FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

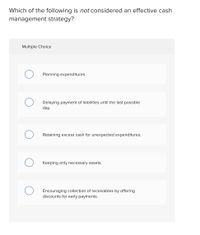

Transcribed Image Text:Which of the following is not considered an effective cash

management strategy?

Multiple Choice

Planning expenditures.

Delaying payment of liabilities until the last possible

day.

Retaining excess cash for unexpected expenditures.

Keeping only necessary assets.

Encouraging collection of receivables by offering

discounts for early payments.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- What is the purpose of setting up a petty cash fund? Select one: O O a. to allow cash for personal use b. to pay for all expenses c. to pay for regular operating expenses d. to pay for small, incidental expensesarrow_forward9. 2S within the central Arizona area. a. Which of the following represents a correct statement concerning the risk of misappropriation of cash for SSC? Multiple Choice This is not a major concern because sales are made on credit. Deposit of cash into a lockbox system decreases the risk of misappropriation. Misappropriation of cash is not a significant problem in a commercial company. The success of QSand increases the risk that cash will be misappropriated. Presentation se....pdf Untitled docume..pdf Untitled docume....pdf Untitled do MacBook Air 02 F3 D0O F4 000 F2 888 F5 F6 114 DEOEarrow_forwardHigh level cash management strategies include a.petty cash b.delaying payment for suppliers c.cash over and short d.bank reconciliationsarrow_forward

- Which of the following is NOT an advantage of depositing funds into a bank account (compared to directly purchasing corporate bonds and shares): Options 1. Higher transactions costs 2. Monitoring performed by the bank on behalf of the depositor 3. Better liquidity if funds are needed quickly 4. Efficient payment services 5.Reduced price risk if funds are needed immediatelyarrow_forwardIndicate whether the following statements are true or false. A guideline for safeguarding cash is to separate the duties of those who have custody of cash from this who keep cash records. Choose... + A guideline for safeguarding cash is that all cash receipts be deposited monthly or yearly. Choose... Separation of duties eliminates the possibility of collusion to steal an asset and hide the theft from the records. Choose... + A voucher system of control is a control system exclusively for cash receipts Choose...arrow_forwardWhich of the following does not show good cash management regarding the controls over cash disbursements? Use a petty cash fund to make only small expenditures. Make all major disbursements by check. Combine the handling of receiving bills, writing checks, and signing checks to one person. Prepare bank reconciliations in a timely manner. All the above shows good cash management controls over cash disbursements. A. В. C. D. E.arrow_forward

- Which type of information asymmetry explains why bad credit risks are more likely to seek bank loans? A. Moral hazard B. Adverse selection C. Principal-agent problemarrow_forwardWhy is not a bad thing to have negative cash from financing activities?arrow_forwardAssess the following statement as true or false. Enter T for true or F for false. 1. 2. 3. 4. Bank reconciliation is one of documentation procedure control. A cash budget contributes to more effective internal control. of segregation of duties. 5. to apply. Allow only one check signer has access to cash recording is an example The assumption of inventory method (i.e. FIFO etc.) may not match the physical flow of goods. Technology has make the perpetual inventory more popular and easierarrow_forward

- E8B. ACCOUNTING CONNECTION Developing a convenient means of reimbursing sales representatives with cash for their incidental expenses, such as for meals and supplies, is a problem many companies face. Under one company's plan, the sales representatives submit the receipts for reimbursement to the petty cash custodian. The representative then receives cash from the petty cash fund. What is the weak point in this system? What fundamental principle of internal con- trol is being ignored? What improvement in the procedure can you suggest?arrow_forwardExplain the primary goal of maintaining a cash book. Use a case study company of your own choice to demonstrate how such a goal (Your arguments must only relate to the main goal of a cash book) can be attained. Provide examples as approperiate Clearly explain how a cash book can be integrated in the extraction/development of the Trial Balance. Are trade discounts included in the cash book? If not or if yes, explain why Are credit transactions included in the cash book? If not or if yes, explain why Ledgers help to organize accounting information into categories normally known as ‘’classes’’. With examples explain the nature and differences between revenue and capital ledgers Using two revenue and capital ledgers, explain how you will treat them in the trial balance. Explain the treatment of the proprietor’s additional contribution to an already existing business. In addition, explain the underlying accounting principle you will apply in answering this question. Thames Cotton Mills…arrow_forwardThe Cash Over and Short account: Multiple Choice Is used to record the income effects of cash overages and cash shortages. Is not necessary in a computerized accounting system. Can never have a credit balance. Is used when the cash account reports a credit balance. Can never have a debit balance.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education