FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

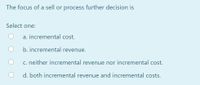

Transcribed Image Text:The focus of a sell or process further decision is

Select one:

a. incremental cost.

b. incremental revenue.

c. neither incremental revenue nor incremental cost.

d. both incremental revenue and incremental costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What are: Relevant / irrelevant / Differential Costs Relevant / irrelevant / Differential Revenues Avoidable / unavoidable costs Sunk costsarrow_forwardccarrow_forwardIn incremental analysis, only relevant costs are considered when making a decision among alternatives. Explain what relevant costs are. Would these include only variable costs? Explain.arrow_forward

- In incremental analysis, the only costs to be considered are O relevant costs. sunk costs. O variable costs. O manufacturing costs.arrow_forwardc. Explain the relationship between contango, cost-of-carry, and convenience yield. d. Explain the relationship between backwardation, cost-of-carry, and convenience yield.arrow_forwardWhich format of the Income Statement is appropriate for financial reporting? O Variable costing O Activity-based O Absorption O any format is fine for financial reportingarrow_forward

- The “plus” in cost-plus pricing is often referred to as Markup. Extra profit. Gross profit. Margin of Safety.arrow_forwardA cost - based transfer price considers the cost of producing the goods when determining the price. True Falsearrow_forwardWhat is meant by incremental revenue or incremental cost?arrow_forward

- Variable costing income will be greater than absorption costing income when: a. Sales is greater than production. b. contribution pricing is applied c. Production is less than or equal to sales. d. Production is greater than salesarrow_forwardProfitability changes may be simply calculated by using what kind of tool: sales price/volume/variable costs/fixed costs.arrow_forward(Variable cost = Total cost - Fixed cost - Net profit) you have not consider the net profit in the calculation. I think it should be added right ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education