FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please don't provide answer in image format thank you

Transcribed Image Text:The amount of Cash and Cash Equivalents reported on December 31, 2020

$

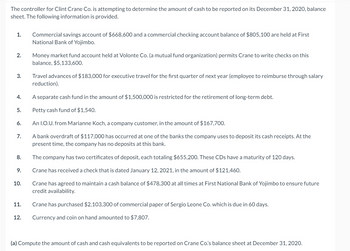

Transcribed Image Text:The controller for Clint Crane Co. is attempting to determine the amount of cash to be reported on its December 31, 2020, balance

sheet. The following information is provided.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

Commercial savings account of $668,600 and a commercial checking account balance of $805,100 are held at First

National Bank of Yojimbo.

Money market fund account held at Volonte Co. (a mutual fund organization) permits Crane to write checks on this

balance, $5,133,600.

Travel advances of $183,000 for executive travel for the first quarter of next year (employee to reimburse through salary

reduction).

A separate cash fund in the amount of $1,500,000 is restricted for the retirement of long-term debt.

Petty cash fund of $1,540.

An I.O.U. from Marianne Koch, a company customer, in the amount of $167,700.

A bank overdraft of $117,000 has occurred at one of the banks the company uses to deposit its cash receipts. At the

present time, the company has no deposits at this bank.

The company has two certificates of deposit, each totaling $655,200. These CDs have a maturity of 120 days.

Crane has received a check that is dated January 12, 2021, in the amount of $121,460.

Crane has agreed to maintain a cash balance of $478,300 at all times at First National Bank of Yojimbo to ensure future

credit availability.

Crane has purchased $2,103,300 of commercial paper of Sergio Leone Co. which is due in 60 days.

Currency and coin on hand amounted to $7,807.

(a) Compute the amount of cash and cash equivalents to be reported on Crane Co.'s balance sheet at December 31, 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Not a previously submitted question. Thank youarrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardPlease provide only typed answer solution no handwritten solution needed allowed... Please do it neat and clean correctly.arrow_forward

- This question has not been submitted previously. Thank youarrow_forwardLutoSave 日 Off UnitlILabAssignment_Question1 O Search (Alt-Q) Protected View Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing fx Formula: Multiply, Subtract; Cell Referencing A D E F G H. K Formula: Multiply, Subtract; Cell Referencing Using Excel to Record Stock Entries Student Work Area PROBLEM Required: Provide input into cells shaded in yellow in this template. Select account names from the drop-down lists. Use cell references to the data area. Use mathematical formulas to calculate any amounts not given. On May 10, Jack Corporation issues common stock for cash. Shares of stock issued Par value per share 2,000 24 %24 10.00 Amount at which stock issued 18.00 Journalize the issuance of the stock. 10 11 Date Debit Credit 12 May 10 13 14 15 16 17 18 19 20 21 22 23 25 26 27 28 29 30 31 32 33 Enter Answer Ready 24arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education