FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

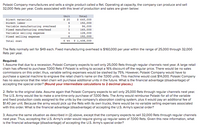

Transcribed Image Text:Polaski Company manufactures and sells a single product called a Ret. Operating at capacity, the company can produce and sell

32,000 Rets per year. Costs associated with this level of production and sales are given below:

Unit

Total

$ 20

$ 640,000

192,000

Direct materials

Direct labor

6

Variable manufacturing overhead

Fixed manufacturing overhead

Variable selling expense

3

96,000

160,000

128,000

192,000

4

Fixed selling expense

6

Total cost

$ 44

$ 1,408,000

The Rets normally sell for $49 each. Fixed manufacturing overhead is $160,000 per year within the range of 25,000 through 32,000

Rets per year.

Required:

1. Assume that due to a recession, Polaski Company expects to sell only 25,000 Rets through regular channels next year. A large retail

chain has offered to purchase 7,000 Rets if Polaski is willing to accept a 16% discount off the regular price. There would be no sales

commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have to

purchase a special machine to engrave the retail chain's name on the 7,000 units. This machine would cost $14,000. Polaski Company

has no assurance that the retail chain will purchase additional units in the future. What is the financial advantage (disadvantage) of

accepting the special order? (Round your intermediate calculations to 2 decimal places.)

2. Refer to the original data. Assume again that Polaski Company expects to sell only 25,000 Rets through regular channels next year.

The U.S. Army would like to make a one-time-only purchase of 7,000 Rets. The Army would reimburse Polaski for all of the variable

and fixed production costs assigned to the units by the company's absorption costing system, plus it would pay an additional fee of

$1.40 per unit. Because the army would pick up the Rets with its own trucks, there would be no variable selling expenses associated

with this order. What is the financial advantage (disadvantage) of accepting the U.S. Army's special order?

3. Assume the same situation as described in (2) above, except that the company expects to sell 32,000 Rets through regular channels

next year. Thus, accepting the U.S. Army's order would require giving up regular sales of 7,000 Rets. Given this new information, what

is the financial advantage (disadvantage) of accepting the U.S. Army's special order?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Zozan Corp. manufactures Hydrogen engines automobiles. Recently 450 new orders placed by customers requesting credit. The variable cost is $35,000 per unit, and the credit price is $43,000 each. Credit is extended for one period, and based on historical experience, payments for 20% of the orders are never collected. The required return is 4% per period. Assuming a repeat customer, should it be filled by the firm? The customer will not buy if credit is not extendedarrow_forward11) Istanbul Company currently sells cellphones for $500. It has costs of $320. A competitor is bringing a new cell phone to market that will sell for $430. Management believes it must lower the price to $430 to compete in the market for cell phones. Marketing believes that the new price will cause sales to increase by 10%, even with a new competitor in the market. Istanbul Company sales are currently 100,000 cell phones per year. What is the target cost if the company wants to maintain its same income level, and marketing is correct (rounded to the nearest cent)? A) $224.00 B) $238.18 C) $266.38 D) $290.00 E) $311.00arrow_forwardOrange Computer decides to sell a new line of foldable smartphones. The phones will sell for $965 per unit with variable cost of $487 per device. The company has spent $840,000 for a marketing study that determined the company will sell 94,000 new generation foldable handsets per year for seven years. The marketing study also determined that the company will lose sales of 9,300 units per year of its prior generation, but larger screen sized handsets. The prior generation, larger screen handsets sell for $1,395 and have variable costs that are 51.25% of the selling price. The company will also increase sales of Its companion watch by 12,200 per year. The watch sells for $396 and has variable costs of $183 of total selling price. The fixed cost for the company each year is $15,750,000. The company has already spent $1,600,000 on research and development for the new gadgets. The plant and equipment required will cost $59,100,000 and will be depreciated on a straight-line basis to zero.…arrow_forward

- Answer full questionarrow_forward25) Can i get help with this question pleasearrow_forwardMcGilla Golf is evaluating a new golf club. The clubs will sell for $1,060 per set and have a variable cost of $480 per set. The company has spent $172,500 for a marketing study that determined the company will sell 53,500 sets per year for seven years. The marketing study also determined that the company will lose sales of 10,100 sets of its high-priced clubs. The high-priced clubs sell at $1,560 and have variable costs of $690. The company also will increase sales of its cheap clubs by 12,700 sets. The cheap clubs sell for $480 and have variable costs of $210 per set. The fixed costs each year will be $9,950,000. The company has also spent $1,325,000 on research and development for the new clubs. The plant and equipment required will cost $33,250,000 and will be depreciated on a straight-line basis to a zero salvage value. The new clubs also will also require an increase in net working capital of $2,710,000 that will be returned at the end of the project. The tax rate is 23 percent…arrow_forward

- Totally Tanked, Inc. sells tank tops. The firm is considering making some changes in order to achieve its goal of increasing its profit.If it makes no changes, the company anticipates the following for the coming year. Maria, one of the company’s managers suggests the following: “I think if we cut our price to $17 a tank top, we will increase our sales to 3,700,000 tank tops. I think that will help us achieve our goal” Question: Mr. Big, the CEO, upon hearing Maria’s plan says “This is great! We should go forward with your plan since we will increase sales by 700,000 tank tops.” How would you answer Mr. Big? # of tank tops to be sold 3,000,000 Selling price per tank top $20 Variable expense per tank top $8 Fixed expenses for the year $20,000,000arrow_forwardIn an attempt to improve the company's profit performance, management is considering a number of alternative actions.Instructions:Determine the effect of each of the following on monthly profits. Each situation is to beevaluated independently of all others.1.Reduce the unit selling price by P2 per unit. Action will increase monthly sales by20,000 units. Fixed factory overhead will increase by P16,000.arrow_forward2. Company XYZ sells CDs. The price of its new CD is $15. Fixed costs are $1,500,000 per year. Variable costs are $9. The company expects to sell 300,000 units this year. a. How many DVDS will the company need to sell to break even? b. If the forecasts are correct, how much will company XYZ make or lose this year (before taxes)?arrow_forward

- Assume the company expects to sell 5 million packages ofPop-Tarts Gone Nutty! in the first year after introductionglobally, but expects that 80 per cent of those sales willcome from buyers who would normally purchase existingPop-Tart flavours (that is, they will be cannibalised sales).Assuming the sales of regular Pop-Tarts are normally 300million packs per year and that the company will incur anincrease in fixed costs of €500,000 during the first year tolaunch Gone Nutty!, will the new product be profitable for the company? Refer to the discussion of cannibalisa-tion in Appendix 2: Marketing by the Numbers for an ex-planation regarding how to conduct the analysisarrow_forwardSelena Corporation is currently considering relaxing its credit standards. Based on the analysis done, relaxing credit standard will potentially increase sales by 5%. Selena Corporation is currently selling 400 units with selling price of P700. Variable costs per unit based on status quo is at P400. The average total cost per unit is P425. What is the additional profit contribution from sales if credit standards are relaxed?arrow_forwardGolden Gate Novelties (GGN) sells souvenir key chains at the local airport. GGN charges $12.00 per chain. The variable cost for a chain, including the wholesale cost of the chain, packaging, the commission paid to the airport operator, and so on, is $10.40. The annual fixed cost for GGN is $15,000. Required: a. How many cases must Golden Gate Novelties sell every year to break even? Note: Do not round intermediate calculations. b. The owner of GGN believes that the company can sell 12,500 chains a year. What is the margin of safety in terms of the number of chains? a. Break-even point b. Margin of safety chains chainsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education