FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

Please do not give solution in image format ?

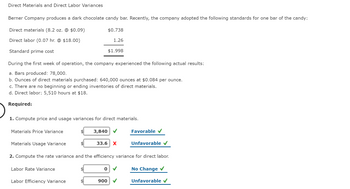

Transcribed Image Text:Direct Materials and Direct Labor Variances

Berner Company produces a dark chocolate candy bar. Recently, the company adopted the following standards for one bar of the candy:

Direct materials (8.2 oz. @ $0.09)

Direct labor (0.07 hr. @ $18.00)

Standard prime cost

Materials Price Variance

During the first week of operation, the company experienced the following actual results:

a. Bars produced: 78,000.

b. Ounces of direct materials purchased: 640,000 ounces at $0.084 per ounce.

c. There are no beginning or ending inventories of direct materials.

d. Direct labor: 5,510 hours at $18.

Required:

$0.738

1. Compute price and usage variances for direct materials.

3,840

Labor Efficiency Variance

1.26

$1.998

0

Materials Usage Variance

2. Compute the rate variance and the efficiency variance for direct labor.

Labor Rate Variance

No Change ✓

33.6 X

900

Favorable ✔

Unfavorable ✓

Unfavorable ✓

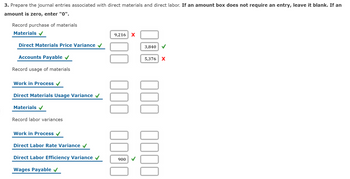

Transcribed Image Text:3. Prepare the journal entries associated with direct materials and direct labor. If an amount box does not require an entry, leave it blank. If an

amount is zero, enter "0".

Record purchase of materials

Materials

Direct Materials Price Variance

Accounts Payable

Record usage of materials

Work in Process

Direct Materials Usage Variance

Materials ✔

Record labor variances

Work in Process

Direct Labor Rate Variance

Direct Labor Efficiency Variance

Wages Payable ✔

9,216 X

000 0000

3,840

5,376

000 0000

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education