FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hi there,

I'm not sure how to solve this question. Which items are supposed to be on the statement of cashflows?

Thanks

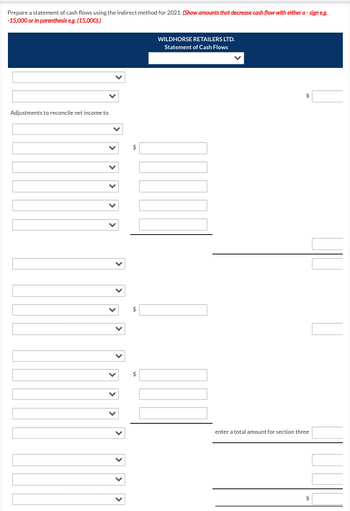

Transcribed Image Text:Prepare a statement of cash flows using the indirect method for 2021. (Show amounts that decrease cash flow with either a-sign eg.

-15,000 or in parenthesis eg. (15,000))

Adjustments to reconcile net income to

$

$

WILDHORSE RETAILERS LTD.

Statement of Cash Flows

enter a total amount for section three

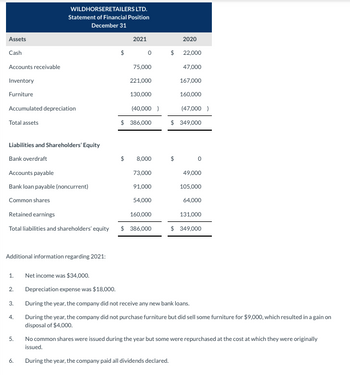

Transcribed Image Text:Assets

Cash

Accounts receivable

Inventory

Furniture

Accumulated depreciation

Total assets

Liabilities and Shareholders' Equity

Bank overdraft

Additional information regarding 2021:

1.

2.

WILDHORSERETAILERS LTD.

Statement of Financial Position

December 31

3.

4.

5.

6.

2021

Accounts payable

Bank loan payable (noncurrent)

Common shares

Retained earnings

Total liabilities and shareholders' equity $ 386,000

75,000

221,000

130,000

(40,000)

$ 386,000

$ 8,000

73,000

91,000

54,000

160,000

$

2020

22,000

47,000

167,000

160,000

(47,000)

$ 349,000

0

49,000

105,000

64,000

131,000

$ 349,000

Net income was $34,000.

Depreciation expense was $18,000.

During the year, the company did not receive any new bank loans.

During the year, the company did not purchase furniture but did sell some furniture for $9,000, which resulted in a gain on

disposal of $4,000.

No common shares were issued during the year but some were repurchased at the cost at which they were originally

issued.

During the year, the company paid all dividends declared.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What are the four accounts that are typically affected by cash transactions. Please use the following illustration to help you answer this question.arrow_forwardIndicate with Yes or No whether each of items should be included in the cash balance presented on the balance sheet. If yes is selected for the Included in Cash Balance column for NSF checks, Savings account,Compensating balance,post dated checks,IOU,cash on hand,cash in sinking fund, travel advance, bank draft and prepaid debit card. Include the Classification items excluded?arrow_forwardPetty Cash Fund Question, When it comes to making payments from the petty cash fund, why isn't there an accounting/journal entry for it? Please Explain.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education