FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

first image contains the general information. please answer number 7-9 only thank you

Transcribed Image Text:Activity 1- ACCHT 221 - RECORDING TRANSACTIONS ; POSTING TO LEDGER AND PREPARATION OF TRIAL BALANCE

Remy opened her Tours4Fun business. During the first month, January, she completed the following transactions:

Began business by investing cash of P300,000 a office equipment valued at P40,000, shop furniture worth

P 65,000.

Paid rent for the month, P20,000.

Bought additional office equipment from Kapamilya Store on credit, P25,000.

a.

b.

C.

Bought shop supplies for cash P8,000.

Received P20,000 from Sally for passporting services rendered.

Purchased another office equipment for cash for P18,000.

Completed work for Novy on credit, at P38,000.

Paid telephone and internet services worth P5,200.

Paid Kapamilya store in full.

Recelved cash from customers for services rendered worth P24,000.

Received P18,000 from Novy as partial payment of the amount she owes the Tours4Fun.

Paid the salary of the office staff, P15,000.

Bought another shop furniture worth P10,000 on credit.

Miscellaneous expenses paid during the month were paid worth P27,000.

d.

e.

f.

8.

h.

1.

J.

k.

1.

m.

n.

Using the following Account Titles, answer the questions found in the attached google forms.

ACCOUNT TITLES:

Cash

Accounts receivable

Shop supplies

Office equipment

Shop furniture

Accounts payable

Remy, capital

Service revenue

Rent expense

Telephone and wifi expense

Salary expense

Miscellaneous expense

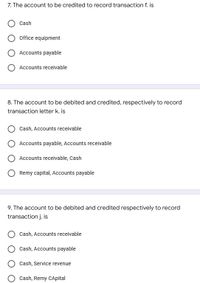

Transcribed Image Text:7. The account to be credited to record transaction f. is

Cash

Office equipment

Accounts payable

Accounts receivable

8. The account to be debited and credited, respectively to record

transaction letter k. is

Cash, Accounts receivable

Accounts payable, Accounts receivable

Accounts receivable, Cash

Remy capital, Accounts payable

9. The account to be debited and credited respectively to record

transaction j. is

Cash, Accounts receivable

Cash, Accounts payable

Cash, Service revenue

Cash, Remy CApital

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How would you interpret this formula: 'Income Statement' ! C5 Ocell C5 from the Income Statement named cell in the current work sheet O cell C5 from the Income Statement tab in the work book O cell C5 from the named range of Income Statement in the file name cell from the file named Income Statement that is copied to C5arrow_forwardHistory Bookmarks Window Help A education.wiley.c WP NWP Assessment Player UI Application Question 18 of 42 View Policies Current Attempt in Progress The double-entry system requires that each transaction must be recorded in a journal and in a ledger. in two sets of books. first as a revenue and then as an expense. in at least two different accounts. Save for Laterarrow_forwardAnswer the following four questions asap pleasearrow_forward

- Assessment 2 - Word Safayet Hossen 困 File Home Insert Design Layout References Mailings Review View Help Tell me what you want to do & Share X Cut e Copy O Find Calibri (Body) -11 A A Aa v AaBbCcDd AaBbCcDd AaBbC AABBCCD AaB AaBbCcD AaBbCcDd AaBbCcDd AaBbCcDd ac Replace Paste BIU - abe X2 x A • aby v I Normal 1 No Spac.. Heading 1 Heading 2 Title Subtitle Subtle Em... Emphasis * Format Painter Clipboard Font Paragraph Styles R Clementine bought the following assets on 1 June 2016, and sold them on the 30th of June 2020: % Roshan DAS I Item Purchase Price Sale Price sonu(k180557) ABC Shares $1,915,000 $1,900,000 Rare Coin $30,000 $32,000 Television $20,500 $18,500 H Sail Boat $10,250 $30,002 % Ha My DANG Portrait by a famous artist $15,000 $11,000 Required: Calculate Clementine's Net Capital Gain or Loss for the 2020 tax year. All calculations must be shown and explanations provided. Z Puja THAGUNNA Mohamed Zafit... ABC Shares: ($15,000) Capital Loss Rare Coin: $2,000 Capital Gain…arrow_forwardome File Edit View History Bookmarks Tab Profiles Window Help ojs-Google Search X WiConnect - Home X M Question 1- Chapter 1 Home x M Reading Mode: Fundamentals x + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fbb.mwcc.edu%252Fwe... apter 1 Homework Saved 2 pints 1 Exercise 1-1 (Algo) Classifying activities reflected in the accounting system LO C1 Select the aspect of accounting associated with the following activities. Activities eBook Ask Print References 1. Measuring revenue from a holiday sale. 2. Measuring the costs of a product. 3. Inputting an employee sales commission. 4. Registering cash sales of products sold. 5. Presenting financial information. 6. Observing transactions and events. 7. Reporting the profitability of a product line. 8. Measuring shipping costs. Mc Graw Hill 11501 MAY 20 Aspects of Accounting Recording tv A Aaarrow_forwardAI - E H E AutoSave Normal Document1 - Word Search badiya aldujaili ff BА EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut Calibri (Body) 11 - A A Aav A E E AaBbCcDc AaBbCcDc AaBbC AABBCCC AaB AAB6CCC AaBbCcDa O Find - A Copy Paste S Replace В IUvab х, х* А I Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em.. A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 1. 2 4 7 Use the following information to answer the next 3 questions Kite Corp. manufactures custom cabinets and uses a job-order costing system. The company had two jobs in process at the beginning of October: Job No. 64 with a total beginning cost of $56,700 and Job No. 65 with a total beginning cost of $83,300. The company applies manufacturing overhead on the basis of machine hours. Budgeted overhead and machine activity for the year were anticipated to be $3,021,000 and 57,000 machine hours. The company worked on four…arrow_forward

- Hello question is attached, thanks.arrow_forwardplease explain step by steparrow_forwardSettings - Password Manager X mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddlewar... AF Prin X M Question 4 - Chapter 7, Assign X Maps O Porter's Five Forc... Assignment 2 i [The following information applies to the questions displayed below.j Leach Incorporated experienced the following events for the first two years of its operations. Year 1: 1. Issued $16,000 of common stock for cash. 2. Provided $84,600 of services on account. 3. Provided $42,000 of services and received cash. 4. Collected $75,000 cash from accounts receivable. 5. Paid $44,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 5 percent of the ending accounts receivable balance will be uncollectible. 7. Closed the revenue account. 8. Closed the expense accounts. Year 2: 1. Wrote off an uncollectible account for $950. 2. Provided $94,000 of…arrow_forward

- Please answer the questions after opening the attached screenshot! I need answers for the bold blank spaces you will see in the excel sheet.arrow_forwardJasmine Thompson AutoSave Document4 Word O Search B Share Comment File Insert Draw Design Layout References Mailings Review View Help Home O Find X Cut Calibri (Body) A A Aa A EE v E EE T AaBbCcDd AaBbCcDd AaBbC AABBCCC AaB AaBbCcD AaBbCcDd AaBbCcDd v 12 S Replace Dictate Editor Copy Paste Emphasis BIU ab x, x' A ~ A EEEE E - 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em... A Select V Format Painter Styles Editing Voice Editor Clipboard Font Paragraph 3 4 5. 6. 1 2. In Year 2, Chalon Company records the payment of $450 cash for an expense accrued in Year 1 and records the accrual of $425 for another expense. Additionally, Chalon Company pays $475 for supplies that were purchased in Year 1 on account. The impact of these three entries on Year 2 total expenses and total liabilities is: Total Expenses Liabilities a. increase by $425 decrease by $500 b. increase by $450 decrease by $25 c. increase by $425 increase by $25 d. increase by $900 decrease by $500 e. increase…arrow_forwardI have answered A-I in the pictures I posted below. I need the answers to J-L.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education