FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

§1231 Netting Process

:§1231 gain

§1231 loss

Net §1231 gain

Nonrecaptured §1231 losses

Net §1231 gain

Ordinary Income:

§1245 recapture

§291 recapture

Ordinary income

Ordinary loss

Ordinary income from §1231 netting

TotalCapital Gains and Losses:

Capital gainCapital loss

Net

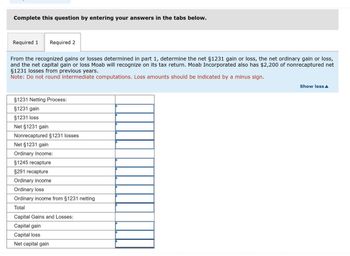

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1

Required 2

From the recognized gains or losses determined in part 1, determine the net §1231 gain or loss, the net ordinary gain or loss,

and the net capital gain or loss Moab will recognize on its tax return. Moab Incorporated also has $2,200 of nonrecaptured net

§1231 losses from previous years.

Note: Do not round intermediate computations. Loss amounts should be indicated by a minus sign.

§1231 Netting Process:

§1231 gain

§1231 loss

Net §1231 gain

Nonrecaptured §1231 losses

Net §1231 gain

Ordinary Income:

§1245 recapture

$291 recapture

Ordinary income

Ordinary loss

Ordinary income from §1231 netting

Total

Capital Gains and Losses:

Capital gain

Capital loss

Net capital gain

Show less▲

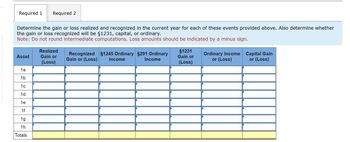

Transcribed Image Text:Required 1

Required 2

Determine the gain or loss realized and recognized in the current year for each of these events provided above. Also determine whether

the gain or loss recognized will be §1231, capital, or ordinary.

Note: Do not round intermediate computations. Loss amounts should be indicated by a minus sign.

Asset

Realized

Gain or

Recognized

Gain or (Loss)

§1245 Ordinary §291 Ordinary

Income

Income

(Loss)

§1231

Gain or

(Loss)

Ordinary Income

or (Loss)

Capital Gain

or (Loss)

1a

1b

1c

1d

1e

1f

1g

1h

Totals

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 14, please answer last part. thanks please pick from the follow accounts: Accumulated Other Comprehensive Income Allowance for Investment Impairment Bond Investment at Amortized Cost Cash Commission Expense Dividends Receivable Dividend Revenue FV-NI Investments FV-OCI Investments Gain on Disposal of Investments - FV-NI Gain on Disposal of Investments - FV-OCI Gain on Sale of Investments GST Receivable Interest Expense Interest Income Interest Payable Interest Receivable Investment in Associate Investment Income or Loss Loss on Discontinued Operations Loss on Disposal of Investments FV-NI Loss on Disposal of Investments FV-OCI Loss on Impairment Loss on Sale of Investments No Entry Note Investment at Amortized Cost Other Investments Recovery of Loss from Impairment Retained Earnings Unrealized Gain or Loss Unrealized Gain or Loss - OCIarrow_forwardchoose from the following accounts: Accumulated Other Comprehensive Income Allowance for Investment Impairment Bond Investment at Amortized Cost Cash Commission Expense Dividends Receivable Dividend Revenue FV-NI Investments FV-OC|Investments Gain on Disposal of Investments - FV-NI Gain on Disposal of Investments - FV-OCI Gain on Sale of Investments GST Receivable Interest Expense Interest Income Interest Payable Interest Receivable Investment in Associate Investment Income or Loss Loss on Discontinued Operations Loss on Disposal of Investments FV-NI Loss on Disposal of Investments FV-OCI Loss on Impairment Loss on Sale of Investments No Entry Note Investment at Amortized Cost Other Investments Recovery of Loss from Impairment Retained Earnings Unrealized Gain or Loss Unrealized Gain or Loss - OCIarrow_forwardInterest earned on only the original principal amount invested is: Select one: a. Beginning interest b. Accumulated interest c. Simple interest d. Present value interestarrow_forward

- Which of the following is a current asset? Question 3 options: goodwill prepaid expenses accrued liabilities deferred revenuearrow_forwardvi.2arrow_forwardWhich of the following items affect taxable income? Select one or more: a. Realized Gains and Losses b. Unrealized Gains and Losses c. Interest Income PreviousSave AnswersFinish attempt ...arrow_forward

- 25. A parent company’s investment account would include an element which is representative of : Multiple Choice the unrecorded difference between fair value and book value of the investee’s assets. the unrecorded book value of the investor’s assets. the goodwill accrued since the purchase of the investee. the recorded current value of the investee’s assets.arrow_forward(CO 3) Which of the following statements is true concerning an intra-entity transfer of a depreciable asset? Group of answer choices Net income attributable to the non-controlling interest is never affected by a gain on the transfer. Net income attributable to the non-controlling interest is always affected by a gain on the transfer. Net income attributable to the non-controlling interest is affected by a downstream gain only Net income attributable to the non-controlling interest is affected only when the transfer is upstream. Net income attributable to the non-controlling interest is increased by an upstream gain in the year of transfer.arrow_forwardWhich of the following is not a from AGI deduction? A. The exclusion of an item of gross income B. Itemized deductions, if taken C. Standard deduction, if taken D. The qualified business income deductionarrow_forward

- How should negative goodwill be shown on the consolidated financial statements of the acquirer? Group of answer choices As a liability on the statement of financial position As a loss on the statement of comprehensive income As a separate amount under shareholders' equity on the statement of financial position As a gain on the statement of comprehensive incomearrow_forwardGains and Losses results from realization events such as: a. sales, purchases, exchanges, or other disposition of property. b. sales, exchanges, or other disposition of property. c. Disposition , sales and donations. d. all of the above.arrow_forward_______ 9. Which of the following constitute property for purposes of §351 Money Debt of Transferee evidenced by a security Debt of Transferee NOT evidenced by a security Interest accrued on b & c after the Transferor acquired the debt Only A Only A & B Only A, B, & d All of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education