FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

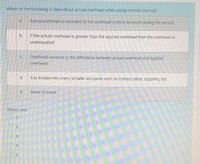

Transcribed Image Text:Which of the following is false about actual overhead while using normal costing?

a.

Actual overhead is recorded to the overhead control account during the period.

b.

If the actual overhead is greater than the applied overhead then the overhead is

underapplied

Overhead variance is the difference between actual overhead and applied

C.

overhead.

d.

It is divided into many smaller accounts such as indirect labor, supplies, etc.

е.

None of these.

Select one:

O c

O d

O a

O e

O b

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain:: What is the purpose of an overhead rate What are the steps to apply the overhead cost to a product What does it represent when the overhead cost for over-appliedarrow_forwardWhich costing system would be more efficient when direct materials and direct labor costs are high, and overhead costs are low?arrow_forwardWhat would cost of good sold be if under or overapplied overhead were closed to cost of goods sold?arrow_forward

- Discuss how traditional methods of allocating overhead to products may not provide a good measure of overhead resources used. How might activity based costing overcome these limitations?arrow_forwardProvide two reasons for an outdated costing system.arrow_forwardIn activity-based costing, some manufacturing costs may be excluded from product costsTRUEFALSEarrow_forward

- If the actual overhead costs incurred are in excess of the applied overhead costs, the difference is called what? a) Predetermined overhead rate b) Underapplied overhead c) Overapplied overhead d) Gross marginarrow_forwardWhy functional (or volume)- based costing approaches may produce distorted costs.arrow_forwardWhat are the advantages and disadvantages of Standard costing system when the labor rate us fixed?arrow_forward

- *Question:** Which method is commonly used in accounting to compare actual costs with standard costs and analyze variances? a) Activity - based costing b) Absorption costing c) Standard costing d) Marginal costingarrow_forwardSince overhead costs are indirect costs, Group of answer choices they require some process of allocation. they can be easily traced to production. they cannot be allocated. a predetermined overhead rate is not advantageous.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education