FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

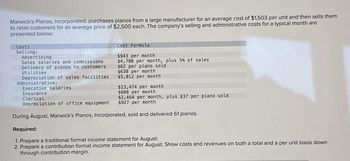

Transcribed Image Text:Marwick's Pianos, Incorporated, purchases pianos from a large manufacturer for an average cost of $1,503 per unit and then sells them

to retail customers for an average price of $2,500 each. The company's selling and administrative costs for a typical month are

presented below:

Costs

Selling:

Advertising

Sales salaries and commissions

Delivery of pianos to customers

Utilities

Cost Formula

$943 per month

$4,780 per month, plus 5% of sales

$62 per piano sold

$638 per month

$5,012 per month

Depreciation of sales facilities

Administrative:

Executive salaries

$13,474 per month

Insurance

$688 per month

Clerical

$2,464 per month, plus $37 per

$927 per month

Depreciation of office equipment

During August, Marwick's Pianos, Incorporated, sold and delivered 61 pianos.

Lano sold

Required:

1. Prepare a traditional format income statement for August.

2. Prepare a contribution format income statement for August. Show costs and revenues on both a total and a per unit basis down

through contribution margin.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ida Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $850. Selected data for the company’s operations last year follow: Units in beginning inventory 0 Units produced 250 Units sold 225 Units in ending inventory 25 Variable costs per unit: Direct materials $ 100 Direct labor $ 320 Variable manufacturing overhead $ 40 Variable selling and administrative $ 20 Fixed costs: Fixed manufacturing overhead $ 60,000 Fixed selling and administrative $ 20,000 The absorption costing income statement prepared by the company’s accountant for last year appears below: Sales $ 191,250 Cost of goods sold 157,500 Gross margin 33,750 Selling and administrative expense 24,500 Net operating income $ 9,250 Required: Prepare an income statement for last year using variable costing.arrow_forwardRoyal Lawncare Company produces and sells two packaged products—Weedban and Greengrow. Revenue and cost information relating to the products follow: Product Weedban Greengrow Selling price per unit $ 11.00 $ 30.00 Variable expenses per unit $ 2.40 $ 12.00 Traceable fixed expenses per year $ 134,000 $ 30,000 Common fixed expenses in the company total $104,000 annually. Last year the company produced and sold 35,500 units of Weedban and 25,000 units of Greengrow. Required: Prepare a contribution format income statement segmented by product lines. Product Line Total Company Weedban Greengrow 0 0 0 0 $0 $0 $0arrow_forwardKenzi, a manufacturer of kayaks, began operations this year. During this year, the company produced 1,100 kayaks and sold 850 at a price of $1,100 each. At year-end, the company reported the following income statement information using absorption costing. Sales (850 × $1,100) $ 935,000 Cost of goods sold (850 × $425) 361,250 Gross profit 573,750 Selling and administrative expenses 220,000 Income $ 353,750 Additional Information a. Product cost per kayak under absorption costing totals $425, which consists of $325 in direct materials, direct labor, and variable overhead costs and $100 in fixed overhead cost. Fixed overhead of $100 per unit is based on $110,000 of fixed overhead per year divided by 1,100 kayaks produced.b. The $220,000 in selling and administrative expenses consists of $85,000 that is variable and $135,000 that is fixed.Prepare an income statement for the current year under variable costing.arrow_forward

- Kenzi, a manufacturer of kayaks, began operations this year. During this year, the company produced 1,025 kayaks and sold 775 at a price of $1,025 each. At year-end, the company reported the following income statement information using absorption costing. Sales (775 × $1,025) $ 794,375 Cost of goods sold (775 × $500) 387,500 Gross profit 406,875 Selling and administrative expenses 250,000 Income $ 156,875 Additional Information a. Product cost per kayak under absorption costing totals $500, which consists of $400 in direct materials, direct labor, and variable overhead costs and $100 in fixed overhead cost. Fixed overhead of $100 per unit is based on $102,500 of fixed overhead per year divided by 1,025 kayaks produced.b. The $250,000 in selling and administrative expenses consists of $105,000 that is variable and $145,000 that is fixed.Prepare an income statement for the current year under variable costing.arrow_forwardMunoz Trophies makes and sells trophies it distributes to little league ballplayers. The company normally produces and sells between 6,000 and 12,000 trophies per year. The following cost data apply to various activity levels: Required Complete the preceding table by filling in the missing amounts for the levels of activity shown in the first row of the table. (Round "Cost per unit" answers to 2 decimal places.) Number of Trophies 6,000 8,000 10,000 12,000 Total costs incurred Fixed $ 64,000 Variable 42,000 Total costs $ 106,000 $ Cost per unit Fixed 2$ 10.67 Variable 7.00 Total cost per trophy 24 17.67 0.00 0.00 S 0.00arrow_forwardMetlock sells books, movies, and magazines to a wide customer base. In a typical month, about 40% of its sales volume is from books, 40% from movies, and 20% from magazines. The selling price and cost information for each of these product categories is as follows. Selling price Variable cost/unit (a) (b) Books $9 3 Your answer is correct. Books In addition, Metlock incurs facility and administrative costs that average $28,080 per month. eTextbook and Media Movies Movies Weighted-average contribution margin $ Magazines $14 Find the weighted-average contribution margin per unit for this company. (Round answer to 2 decimal places, e.g. 15.25.) Your answer is incorrect. 9 Magazines $5 units 1 Determine how many units from each product category Metlock must sell to break even. (Round answers to O decimals, e.g. 15.) units units 5.2 per unit Attempts: unlimitedarrow_forward

- Slapshot Company makes ice hockey sticks and sold 1,880 sticks during the month of June at a total cost of $433,000. Each stick sold at a price of $400. Slapshot also incurred two types of selling costs: commissions equal to 10% of the sales price and other selling expenses of $65,000. Administrative expense totaled $53,800. Must put into a manufacturing firm income statement.arrow_forwardXylo produces xylophones. Each xylophone is sold for $850. Selected data for the company’s operations last year follow: Units in beginning inventory 0 Units Produced 250 Units Sold 225 Units in ending inventory 25 Variable Costs per unit: Direct materials $100 Direct labor $320 Variable Mfg Overhead $40 Variable Selling & Admin $20 Fixed Costs: Fixed Mfg Overhead $60,000 Fixed Selling & Admin $20,000 Required: Compute the unit product cost for one xylophone under absorption…arrow_forwardIda Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are sold for $875. Selected data for the company’s operations last year follow: Units in beginning inventory 0 Units produced 13,000 Units sold 10,000 Units in ending inventory 3,000 Variable costs per unit: Direct materials $ 230 Direct labor $ 410 Variable manufacturing overhead $ 55 Variable selling and administrative $ 22 Fixed costs: Fixed manufacturing overhead $ 780,000 Fixed selling and administrative $ 910,000 Required: 1. Assume that the company uses absorption costing. Compute the unit product cost for one gamelan. (Round your intermediate calculations and final answer to the nearest whole dollar amount.) 2. Assume that the company uses variable costing. Compute the unit product cost for one gamelan. 1. Absorption costing unit product cost 2. Variable costing unit product costarrow_forward

- Wet Pets Inc. makes 100-gallon plexiglass aquariums. They reported the following financial information for last year: Direct labor: 7,200 hours @ $20 per hr. Production manager salary: $60,000 Factory rent: $28,800 Equipment maintenance: $12,000 (considered a variable expense) Equipment depreciation: $12,000 Production for the year: 12,000 units Total Revenue: $1,200,000 Total aquariums sold during the period: 10,000 units Operating Income under absorption costing (after non-production expenses): $244,800 Assume that the fixed costs were the same on a per-unit basis during the prior period. What would Operating Income be under variable costing? (Round per-unit costs to the nearest cent.) Select one: O a. $228,000 b. $226,000 c. $261,600 d. $263,592 e. None of these options are correct.arrow_forwardThe following costs result from the production and sale of 1,000 drum sets manufactured by Tight Drums Company for the year ended December 31. The drum sets sell for $500 each. Variable costs Plastic for casing Wages of assembly workers Drum stands Sales commissions Fixed costs Taxes on factory Factory maintenance Factory machinery depreciation Lease of equipment for sales staff Accounting staff salaries Administrative salaries Required 1 Required 2 Required: 1. Prepare a contribution margin income statement for the year. 2. Compute contribution margin per unit and contribution margin ratio. 3. For each dollar of sales, how much is left to cover fixed costs and contribute to income? Sales Variable costs: Complete this question by entering your answers in the tabs below. Contribution margin Fixed costs $ 17,000 82,000 Required 3 Income 26,000 15,000 Prepare a contribution margin income statement for the year. TIGHT DRUMS COMPANY Contribution Margin Income Statement For Year Ended…arrow_forwardGlass time repairs chips in car windshields. The company incurred the following operating cost for the month of March 2024 Glass time earned $28,000 in service revenues for the month of March by repairing 250 windshields. All cost shown are considered to be directly related to the repair service. 1) prepare an income statement for the month of March 2) compute the cost per unit of repairing one windshield 3) the manager of glass time must keep the unit operating costs below $60 per windshield in order to get his bonus. Did he meet the goal?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education