FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:le Chrome

File Edit View History

MInbox (228) - abigailoforiwaal X

Bookmarks

Profiles Tab

Window Help

M Gmail

xiConnect - Home

x

M Question 7 - Mid-Term Exam

wiL47988_xappA_A-

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... ☆

Mid-Term Exami

Saved

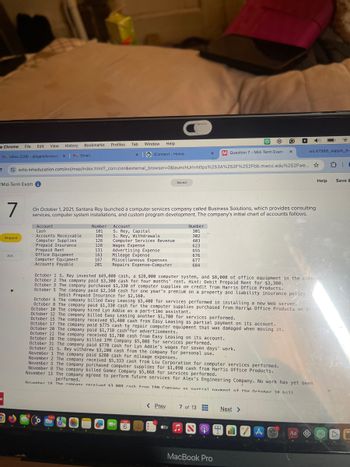

7

On October 1, 2021, Santana Rey launched a computer services company called Business Solutions, which provides consulting

services, computer system installations, and custom program development. The company's initial chart of accounts follows.

Account

Cash

Number

101

Account

Number

S. Rey, Capital

301

Accounts Receivable

Skipped

106

S. Rey, Withdrawals

302

Computer Supplies

126

Computer Services Revenue

403

Prepaid Insurance

128

Wages Expense

623

Prepaid Rent

131

Advertising Expense

655

Ask

Office Equipment

163

Mileage Expense

676

Computer Equipment

167

Miscellaneous Expenses

677

Accounts Payable

201

Repairs Expense-Computer

684

W

Help

Save &

October 1 S. Rey invested $49,000 cash, a $28,000 computer system, and $8,000 of office equipment in the company.

October 2 The company paid $3,300 cash for four months' rent. Hint: Debit Prepaid Rent for $3,300.

October 3 The company purchased $1,330 of computer supplies on credit from Harris Office Products.

October 5 The company paid $2,160 cash for one year's premium on a property and liability insurance policy.

Debit Prepaid Insurance for $2,160.

October 6 The company billed Easy Leasing $5,400 for services performed in installing a new Web server.

October 8 The company paid $1,330 cash for the computer supplies purchased from Harris Office Products on Octob

October 10 The company hired Lyn Addie as a part-time assistant.

October 12 The company billed Easy Leasing another $1,700 for services performed.

October 15 The company received $5,400 cash from Easy Leasing as partial payment on its account.

October 17 The company paid $775 cash to repair computer equipment that was damaged when moving it.

October 20 The company paid $1,718 cash for advertisements.

October 22 The company received $1,700 cash from Easy Leasing on its account.

October 28 The company billed IFM Company $5,808 for services performed.

October 31 The company paid $770 cash for Lyn Addie's wages for seven days' work.

October 31 S. Rey withdrew $3,200 cash from the company for personal use.

November 1 The company paid $280 cash for mileage expenses.

November 2 The company received $5,333 cash from Liu Corporation for computer services performed.

November 5 The company purchased computer supplies for $1,090 cash from Harris Office Products.

November 8 The company billed Gomez Company $5,868 for services performed.

November 13 The company agreed to perform future services for Alex's Engineering Company. No work has yet been

performed.

November 18 The company received 3 a08 cash from TFM Company as nartial navment of the October 28 hill

11811

6

< Prev

7 of 13

Next >

tv♫

MacBook Pro

AO

Aa

Transcribed Image Text:ogle Chrome

File

Edit View History

Bookmarks

Profiles Tab

Window Help

xiConnect - Home

x M Question 7 - Mid-Term Exam

×

C

M Inbox (228) - abigailoforiwaa x M Gmail

wiL47988

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... ☆

Mid-Term Exam i

Saved

Help

7

Skipped

Ask

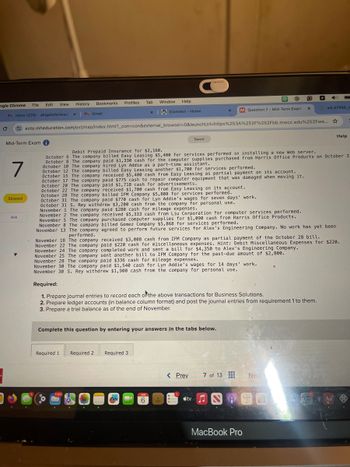

Debit Prepaid Insurance for $2,160.

October 6 The company billed Easy Leasing $5,400 for services performed in installing a new Web server.

October 8 The company paid $1,330 cash for the computer supplies purchased from Harris Office Products on October 3

October 10 The company hired Lyn Addie as a part-time assistant.

October 12 The company billed Easy Leasing another $1,700 for services performed.

October 15 The company received $5,400 cash from Easy Leasing as partial payment on its account.

October 17 The company paid $775 cash to repair computer equipment that was damaged when moving it.

October 20 The company paid $1,718 cash for advertisements.

October 22 The company received $1,700 cash from Easy Leasing on its account.

October 28 The company billed IFM Company $5,808 for services performed.

October 31 The company paid $770 cash for Lyn Addie's wages for seven days' work.

October 31 S. Rey withdrew $3,200 cash from the company for personal use.

November 1 The company paid $280 cash for mileage expenses.

November 2 The company received $5,333 cash from Liu Corporation for computer services performed.

November 5 The company purchased computer supplies for $1,090 cash from Harris Office Products.

November 8 The company billed Gomez Company $5,868 for services performed.

November 13 The company agreed to perform future services for Alex's Engineering Company. No work has yet been

performed.

November 18 The company received $3,008 cash from IFM Company as partial payment of the October 28 bill.

November 22 The company paid $220 cash for miscellaneous expenses. Hint: Debit Miscellaneous Expenses for $220.

November 24 The company completed work and sent a bill for $4,350 to Alex's Engineering Company.

November 25 The company sent another bill to IFM Company for the past-due amount of $2,800.

November 28 The company paid $336 cash for mileage expenses.

November 30 The company paid $1,540 cash for Lyn Addie's wages for 14 days' work.

November 30 S. Rey withdrew $1,900 cash from the company for personal use.

Required:

1. Prepare journal entries to record each of the above transactions for Business Solutions.

2. Prepare ledger accounts (in balance column format) and post the journal entries from requirement 1 to them.

3. Prepare a trial balance as of the end of November.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2 Required 3

11,811

JUN

6

< Prev

7 of 13

Next

tv

MacBook Pro

Aa

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Google Chrome File Edit View History Bookmarks Profiles Tab Window Help O Inbox (228) - X MACC101 Princ X (4726) IFRS V Accounting 10 x Accounting10 × M Question 5- X C C ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252 Saved Chapter 7 Homework i 5 Part 2 of 2 29.23 points eBook Print References Wiset Company completes these transactions during April of the current year (the terms of all its credit sales are 2/10, n/30). April 2 April 3 (a) April 3 (b) April 4 April 5 April 6 April 9 April 11 April 12 April 13 (a) April 13 (b) April 14 April 16 (a) April 16 (b) April 17 April 18 April 20 (a) April 20 (b) April 23 (a) April 23 (b) April 25 April 26 April 27 (a) Purchased $14,000 of merchandise on credit from Noth Company, terms 2/10, n/60. Sold merchandise on credit to Page Alistair, Invoice Number 760, for $8,000 (cost is $7,000). Purchased $1,570 of office supplies on credit from Custer, Incorporated, terms n/30. Issued…arrow_forwardGoogle Chrome File Edit View History Inbox (228)- X MACC101 Princ × Bookmarks Profiles Tab Window Help (4726) IFRS v Accounting10 x | Accounting10 X M Question 4- x Connect ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252... Q 0 Chapter 7 Homework Seved 4 Part 1 of 2 26.73 points eBook Ask Print References Mc Graw Hill Wiset Company completes these transactions during April of the current year (the terms of all its credit sales are 2/10, n/30). April 2 April 3 (a) April 3 (b) April 4 April 5 April 6 April 9 April 11 April 12 April 13 (a) Purchased $14,000 of merchandise on credit from Noth Company, terms 2/10, n/60. Sold merchandise on credit to Page Alistair, Invoice Number 760, for $8,000 (cost is $7,000). Purchased $1,570 of office supplies on credit from Custer, Incorporated, terms n/30. Issued Check Number 587 to World View for advertising expense of $913. Sold merchandise on credit to Paula Kohr, Invoice Number 761,…arrow_forwardme File Edit View History Bookmarks Profiles Tab Window Help box (240) - abigailoforiwaa x M Gmail x QuickLaunchSSO :: Single Sig X M Question 12 - Mid-Term Exam On Decembe ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Term Exam i 2 Saved Help The December 31, 2021, adjusted trial balance of Business Solutions (reflecting its transactions from October through December of 2021) follows. Number Account Title 101 Cash 106 Accounts receivable Ask 126 Computer supplies 128 Prepaid insurance 131 Prepaid rent 163 Office equipment 164 Accumulated depreciation-Office equipment 167 Computer equipment 168 Accumulated depreciation-Computer equipment 201 Accounts payable 210 Wages payable 236 Unearned computer services revenue 301 S. Rey, Capital 302 S. Rey, Withdrawals 403 612 Computer services revenue Depreciation expense-Office equipment 613 Depreciation expense-Computer equipment 623 Wages expense 637 Insurance expense…arrow_forward

- File Edit View History C Bookmarks Profiles Tab Window Help Netflix 120 Inbox (X MACC10 × Accoux Accour X M Questi X QuickLxM Questi x M Questi x wiL47 X mal Exam 14 ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252... Q Saved Mc Graw Hill Santana Rey, owner of Business Solutions, realizes that she needs to begin accounting for bad debts expense. Assume that Business Solutions has total revenues of $61,000 during the first three months of 2022 and that the Accounts Receivable balance on March 31, 2022, is $22,117. Required: 1a. Prepare the adjusting entry to record bad debts expense, which are estimated to be 2% of total revenues on March 31, 2022. There is a zero unadjusted balance in the Allowance for Doubtful Accounts at March 31. 1b. Prepare the adjusting entry to record bad debts expense, which are estimated to be 3% of accounts receivable on March 31, 2022. There is a zero unadjusted balance in the Allowance for…arrow_forwardFile Edit View History Bookmarks Profiles Tab Window inbox (228) ab X ACC101 Principle X (4726) IFRS vs. GX Help Accounting101 Ex × Accounting 101 Ex x WiConnect - Home ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fweb apter 7 Homework LO 5 Part 2 of 2 29.23 points Mc Graw Hill ← Saved Wiset Company completes these transactions during April of the current year (the terms of all its credit sales are 2/10, n/30). April 2 April 3 (a) April 3 (b) April 4 April 5 April 6 April 9 April 11 April 12 Purchased $14,000 of merchandise on credit from Noth Company, terms 2/10, n/60. Sold merchandise on credit to Page Alistair, Invoice Number 760, for $8,000 (cost is $7,000). Purchased $1,570 of office supplies on credit from Custer, Incorporated, terms n/30. Issued Check Number 587 to World View for advertising expense of $913. Sold merchandise on credit to Paula Kohr, Invoice Number 761, for $17,000 (cost is $15,500). Returned $80…arrow_forwardogle Chrome File Edit View History Bookmarks Profiles My Inbox (232) - abigailof X Tab Window Help My Verify Your Email Addr 98 × G The following unadjust x iConnect - Home X M Question 4- Chapter ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... C bjs-Google Search Chapter 4 Homework 29.4 points 4 Saved New Help Save & Exit Check my The following unadjusted trial balance is for Ace Construction Company at its June 30 current fiscal year-end. The credit balance of the V. Ace, Capital account was $51,300 on June 30 of the prior year, and the owner invested $27,000 cash during the current fiscal year. ACE CONSTRUCTION COMPANY Unadjusted Trial Balance June 30 eBook Number Account Title 101 Cash Ask 126 Supplies 128 Prepaid insurance Print 167 168 eferences 201 Equipment Accumulated depreciation-Equipment Accounts payable 203 Interest payable 208 Rent payable 210 Wages payable 213 Property taxes payable 251 Long-term…arrow_forward

- D Google Chrome File Edit View History Bookmarks Profiles Tab Window Help bjs-Google Search X M Chapter 2 Quiz - Connect x QuickLaunchSSO:: Single Siç x M Question 13 - Chapter 2 Hom + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Chapter 2 Homework i 13 Part 2 of 3 1.38 points Saved [The following information applies to the questions displayed below.] The accounting records of Nettle Distribution show the following assets and liabilities as of December 31 for Year 1 and Year 2. December 31 Cash Accounts receivable Office supplies Year 1 $ 49,570 26,907 4,244 Year 2 $ 8,765 21,096 3,109 138,786 Office equipment 130,293 Trucks 50,986 59,986 Building 0 169,963 Land 0 42,411 Accounts payable 70,740 35,085 0 112,374 eBook Ask Note payable Print Problem 2-5A (Algo) Part 2 References Mc Graw Hill He 2. Compute net income for Year 2 by comparing total equity amounts for these two years and using the following…arrow_forwardpogle Chrome File Edit View History Bookmarks Profiles Tab Window Help Inbox (264)-abic x MACC101 Principle: x (4724) IFRS vs. G X M Chapter 6 Home X M Question 14 - Cha x iConnect - Home × M esc ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Chapter 6 Homework Saved 2 Part 1 of 2 Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Hemming Company reported the following current-year purchases and sales for its only product. Date 14.25 points March 14. March 15 July 30 October 5 October 26 Sales Purchase Sales January 1 January 10 Activities. Beginning inventory Units Acquired at Cost 260 units @$12.40= Units Sold at Retail $ 3,224 215 units @ $42.40 420 units Purchase Sales Purchase Totals 460 units @ $17.40 = @ $22.40 = 7,308 380 units @ $42.40 10,304 425 units @ $42.40 160 units 1,300 units @ $27.40 = 4,384 $ 25,220 1,020 units 1…arrow_forwardChrome File Edit View History Bookmarks Tab Profiles Window Help Inbox (240) - abigailoforiwaa X M Gmail × | QuickLaunchSSO:: Single Sig x M Question 13 - Mid-Term Exam x On December 1, Jasmin Erns Ne ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Mid-Term Exam Saved 13 Refer to Apple's financial statements in Appendix A to answer the following. Skipped Help Save & Exit 1. For the fiscal year ended September 28, 2019, what amount is credited to Income Summary to summarize its revenues earned? 2. For the fiscal year ended September 28, 2019, what amount is debited to Income Summary to summarize its expenses incurred? 3. For the fiscal year ended September 28, 2019, what is the balance of its Income Summary account before it is closed? 1. Amount credited to income summary 2. Amount debited to income summary Ask 3. Balance in income summary account Mc с $ tv MacBook Pro G Search or type URL & ☆ Aa Carrow_forward

- rome Edit File View History D Bookmarks Profiles Tab Window Help G bjs - Google Search C The following financial statem× | iConnect - Home X M Question 17 - Chapter 1 Home ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fbb.mwcc.edu%2 hapter 1 Homework 17 Part 4 of 5 4.84 points Saved Required information Problem 1-2A (Algo) Computing missing information using accounting knowledge LO A1 [The following information applies to the questions displayed below.] The following financial statement information is from five separate companies. Company A Company B Company C Company D Beginning of year eBook Assets Liabilities $ 36,000 29,520 $ 28,080 19,656 $ 23,040 12,441 $ 64,080 Company E $ 98,280 44,215 ? Ask Print End of year Assets 41,000 29,520 ? 74,620 Liabilities ? 20,073 13,460 35,817 113,160 89,396 Changes during the year References Owner investments 6,000 1,400 9,750 ? 6,500 Net income (loss) 9,470 ? 6,000 11,938 8,608 Owner withdrawals…arrow_forwardestkentucky.kctcs.edu - Yahc X ube Maps Maps News News Translate M SmartBook 2.0 M SmartBook 2.0 ter 10 Homework i Book Hint Gradebook / ACC 202: Manage X M Question 6 - Chapter 10 Home X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Felearning.kctcs.edu%252Fultra%252F Ask 5 Surf Company can sell all of the two surfboard models it produces, but it has only 476 direct labor hours available. The Glide model requires 2 direct labor hours per unit. The Ultra model requires 4 direct labor hours per unit. Contribution margin per unit is $276 for Glide and $452 for Ultra. Print erences W 1 Q (a) Compute the contribution margin per direct labor hour for each product. (b) Determine the best sales mix and the resulting contribution margin. Required A Complete this question by entering your answers in the tabs below. MyPath - Home Compute the contribution margin per direct labor hour for each product. F1 Contribution margin per direct labor hour…arrow_forwardA Desrnos Scientific Caloulator O Dashboard NWP Assessment Player UI Appl x ducation.wiley.com/was/ui/v2/assessment-player/index.html?launchld%-D45890eae-ca08-4075-a619-cdfdc9fe1785#/question/7 ACC201-01 Welcome - Liferay 9 MLA Citation Gener. Goldlink e Google Keep O Dashboard ou Tube Desmos work 8.5/1 Question 8 of 10 > Prepare an income statement for Splish Brothers Inc. for the year ended December 31, 2017. Splish Brothers Inc. Income Statement For the Year Ended December 31, 2017 Net Income / (Loss) Cost of Goods Sold 2$4 24 up %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education