FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

screenshot

attached

question in the screenshot thank you

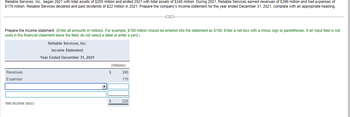

Transcribed Image Text:Reliable Services, Inc., began 2021 with total assets of $255 million and ended 2021 with total assets of $345 million. During 2021, Reliable Services earned revenues of $396 million and had expenses of

$170 million. Reliable Services declared and paid dividends of $22 million in 2021. Prepare the company's income statement for the year ended December 31, 2021, complete with an appropriate heading.

Prepare the income statement. (Enter all amounts in millions. For example, $100 million should be entered into the statement as $100. Enter a net loss with a minus sign or parentheses. If an input field is not

used in the financial statement leave the field; do not select a label enter a zero.)

Reliable Services, Inc.

Income Statement

Year Ended December 31, 2021

Revenues

Expenses

Net income (loss)

▼

(millions)

$

396

170

226

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- rome Edit File View History D Bookmarks Profiles Tab Window Help G bjs - Google Search C The following financial statem× | iConnect - Home X M Question 17 - Chapter 1 Home ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch Url=https%253A%252F%252Fbb.mwcc.edu%2 hapter 1 Homework 17 Part 4 of 5 4.84 points Saved Required information Problem 1-2A (Algo) Computing missing information using accounting knowledge LO A1 [The following information applies to the questions displayed below.] The following financial statement information is from five separate companies. Company A Company B Company C Company D Beginning of year eBook Assets Liabilities $ 36,000 29,520 $ 28,080 19,656 $ 23,040 12,441 $ 64,080 Company E $ 98,280 44,215 ? Ask Print End of year Assets 41,000 29,520 ? 74,620 Liabilities ? 20,073 13,460 35,817 113,160 89,396 Changes during the year References Owner investments 6,000 1,400 9,750 ? 6,500 Net income (loss) 9,470 ? 6,000 11,938 8,608 Owner withdrawals…arrow_forwardEdit View History Bookmarks Window Help A education.wiley.co Exam 1 WP NWP Assessment Player UI Application DAX Question 35 of 42 View Policies Current Attempt in Progress Each of the following accounts is closed to Income Summary except Expenses. Dividends. Revenues. All of these are closed to Income Summary. Save for Laterarrow_forwardcise #1 Protected View Saved V Mailings Review View Help es. Unless you need to edit, it's safer to stay in Protected View. The purpose of this assignment is to demonstrate your knowledge of Balance Sheet Preparation. Prior to beginning this exercise, it is recommended that you refer to the "Balance Sheet Activity." Search The accounts and amounts below were taken from the accounting records of Southern Company on September 30, 2021. 1. Review the list of accounts and determine, based on the descriptions, which of them should be included on the Balance Sheet Inventory Notes Payable Salaries Expense Accounts Payable Service Revenue Wages Payable 2. Prepare Southern's Balance Sheet on the template below, using the proper "format" from the "Balance Sheet - Basic" document. The proper format includes row descriptions and indentions. and the column in which each row amount should be reported. Miscellaneous Expense Current Period Earnings Cash Enable Editing Owners' Equity Accounts…arrow_forward

- View History Bookmarks Window Help A education.wiley Exam 1 WP NWP Assessment Player UI Application Question 20 of 42 View Policies Current Attempt in Progress The usual sequence of steps in the transaction recording process is: journal ledger → analyze. analyze journal ledger. journal analyze ledger. ledger journal → analyze. Save for Laterarrow_forwardhrome File Edit View History Objs - Google Search Bookmarks Profiles Tab x QuickLaunchSSO :: Single Sic x Window Help M Question 3- Chapter 3 Home .X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... 一口 Chapter 3 Homework i 3 Saved Help Save Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Exercise 3-6 (Algo) Preparing adjusting entries LO P1, P2, P3 Return 8.54 points a. Depreciation on the company's equipment for the year is computed to be $14,000. b. The Prepaid Insurance account had a $6,000 debit balance at December 31 before adjusting for the costs of any expired coverage. An analysis of the company's insurance policies showed that $550 of unexpired insurance coverage remains. c. The Supplies account had a $480 debit balance at the beginning of the year, and $2,680 of supplies were purchased during the year. The December 31…arrow_forwardChrome File Edit View History Bookmarks Profiles Tab Window Help Project Chapters 5-7 Content WP NWP Assessme X 2,041 Content OCT 26 education.wiley.com/was/ui/v2/assessment-player/index.html?launchId=36ec0bd6-8a4b-4bac-8fcd-95120acedb08#/question/0 Question 1 of 1 View Policies Show Attempt History Current Attempt in Progress Cash On December 1, 2022, Sheffield Corp. had the following account balances. Notes Receivable Accounts Receivable Inventory Prepaid Insurance Equipment Dec. 7 1. × 2. 12 (a) 17 19 22 26 31 Adjustment data: terms 1/10 n/30 × bExplain the appl X During December, the company completed the following transactions. > Debit $18,100 2,500 7,800 tv 15,500 1,500 28,100 $73,500 Accumulated Depreciation-Equipment Accounts Payable Common Stock Retained Earnings Depreciation was $210 per month. Insurance of $400 expired in December. Your answer is partially correct. Credit $3,100 6,000 loc 50,300 Received $3,600 cash from customers in payment of account (no discount allowed).…arrow_forward

- File Edit View History Bookmarks Profiles Tab Window Help ogle Search x QuickLaunchSSO :: Single Sig x M Question 8 - Chapter 2 Home X M Chapter 2 Quiz - Connect x + to.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... K Homework nces Saved Required information Use the following information for Exercises 17-18 below. (Algo) [The following information applies to the questions displayed below.] The transactions of Belle Company's appear below. 1. D. Belle created a new business and invested $5,400 cash, $6,900 of equipment, and $12,000 in web servers. 2. The company paid $4,000 cash in advance for prepaid insurance coverage. 3. The company purchased $700 of supplies on credit. 4. The company paid $900 cash for selling expenses. 5. The company received $5,400 cash for services provided. 6. The company paid $700 cash toward accounts payable. 7. The company paid $2,500 cash for equipment. H Exercise 2-17 (Algo) Entering…arrow_forwardted with McGraw-Hill CoX O Question 2 - chapter 16- proble X ezto.mheducation.com/ext/map/index.html?_con3Dcon&external_browser%3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-grou chapter 16 - problems i Saved Help Save & Exit Su 2 Lazare Corporation expects an EBIT of $30,800 every year forever. Lazare currently has no debt, and its cost of equity is 14%. The firm can borrow at 9%. (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) a. If the corporate tax rate is 35%, what is the value of the firm? Value of the firm b. What will the value be if the company converts to 50% debt? Value of the firm c. What will the value be if the company converts to 100% debt? Value of the firm Next > %24 %24 %24arrow_forwardAutoSave Normal 因 Document1 - Word Search badiya aldujaili ff BА EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut Calibri (Body) v 11 - A^ A Aav A E E O Find - AaBbCcDc AaBbCcDc AABBCC AABBCCC AaB AABBCCC AaBbCcDa 自Copy Paste S Replace В IUvab х, х* А 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em.. A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 2 3 4 Winter Company reported the following for the most recent month: Physical Units 700 Beginning work in process (60% complete) Units transferred in (started) during month Ending work in process 4,800 950 Materials are added at the end of the process and conversion costs are added evenly throughout the process. If equivalent whole units of production for conversion using the weighted average were 4,816, what percent complete was ending work in process at the end of the month? (Round to the nearest whole percent.) а. 20% b. 16%…arrow_forward

- Edit View History Bookmarks Profiles Tab Window Help t Fridays - Become a w x sp MyPath - Home Gradebook / ACC 202: Manage X M Question 7 - Chapter 11 Home X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Felearning.kctcs.edu%252Fultra%252F Maps News Translate M SmartBook 2.0 M SmartBook 2.0 Homework i t Perez Company is considering an investment of $28,245 that provides net cash flows of $9,300 annually for four years. (a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) (b) The hurdle rate is 7%. Should the company invest in this project on the basis of internal rate of return? Complete this question by entering your answers in the tabs below. Required A What is the internal rate of return of this investment? Present value factor Internal rate of return FI Required B @ 2 F2 # 3 APR…arrow_forwardSafari File Edit View History Bookmarks Window Help uLink - Student... W 1. 2. uLink - Student... 3. 4. learn-eu-central-1-prod-fleet01-xythos.content.blackboardcdn.com uLink - Student... 21 445 Entity A enters into the following transactions. You are required to show the impact of the transactions below on the accounting equation. e Content 9 Bb https://learn-eu-... Entity A purchased 1 000 bags of cement from K Ltd on credit. K Ltd normally sells a bag for R45. Entity A received a 10% discount for the 1 000 bags. Entity A returned 150 bags of cement, as they were defective. On the same day, the outstanding balance was settled through an online payment. This transaction did not affect the discount offered to Entity A. Select the correct values from the dropdown menus in the table provided in the Blackboard activity. MAR 7 In an attempt to assist the business, the owner of Entity A deposited R100 000 into the entity's bank account. A quarter of the amount is payable to the owner and…arrow_forwardFile Edit History View Bookmarks Profiles Tab Window Help D G YouTube Inbox (228 X MACC101 P X Accounting X | Accounting x M Question 11 x M Question 1 X b Answered: X ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 9 Homework i Saved 13 30.12 points eBook Ask The following transactions are from Ohlm Company. Note: Use 360 days a year. Year 1 December 16 Accepted a(n) $12,800, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note.. Print References Mc Graw Hill Year 2 February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n) $6,400, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,900, 30-day, 7% note in granting Ava Privet a time extension on her past-due account…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education