 2021? b. Determine the change in net working capital in 2021. c. Determine the cash flow generated by the firm's assets during 2021. a. Change in cash b. Change in net working capital c. Cash flow from assetsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education