FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Edit View History Bookmarks Profiles Tab Window Help

method (Ch. 1)-202 X Bb Microsoft PowerPoint - 2. The x

V Top 50 Accountin... a Amazon Seller

h. 1)

2

D.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/

2019

2020

2021

Dividends

Income Declared

$70,000 $7,100

82,000 14,200

F2

#

3

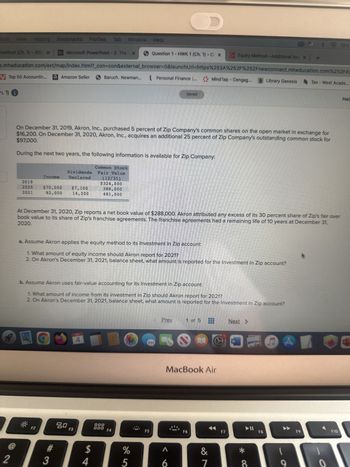

On December 31, 2019, Akron, Inc., purchased 5 percent of Zip Company's common shares on the open market in exchange for

$97,000.

$16,200. On December 31, 2020, Akron, Inc., acquires an additional 25 percent of Zip Company's outstanding common stock for

During the next two years, the following information is available for Zip Company:

80

Baruch. Newman...

F3

4

Common Stock

Fair Value

$

(12/31)

$324,000

388,000

481,000

4

At December 31, 2020, Zip reports a net book value of $288,000. Akron attributed any excess of its 30 percent share of Zip's fair over

2020.

book value to its share of Zip's franchise agreements. The franchise agreements had a remaining life of 10 years at December 31,

a. Assume Akron applies the equity method to its Investment in Zip account:

1. What amount of equity income should Akron report for 2021?

2. On Akron's December 31, 2021, balance sheet, what amount is reported for the Investment in Zip account?

b. Assume Akron uses fair-value accounting for its Investment in Zip account:

1. What amount of income from its investment in Zip should Akron report for 2021?

2. On Akron's December 31, 2021, balance sheet, what amount is reported for the Investment in Zip account?

Question 1 HWK 1 (Ch. 1) - CX

DOD

000

Personal Finance ...

F4

%

5

F5

D

Saved

Prev

A

6

Grak

1 of 5

MacBook Air

Mind Tap - Cengag...

F6

Equity Method-Additional Issu x +

&

7

F7

Next >

W

Library Genesis

*

8

F8

C

A

9

Tax-West Acade...

F9

19%

o

F10

Help

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 10 images

Knowledge Booster

Similar questions

- On March 22, 2023, Amelia, Inc., purchased 500 shares of its own common stock in the market for $21 per share. On May 19, 2023, the company sold 300 of these shares in the open market at a price of $24 per share. Required: Use the horizontal model (or write the entry) to show the effects on Amelia, Inc.'s financial statements of: a). The purchase of the treasury stock on March 22, 2023. The sale of the treasury stock on May 19, 2023. b).arrow_forwardOn February 1, 2019, Wild Bill Corporation repurchases 810 shares of its outstanding common stock for $9 per share. On March 1, 2019, Wild Bill sells 260 shares of treasury stock for $12 per share. On May 10, 2019, Wild Bill sells the remaining 550 shares of its treasury stock for $6 per share. Required: Prepare the journal entries to record these transactions. 2019 Feb. 1 fill in the blank 2 fill in the blank 4 (Record purchase of treasury shares) Mar. 1 fill in the blank 6 fill in the blank 7 fill in the blank 9 fill in the blank 10 fill in the blank 12 fill in the blank 13 (Record reissue of treasury shares) May 10 fill in the blank 15 fill in the blank 16 fill in the blank 18 fill in the blank 19 fill in the blank 21 fill in the blank 22 fill in the blank 24 fill in the blank 25 (Record reissue of treasury shares)arrow_forwardFlexsteel acquired 1,000 shares of its $1 par value stock for $44 per share on April 4, 2019 and held these shares in treasury. On March 1, 2020, the company resold all the treasury shares for $40 per share. What is the journal entry would be recorded when Flexsteel resells the shares of treasury stock?arrow_forward

- On December 31, 2019, Akron, Inc., purchased 5 percent of Zip Company's common shares on the open market in exchange for $15,500. On December 31, 2020, Akron, Inc., acquires an additional 25 percent of Zip Company's outstanding common stock for $94,000. During the next two years, the following information is available for Zip Company: Common Stock Fair Value (12/31) $321,000 376,000 478,000 Dividends Income Declared 2019 $79,000 89,000 $6,200 15,800 2020 2021 At December 31, 2020, Zip reports a net book value of $280,000. Akron attributed any excess of its 30 percent share of Zip's fair over book value to its share of Zip's franchise agreements. The franchise agreements had a remaining life of 10 years at December 31, 2020. a. Assume Akron applies the equity method to its Investment in Zip account: 1. What amount of equity income should Akron report for 2021? 2. On Akron's December 31, 2021, balance sheet, what amount is reported for the Investment in Zip account? b. Assume Akron uses…arrow_forwardOn December 31, 2019, Akron, Inc., purchased 5 percent of Zip Company's common shares on the open maket in eiciarche for $16,000. On December 31,2020 , Akron, Inc., acquires an additional 25 percent of Zip Companys outstanding commen stociter $95,000. During the next two years, the following information is available for Zip Company. \table[[,Income,\table[[Dividends],[Declared]],\table[[Common Stock],[Fair Value],[(1231)arrow_forwardOn December 31, 2019, Akron, Inc., purchased 5 percent of Zip Company's common shares on the open market in exchange for $15,600. On December 31, 2020, Akron, Inc., acquires an additional 25 percent of Zip Company's outstanding common stock for $97,000. During the next two years, the following information is available for Zip Company: Income Dividends Declared Common StockFair Value (12/31) 2019 $312,000 2020 $85,000 $7,900 388,000 2021 94,000 16,000 487,000 At December 31, 2020, Zip reports a net book value of $298,000. Akron attributed any excess of its 30 percent share of Zip's fair over book value to its share of Zip's franchise agreements. The franchise agreements had a remaining life of 10 years at December 31, 2020. Assume Akron applies the equity method to its Investment in Zip account: What amount of equity income should Akron report for 2021? On Akron’s December 31, 2021, balance sheet, what amount is reported for the Investment in Zip account?arrow_forward

- On January 1, 2020, Churl Company paid $1,700,000 for a 40% stake in Flip Company. The Flip Company's stockholders equity on January 1 and December 31, 2020 is shown below: Share capital Revaluation surplus Retained earnings January 1 3,000,000 1,000,000 December 31 3,000,000 1,300,000 1,500,000 By Jan 1, 2020, all of Flip's identified assets and liabilities were recognized at fair value. During the current fiscal year, the flip firm recorded a profit before income tax of 1,000,000 and paid dividends to stockholders of 150,000. The revaluation excess is the outcome of Flip Company's land reassessment on December 31, 2020. Flip displays OCI net of any relevant income tax. Furthermore, Flip Company provides depreciation using the declining balance approach, whereas Churl Company employs a straight line. The cumulative depreciation would have been enhanced by 200,000 if Flip Company had used the straight line. The tax rate is set at 35%. On December 31, 2020, Churl Company will report its…arrow_forwardGodoarrow_forwardJuniper Inc. acquired a 25% interest in Saturn Co. on January 1, 2021, for $260,000. During 2021, Saturn reported net income of $86,000, and paid a total cash dividend to shareholders in the amount of $16,000. Juniper uses the equity method to account for this investment. At the end of 2021, Juniper will report the following debit balance in the investment account: Question 6 options: $285,500 $260,000 $277,500 $281,500arrow_forward

- Please help mearrow_forwardDuring 2021 Blossom Company purchased 8700 shares of Nash Inc. for $17 per share. During the year Blossom Company sold 1850 shares of Nash, Inc. for $22 per share. At December 31, 2021 the market price of Nash, Inc.’s stock was $15 per share. What is the total amount of gain/(loss) that Blossom Company will report in its income statement for the year ended December 31, 2021 related to its investment in Nash, Inc. stock? $-8150 $-17400 $-4450 $9250arrow_forwardABC Co. reports under IFRS and has a December 31st year end. On January 1, 2020, ABC Co. purchased 3000 shares (30%) of the outstanding common shares of XYZ Inc. for $28/share in cash. XYZ Inc. provided the following statement of comprehensive income for the year ended Dec 31, 2020: Net income $22,500 Other comprehensive income 600 Comprehensive income $23,100 XYZ Inc. paid dividends of $1.20 per share during the year. Due to recent uncertainty in XYZ’s industry, shares were trading at $26.50 per share at year end. ABC CO.'s accountant is still investigating whether it will need to classify the investment as an investment in associate or FVTOCI. Required: a. Prepare the 2020 journal entries for ABC Co for the investments assuming the investment is classified as : i) investment in associate (equity method) ii) FVTOCI b. Calculate the value of the investment in XYZ Inc on the balance sheet of ABC Co. at December 31, 2020 as classified as: i) investment in…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education