FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

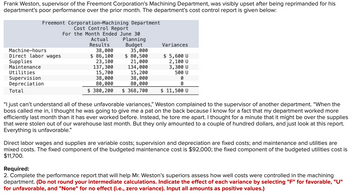

Transcribed Image Text:Frank Weston, supervisor of the Freemont Corporation's Machining Department, was visibly upset after being reprimanded for his

department's poor performance over the prior month. The department's cost control report is given below:

Freemont Corporation-Machining Department

Cost Control Report

For the Month Ended June 30

Machine-hours

Direct labor wages

Supplies

Maintenance

Utilities

Supervision

Depreciation

Total

Actual

Results

38,000

$ 86,100

Planning

Budget

35,000

$ 80,500

21,000

134,000

Variances

$ 5,600 U

2,100 U

3,300 U

500 U

23, 100

137,300

15,700

38,000

80,000

$ 380,200 $ 368,700 $ 11,500 U

15,200

38,000

80,000

0

0

"I just can't understand all of these unfavorable variances," Weston complained to the supervisor of another department. "When the

boss called me in, I thought he was going to give me a pat on the back because I know for a fact that my department worked more

efficiently last month than it has ever worked before. Instead, he tore me apart. I thought for a minute that it might be over the supplies

that were stolen out of our warehouse last month. But they only amounted to a couple of hundred dollars, and just look at this report.

Everything is unfavorable."

Direct labor wages and supplies are variable costs; supervision and depreciation are fixed costs; and maintenance and utilities are

mixed costs. The fixed component of the budgeted maintenance cost is $92,000; the fixed component of the budgeted utilities cost is

$11,700.

Required:

2. Complete the performance report that will help Mr. Weston's superiors assess how well costs were controlled in the machining

department. (Do not round your intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, "U"

for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You mention changes and revisions to the standard cost systems. If you were the Operations manager of a manufacturing firm, what control would you have in place to assure those changes were proper and accurate? What assertions would apply here?arrow_forwardPlease help me with the functions needed to populate the correct answers in the highlighted areas. Thank you! Accessibility tab summary: Financial information for Patterson Incorporated, is presented in cells A4 to G14 and rows 16 to 17. A statement of requirement is presented in rows 19 to 24. A table for Standard Cost Variance Analysis - Direct Materials for student presentation is presented in cells A26 to B29 and A31 to C32. A table for Standard Cost Variance Analysis - Variable Manufacturing Overhead for student presentation is presented in cells A43 to B45 and A47 to C48. A statement of requirement is presented in row 50. A table for student presentation is presented in cell A52 to E62. Standards for one of Patterson, Inc.'s products is shown below, along with actual cost data for the month: Direct materials: Standard 2.4 yards @ $2.75 per yard $6.60 Actual 3.0 yards @ $2.70 per yard $8.10 Direct…arrow_forwardBest, Inc. uses a standard cost system and provides the following information. (Click the icon to view the information.) variable overhead, $3,800; actual fixed overhead, $3, 500; actual direct labor hours, 1,400. Read the requirements. Data table Requirement 1. Compute the variable overhead cost and efficiency variances and fixed overhead cost and volume variances. Begin with the variable overhead cost and efficiency variances. Select the required formulas, compute the variable overhead cost and favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ = actual quantity; FOH = fixed overhead; SC = standardco \table [[,, Formula,Variance], [VOH cost variance, = , 1 = , ], [VOH efficiency variance, =,1 =, 0arrow_forward

- Standard Costing, Ethical Behavior, Usefulness of Costing Pat James, the purchasing agent for a local plant of the Oakden Electronics Division, was considering the possible purchase of a component from a new supplier. The component’s purchase price, $0.90 compared favorably with the standard price of $1.10. Given the quantity that would be purchased, Pat knew that the favorable price variance would help to offset an unfavorable variance for another component. By offsetting the unfavorable variance, his overall performance report would be impressive and good enough to help him qualify for the annual bonus. More importantly, a good performance rating this year would help him to secure a position at division headquarters at a significant salary increase. Purchase of the part, however, presented Pat with a dilemma. Consistent with his past behavior, Pat made inquiries regarding the reliability of the new supplier and the part’s quality. Reports were basically…arrow_forward[1] The purpose of identifying manufacturing variances and assigning their responsibility to a person/department should be to A. Trace the variances to finished goods so that the inventory can be properly valued at year-end. B. Determine the proper cost of the products produced so that selling prices can be adjusted accordingly. C. Use the knowledge about the variances to promote learning and continuous improvement in the manufacturing process D. Pinpoint fault for operating problems in the organization.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Identifying favorable and unfavorable variances. Tred-America, Inc., manufactures tires for large auto companies. It uses standard costing and allocates variable and fixed manufacturing overhead based on machine-hours. For each independent scenario given, indicate whether each of the manufacturing variances will be favorable or unfavorable or, in case of insufficient information, indicate "CBD" (cannot be determined). Fixed Variable Variable Fixed Overhead Overhead Overhead Overhead Production- Spending Efficiency Variance Spending Variance Volume Scenario Variance Variance Production output is 8% more than budgeted, and actual fixed manufacturing overhead costs are 7% less than budgeted Production output is 11% more than budgeted; actual machine-hours are 5% less than budgeted Production output is 15% less than budgeted Actual machine-hours are 18% greater than flexible-budget machine-hours Relative to the flexible budget, actual machine-hours are 10% greater, and actual variable…arrow_forwardPlease provide solution as same format in question. Thanks.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Standard Costing and Variance Analysis Standard cost systems set budgets for the materials, labor, and factory overhead used by a manufacturer to produce its product. Deviations from these standards are reported as variances.. Standards-variance analysis cost control system can be applied to non-manufacturing businesses, provided that they use repetitive activities to produce a common product or service. Based on real-life experience, describe and discuss a non-manufacturing (service) business that could benefit from the use of standards. Also explain how standards would help that business control its operations.arrow_forwardPlease Explain Proper Step by Step and Do Not Give Solution In Image Format And Fast Answering Please Thanks In Advance ?arrow_forwardPlease answer complete question, with working,,,,, Please provide answer in text (Without image)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education