Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

PLEASE answer all using template attached.

PLEASE only answer if sure of SOLUTION.

WILL THUMBS UP IF CORRECT.

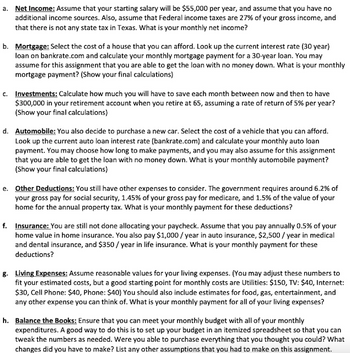

Transcribed Image Text:a.

Net Income: Assume that your starting salary will be $55,000 per year, and assume that you have no

additional income sources. Also, assume that Federal income taxes are 27% of your gross income, and

that there is not any state tax in Texas. What is your monthly net income?

b. Mortgage: Select the cost of a house that you can afford. Look up the current interest rate (30 year)

loan on bankrate.com and calculate your monthly mortgage payment for a 30-year loan. You may

assume for this assignment that you are able to get the loan with no money down. What is your monthly

mortgage payment? (Show your final calculations)

c. Investments: Calculate how much you will have to save each month between now and then to have

$300,000 in your retirement account when you retire at 65, assuming a rate of return of 5% per year?

(Show your final calculations)

d. Automobile: You also decide to purchase a new car. Select the cost of a vehicle that you can afford.

Look up the current auto loan interest rate (bankrate.com) and calculate your monthly auto loan

payment. You may choose how long to make payments, and you may also assume for this assignment

that you are able to get the loan with no money down. What is your monthly automobile payment?

(Show your final calculations)

e. Other Deductions: You still have other expenses to consider. The government requires around 6.2% of

your gross pay for social security, 1.45% of your gross pay for medicare, and 1.5% of the value of your

home for the annual property tax. What is your monthly payment for these deductions?

f. Insurance: You are still not done allocating your paycheck. Assume that you pay annually 0.5% of your

home value in home insurance. You also pay $1,000/year in auto insurance, $2,500 / year in medical

and dental insurance, and $350 / year in life insurance. What is your monthly payment for these

deductions?

g. Living Expenses: Assume reasonable values for your living expenses. (You may adjust these numbers to

fit your estimated costs, but a good starting point for monthly costs are Utilities: $150, TV: $40, Internet:

$30, Cell Phone: $40, Phone: $40) You should also include estimates for food, gas, entertainment, and

any other expense you can think of. What is your monthly payment for all of your living expenses?

h. Balance the Books: Ensure that you can meet your monthly budget with all of your monthly

expenditures. A good way to do this is to set up your budget in an itemized spreadsheet so that you can

tweak the numbers as needed. Were you able to purchase everything that you thought you could? What

changes did you have to make? List any other assumptions that you had to make on this assignment.

Transcribed Image Text:a) Net Income:

Gross Salary=

State Taxes (0%) =

Federal Taxes (27%) =

Net Annual Salary =

Net Monthly Salary =

b) Mortgage:

Cost of House (Loan Value) =

APR=

Payback Periods =

Monthly Mortgage Payment =

c) Retirement Investment:

Savings at Retirement =

Saving Periods =

Interest Rate =

Savings Deposit / month=

d) Automobile Payment:

Cost of Vehicle (Loan Value) =

APR =

Payback Periods =

Monthly Automobile Payment=

e) Other Deductions:

Social Security (6.2%) =

Medicare (1.45%) =

Property Tax (1.5% House Value) =

Total Other Deductions =

f) Insurance:

Home Insurance (0.5% House Value) =

Auto Insurance =

Medical/Dental Insurance =

Life Insurance =

Total Insurance Costs=

g) Living Expenses:

Utilities =

TV =

Internet =

Cell Phone=

Phone =

Gas =

Food =

Credit Card =

Other =

Total Living Expenses =

Total Net Income Per Month=

Total Expenses Per Month =

Difference =

/year

/year

/year

/year

month

monthly payments

month

monthly deposits

/month

monthly payments

/month

/month

/month

/month

/month

/month

/month

/month

/month

/month

/month

/month

/month

/month

month

/month

/month

/month

/month

/month

/month

/month

/month

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- All qesions answer please ? 50 minetsarrow_forwardWhat is the present value of the following set of cash flows at an interest rate of 8% p.a. compounded annually? End of Year 1 $1,150 End of Year 2 $2,300 End of Year 3 $5,100 Select one: a. $7,401.20 b. $7,085.23 c. $8,550.00 d. $7,805.23arrow_forwardSelect the letter of the item below that best matches the definitions that follow. a. Data Files CD ________ b. Lists ________ c. Forms ________ d. Registers ________ e. Reports and graphs ________ f. Restoring a backup ________ g. Icon bar ________ h. Home page ________ i. Backing up a file ________ 1. One click access to QuickBooks Accountant Centers and Home page. 2. The process of rebuilding a backup file to a full QuickBooks Accountant file ready for additional input. 3. Electronic representations of paper documents used to record business activities such as customer invoices, vendor bills, and checks. 4. A big-picture approach of how your essential business tasks fit together organized by logical groups such as customers, vendors, and employees. 5. Groups of names such as customers, vendors, employees, items, and accounts. 6. Contains backups of all the practice files needed for chapter work and completion of assignments. 7. The process of creating a copy of a…arrow_forward

- I have answered A-I in the pictures I posted below. I need the answers to J-L.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardIn the image you can look at the question . Is asking me to choose the correct answer below and fill in the answer box to complete your choice . How can I solve this type of question ?arrow_forward

- Required information [The following information applies to the questions displayed below.] Consider the following narrative describing the process of filling a customer's order at a Starbucks branch: Identify the start and end events and the activities in the following narrative, and then draw the business process model using BPMN: the Starbucks customer entered the drive-through lane and stopped to review the menu. He then ordered a Venti coffee of the day and a blueberry muffin from the barista. The barista recorded the order in the cash register. While the customer drove to the window, the barista filled a Venti cup with coffee, put a lid on it, and retrieved the muffin from the pastry case and placed it in a bag. The barista handed the bag with the muffin and the hot coffee to the customer. The customer has an option to pay with cash, credit card, or Starbucks gift card. The customer paid with a gift card. The barista recorded the payment and returned the card along with the…arrow_forwardPlease correct and incorrect option explain and correct answerarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education