FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please help to answer the questions pictured in the attached images (cash at beginning and end of year are also required, it wouldn't fit in the two allowed images):

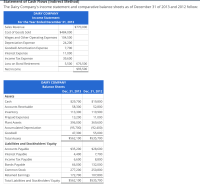

Transcribed Image Text:Required

a. Compute the change in cash that occurred in 2013.

b. Prepare a statement of cash flows using the indirect method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- eBook Recording Petty Cash Fund Transactions Illustrate the effect on the accounts and financial statements of the following transactions. If no account or activity is affected, select "No effect" from the dropdown and leave the corresponding number entry box blank. Enter account decreases and cash outflows as negative amounts. a. Established a petty cash fund of $1,125. Statement of Cash Flows Assets Statement of Cash Flows + Assets Balance Sheet + b. The amount of cash in the petty cash fund is now $169. Replenished the fund, based on the following summary of petty cash receipts: office supplies, $506; miscellaneous selling expense, $197; miscellaneous administrative expense, $253. Enter account decreases and cash outflows as negative amounts. Balance Sheet Liabilities = + Stockholders' Equity + Income Statement Liabilities + Stockholders' Equity + Income Statementarrow_forwardPlease do not give solution in image format ? And Fast Answering Please And Explain Proper Step by Step.arrow_forwardc. Of the above accounts, $5,000 is determined to be specifically uncollectible. Prepare the journal entry to write off the uncollectible account. (Disregard the date.) Date Description Date d. The company collects $5,000 subsequently on a specific account that had previously been determined to be uncollectible in (c). Prepare the journal entry(ies) necessary to restore the account and record the cash collection. (Disregard the date.) Description Debit Debit Credit Creditarrow_forward

- Please help which option is the correct onearrow_forwardAre there any regulations or procedures in place for source documentation and receipts for payments or purchases made by the nonprofit organization? Is it any difference whether you pay with petty cash, a cheque, or a credit card?arrow_forwardWhich of the following is not considered an effective cash management strategy? Multiple Choice Planning expenditures. Delaying payment of liabilities until the last possible day. Retaining excess cash for unexpected expenditures. Keeping only necessary assets. Encouraging collection of receivables by offering discounts for early payments.arrow_forward

- Manitoba Exporters Inc. (MEI) sells Inuit carvings to countries throughout the world. On December 1, Year 5, MEI sold 13,000 carvings to a wholesaler in a foreign country at a selling price of 650,000 foreign currency units (FCs) when the spot rate was FC1 = $0.758. The invoice required the foreign wholesaler to remit by April 1, Year 6. On December 3, Year 5, MEI entered into a forward contract with the Royal Bank at the 120-day forward rate of FC1 = $0.798 and the spot rate was still FC1 = $0.758. The fiscal year-end of MEI is December 31, and on this date the spot rate was FC1 = $0.774 and the forward rate was FC1 = $0.810. The payment from the foreign customer was received on April 1, Year 6, when the spot rate was FC1 = $0.819. Assume that MEI uses hedge accounting. Also, assume that the forward element and spot elements on the forward contract are accounted for separately. Required: (a) Prepare the journal entries for the below items assuming that MEI designates the forward…arrow_forward2. Fill in all of the blanksarrow_forwardCarmen is making an interbank transfer of $1,500 from Bank A to Bank B to cover an overdraft. What is the effect of entering this transaction in Transfer within QuickBooks? Select an answer: It records the transfer she made. It instructs Bank A to transfer the funds. It informs Bank B that the funds are on the way.arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward3) If the client refuses to make the journal entries you have outlined on the Cash Lead Sheet, and materiality is $1,000 for this client, would you conclude that Cash is fairly stated at the amount shown on the trial balance? Why or why not?arrow_forwardMatching Question Match the banking term on the left with its definition on the right. Drag and drop application. Deposit ticket Deposit ticket drop zone empty. Check Check drop zone empty. Bank account Bank account drop zone empty. Remittance advice Remittance advice drop zone empty. Electronic funds transfer Electronic funds transfer drop zone empty. Lists currency, coins and checks deposited into an account Explains the reason for payment Used to deposit money for safekeeping and help control withdrawals. A document signed by the depositor instructing the bank to pay a specified amount of money Electronic transfer of cash from one party to anotherarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education