FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

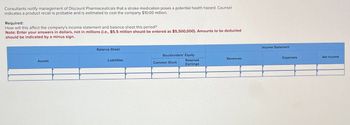

Transcribed Image Text:Consultants notify management of Discount Pharmaceuticals that a stroke medication poses a potential health hazard. Counsel

indicates a product recall is probable and is estimated to cost the company $10.00 million.

Required:

How will this affect the company's income statement and balance sheet this period?

Note: Enter your answers in dollars, not in millions (i.e., $5.5 million should be entered as $5,500,000). Amounts to be deducted

should be indicated by a minus sign.

Assets

Balance Sheet

Stockholders' Equity

Liabilities

Revenues

Common Stock

Retained

Earnings

Income Statement

Expenses

Net Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Help me with question b) only: Ratio calculations are: Anne's business for October 2021 Net profit Margin = net profit/sales = (210)/5600 = - 3.75% Gross profit margin = gross profit/sales = 770/5600 = 13.75% Current ratio= current assets/current liability= 15,840/5,150= 3.08 Acid test ratio = (cash+ accounts receivable) / current liability = (7,340+8030+150)/5,150 = 3.02 Accounts receivable collection period = Receivables / Average daily credit sales = 150/ (5600/360 days) = 9.64 days or 10 days Accounts payable payment period = Accounts Payable / Average daily purchases = (5,150/ (5,150/360 days) = 360 daysarrow_forwardIncome Statement: The income statement of Taco Bell company is given for the years 2020 & 2019. 2020 2019 General and administrative expenses 25,000 24,000 Interest expense 1,200 1,500 Net sales $124,000 $138,000 Selling expenses 11,880 12,720 Income taxes $1,109.5 1,883 COGS 108,000 95,000 Gain on Sale of land 450 600 1. What is the operating profit marain for the company over the years 2020 and + O d) ENG TOSHIBAarrow_forwardUse the following information to answer this question. Windswept, Incorporated 2022 Income Statement (in millions) Het sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income Cash Accounts receivable Inventory Total Net fixed assets Total assets 2021 What is the equity multiplier for 20227 $11,100 8,050 430 $ 2,620 104 $2,516 881 $ 1,635 Windswept, 2921 and 2022 Balance Sheets. (in millions) 2022 $300 1,150 1,050 2,060 1,775 $ 3,510 $3,155 3,520 4,120 $7,030 $7,275 $ 330 porated Accounts payable Long-term debt Common stock Retained earnings Total liabilities & equity 2021 $1,870 1,090 3,400 670 2022 $1,932 1,373 3,050 920 $7,030 $7,275.arrow_forward

- Uptodate Projects Ltd has approached you to analyse and interpret their financial statements.The following amounts were extracted from the records of the company: 2019 2020 2021 R R RTurnover 200 000 220 000 250 000Cost of sales 140 000 150 000 165 000Profit before interest and tax 12 000 11 000 10 500Accounts receivable 16 500 25 000 29 600Accounts payable 13 000 14 700 17000 Inventory 18 750 26 000 30 400Bank/ (Overdraft)…arrow_forwardQ2. The following information has been extracted from the draft financial statements of Moba limited.. MOBA LIMITED STATEMENTS OF FINANCIAL POSITION AS AT 31 JUNE 2021 2022 Non-current assets Current assets Inventory Trade receivables Bank Total assets Equity and liabilities Equity Ordinary share capital Share premium Retained earnings Non-current liabilities 10% Loan note (redeemable 31 June 2022) Current liabilities Trade payables Taxation Bank overdraft Operating profit Interest payable Profit before taxation K'000 Taxation 450 180 58 580 360 0 K'000 Κ'000 4,600 940 5.540 3,500 300 1,052 4,852 0 688 5.540 Additional information (a) The statement of profit or loss for the year ended 31 June 2022 shows the following. 500 230 170 K'000 Profit for financial year (b) During the year dividends paid were K270,000. (c) Profit before taxation had been arrived at after charging K700,000 for depreciation on DANCON assets. (d) During the year non-current assets with a net book value of K200,000…arrow_forwardleft numbers are 2025 right column is 2024. i need to figure out B. asset turnover C return on assets D. return on common stockholder equity.arrow_forward

- where did the fixed sellind and admin $110,000 come fromarrow_forwardCOTB MC Qu. 16-76 (Algo) Assume a company provided the... Assume a company provided the following information: Net operating income Net income before tax Net income Gross margin The times interest earned ratio is closest to: $ 184,000 $ 170,000 $ 119,000 $ 680,000arrow_forwardH1.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education